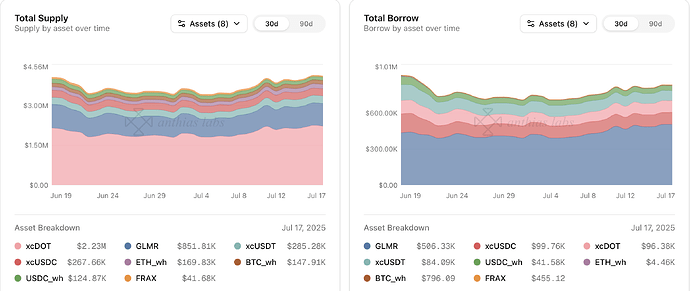

Anthias Labs would like to provide an update on market performance over the past week for Core markets on Base, Optimism, Moonbeam, and Moonriver. Data from 6/28/25 to 7/4/25.

Asset

Current Borrow Cap

Current Supply Cap

Average Borrow Cap Usage (Past Week)

Average Supply Cap Usage (Past Week)

Average Utilization

USDC

184.00M

200.00M

43.31%

45.74%

87.11%

WETH

64.00K

96.00K

40.10%

32.14%

82.99%

USDS

690.00K

750.00K

1.34%

1.51%

81.44%

EURC

21.00M

21.90M

18.74%

27.25%

65.95%

DAI

300.00K

400.00K

6.38%

7.97%

59.99%

AERO

25.00M

70.00M

45.20%

35.12%

46.08%

VIRTUAL

2.30M

4.50M

23.96%

38.91%

31.48%

cbXRP

500.00K

1.00M

13.87%

26.30%

27.02%

tBTC

36.00

90.00

8.72%

14.35%

24.32%

LBTC

38.00

95.00

29.96%

49.88%

24.01%

WELL

75.00M

150.00M

31.90%

86.86%

19.03%

MORPHO

1.00M

4.00M

51.47%

72.23%

18.06%

cbBTC

640.00

1.50K

18.17%

47.84%

16.20%

USDbC

1.00

1.00

155.04K%

1.21M%

12.86%

wstETH

4.80K

14.40K

5.13%

31.73%

5.39%

cbETH

6.40K

16.00K

1.34%

16.66%

3.22%

rETH

900.00

2.60K

2.58%

49.04%

1.82%

weETH

700.00

4.00K

4.52%

49.89%

1.58%

wrsETH

430.00

1.00K

0.17%

17.64%

0.42%

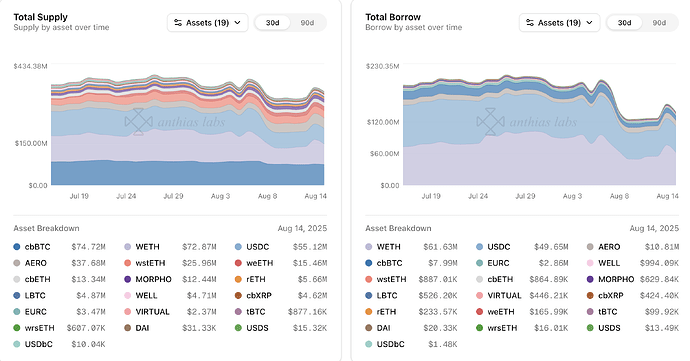

Asset

Total Borrow

Total Supply

Utilization

USDC

+4% from 79.75M USDC to 82.88M USDC

+0% from 92.48M USDC to 92.87M USDC

+3% from 86.24% to 89.24%

WETH

-26% from 31.25K WETH to 23.26K WETH

-22% from 36.47K WETH to 28.42K WETH

-4% from 85.68% to 81.86%

USDS

+1% from 9.16K USDS to 9.27K USDS

-1% from 11.38K USDS to 11.23K USDS

+3% from 80.49% to 82.54%

EURC

+5% from 3.92M EURC to 4.11M EURC

+5% from 5.85M EURC to 6.13M EURC

-0% from 67.00% to 66.93%

DAI

-3% from 19.43K DAI to 18.94K DAI

-2% from 32.37K DAI to 31.71K DAI

-1% from 60.03% to 59.71%

AERO

+39% from 8.97M AERO to 12.51M AERO

-5% from 25.25M AERO to 24.07M AERO

+46% from 35.53% to 51.97%

VIRTUAL

-29% from 582.50K VIRTUAL to 412.51K VIRTUAL

-3% from 1.76M VIRTUAL to 1.70M VIRTUAL

-27% from 33.16% to 24.31%

cbXRP

+17% from 11.65K cbXRP to 13.60K cbXRP

+20% from 238.99K cbXRP to 287.28K cbXRP

-3% from 4.87% to 4.73%

tBTC

-4% from 3.17 tBTC to 3.04 tBTC

-2% from 12.78 tBTC to 12.54 tBTC

-2% from 24.80% to 24.24%

LBTC

+8% from 11.14 LBTC to 12.01 LBTC

+4% from 46.89 LBTC to 48.66 LBTC

+4% from 23.77% to 24.68%

WELL

-38% from 26.61M WELL to 16.39M WELL

+45% from 99.05M WELL to 143.30M WELL -57% from 26.86% to 11.44%

MORPHO

+6% from 497.82K MORPHO to 526.08K MORPHO

+48% from 2.70M MORPHO to 4.00M MORPHO -29% from 18.47% to 13.15%

cbBTC

+1% from 115.89 cbBTC to 117.32 cbBTC

+1% from 719.15 cbBTC to 724.14 cbBTC

+1% from 16.11% to 16.20%

USDbC

+0% from 1.55K USDbC to 1.55K USDbC

-3% from 12.14K USDbC to 11.73K USDbC

+3% from 12.77% to 13.21%

wstETH

-65% from 259.09 wstETH to 90.15 wstETH -1% from 4.62K wstETH to 4.59K wstETH

-65% from 5.61% to 1.96%

cbETH

-19% from 89.15 cbETH to 72.57 cbETH

-1% from 2.68K cbETH to 2.66K cbETH

-18% from 3.33% to 2.73%

rETH

+0% from 23.22 rETH to 23.22 rETH

-5% from 1.29K rETH to 1.23K rETH

+5% from 1.80% to 1.89%

weETH

-5% from 32.92 weETH to 31.15 weETH

-0% from 2.00K weETH to 1.99K weETH

-5% from 1.65% to 1.57%

wrsETH

+6% from 0.57 wrsETH to 0.61 wrsETH

-46% from 278.35 wrsETH to 151.25 wrsETH +95% from 0.21% to 0.40%

AERO borrows up 39%, utilization from 35.53% to 51.97%

MORPHO supply up 48%, from 2.70M to 4.00M, supply cap maxed

VIRTUAL borrows down 29%, from 582.50K to 412.51K

WETH borrows down 26%, from 31.25K to 23.26K

WETH supply down 22%, from 36.47K to 28.42K

WELL borrows down 38%, from 26.61M to 16.39M

WELL supply up 45%, from 99.05M to 143.30M

wstETH borrows down 65%, from 259.09 to 90.15

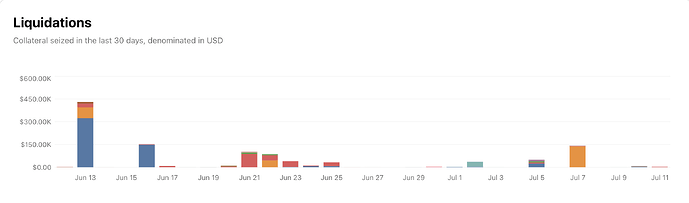

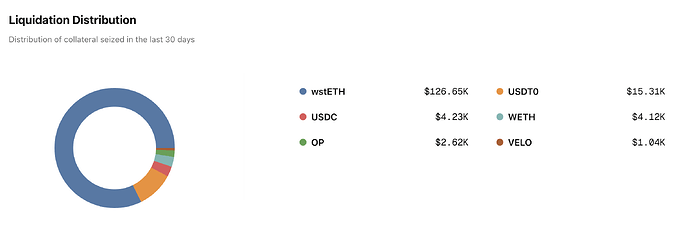

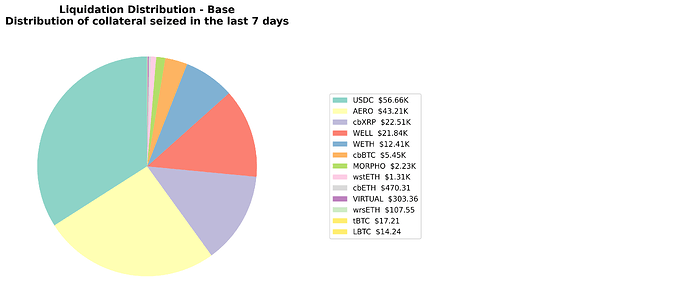

Total liquidations: 44Total Collateral Seized (USD): $41,962.43

Asset

Total Seized (Tokens)

Total Seized (USD)

Liquidation Count

weETH

12.887000

$32,793.90

1

USDC

5,429.562300

$5,429.27

10

VIRTUAL

2,243.349000

$3,450.45

2

AERO

253.619875

$202.20

5

WETH

0.018991

$46.25

24

cbBTC

0.000331

$35.46

1

WELL

190.263000

$4.90

1

Asset

Current Borrow Cap

Current Supply Cap

Average Borrow Cap Usage (Past Week)

Average Supply Cap Usage (Past Week)

Average Utilization

WETH

30.00K

32.00K

34.10%

36.41%

87.81%

DAI

4.50M

4.80M

7.78%

8.21%

87.80%

USDC

34.00M

36.40M

26.55%

29.15%

85.07%

USDT

18.40M

22.60M

1.61%

1.60%

78.67%

USDT0

8.00M

10.00M

32.24%

41.27%

63.52%

wrsETH

160.00

400.00

3.05%

8.80%

13.86%

rETH

340.00

750.00

3.07%

14.30%

9.74%

VELO

20.00M

68.00M

14.82%

57.08%

7.63%

OP

650.00K

5.60M

21.96%

44.84%

5.69%

wstETH

1.50K

5.00K

3.27%

20.00%

4.91%

WBTC

0.00

0.00

0.00%

0.00%

4.31%

weETH

220.00

1.20K

13.30%

99.90%

2.44%

cbETH

0.00

10.00

0.00%

9.01%

0.20%

Asset

Total Borrow

Total Supply

Utilization

WETH

+2% from 10.19K WETH to 10.40K WETH

+3% from 11.51K WETH to 11.88K WETH

-1% from 88.50% to 87.58%

DAI

+19% from 398.92K DAI to 472.98K DAI

+17% from 440.95K DAI to 517.19K DAI

+1% from 90.47% to 91.45%

USDC

+15% from 7.88M USDC to 9.03M USDC

+14% from 9.21M USDC to 10.51M USDC

+0% from 85.56% to 85.89%

USDT

-28% from 423.87K USDT to 306.50K USDT

-23% from 476.72K USDT to 368.95K USDT

-7% from 88.91% to 83.07%

USDT0

-5% from 2.67M USDT0 to 2.54M USDT0

-31% from 4.96M USDT0 to 3.42M USDT0

+38% from 53.86% to 74.29%

wrsETH

-22% from 5.49 wrsETH to 4.29 wrsETH

-0% from 35.20 wrsETH to 35.17 wrsETH

-22% from 15.60% to 12.20%

rETH

+13% from 10.21 rETH to 11.49 rETH

+2% from 106.29 rETH to 108.85 rETH

+10% from 9.60% to 10.56%

VELO

+19% from 2.52M VELO to 3.00M VELO

+1% from 38.71M VELO to 39.03M VELO

+18% from 6.52% to 7.68%

OP

+1% from 142.71K OP to 144.05K OP

+1% from 2.49M OP to 2.52M OP

-0% from 5.73% to 5.71%

wstETH

+1% from 48.99 wstETH to 49.24 wstETH

-1% from 1.02K wstETH to 1.01K wstETH

+2% from 4.81% to 4.89%

WBTC

0% from 0.00 WBTC to 0.00 WBTC

0% from 0.07 WBTC to 0.07 WBTC

0% from 4.31% to 4.31%

weETH

-66% from 40.45 weETH to 13.69 weETH +0% from 1.20K weETH to 1.20K weETH

-66% from 3.38% to 1.14%

cbETH

-91% from 0.00 cbETH to 0.00 cbETH -0% from 0.90 cbETH to 0.90 cbETH

-93% from 0.24% to 0.02%

weETH borrows down 66% (40.45 to 13.69), supply cap maxed

USDT0 supply down 31% (4.96M to 3.42M)

DAI utilization crossed 90% kink

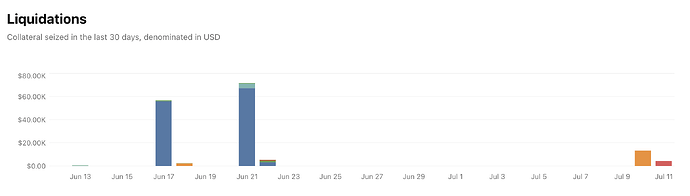

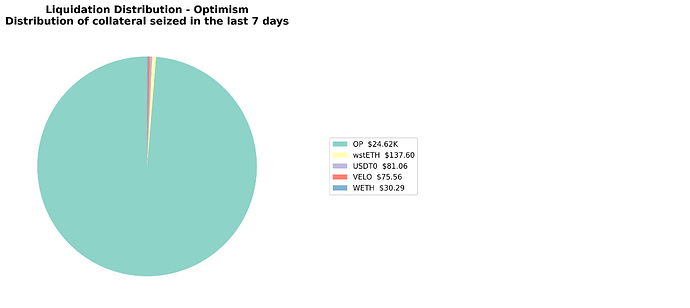

No liquidation events on OP Mainnet this week.

Asset

Current Borrow Cap

Average Borrow Cap Usage (Past Week)

Average Supply Cap Usage (Past Week)

Average Utilization

GLMR

0.1

6419.58M%

0.00%

56.02%

xcUSDC

0.1

100.75M%

0.00%

39.65%

xcUSDT

0.1

92.72M%

0.00%

38.42%

USDC_wh

0.1

43.27M%

0.00%

34.86%

xcDOT

0.1

23.37M%

0.00%

4.27%

ETH_wh

0.1

1.44K%

0.00%

2.81%

FRAX

0.1

455.10K%

0.00%

0.82%

BTC_wh

0.1

10.01%

0.00%

0.80%

Asset

Total Borrow

Total Supply

Utilization

GLMR

+0% from 6.41M GLMR to 6.43M GLMR

-4% from 11.63M GLMR to 11.15M GLMR

+5% from 55.15% to 57.67%

xcUSDC

-0% from 100.87K xcUSDC to 100.64K xcUSDC

+0% from 254.03K xcUSDC to 254.10K xcUSDC

-0% from 39.71% to 39.61%

xcUSDT

-0% from 92.87K xcUSDT to 92.57K xcUSDT

-1% from 243.36K xcUSDT to 241.11K xcUSDT

+1% from 38.16% to 38.40%

USDC_wh

+0% from 43.17K USDC_wh to 43.33K USDC_wh

+2% from 121.48K USDC_wh to 124.44K USDC_wh

-2% from 35.53% to 34.82%

xcDOT

+0% from 23.37K xcDOT to 23.37K xcDOT

-1% from 551.12K xcDOT to 545.51K xcDOT

+1% from 4.24% to 4.28%

ETH_wh

-4% from 1.46 ETH_wh to 1.41 ETH_wh

-0% from 51.37 ETH_wh to 51.30 ETH_wh

-4% from 2.84% to 2.74%

FRAX

+0% from 455.09 FRAX to 455.10 FRAX

+12% from 50.32K FRAX to 56.32K FRAX

-11% from 0.90% to 0.81%

BTC_wh

+19% from 0.01 BTC_wh to 0.01 BTC_wh

-1% from 1.25 BTC_wh to 1.24 BTC_wh

+20% from 0.68% to 0.82%

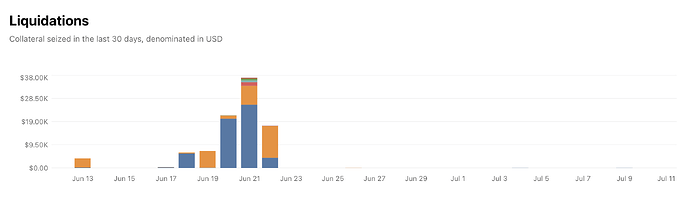

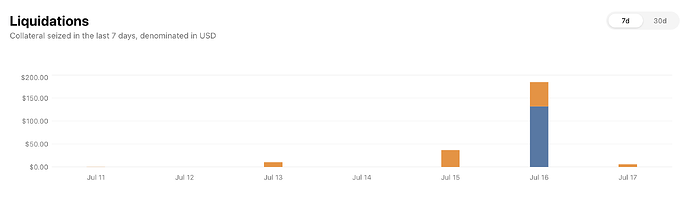

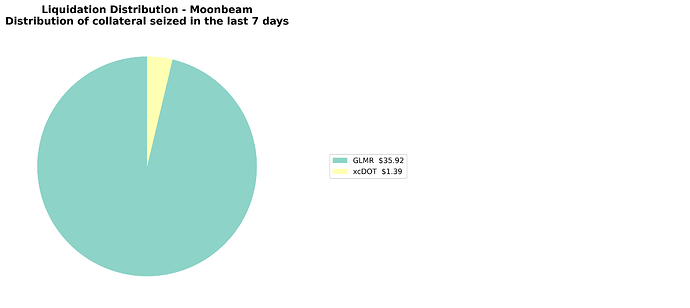

Total liquidations: 2Total Collateral Seized (USD): $41.58

Asset

Total Seized (Tokens)

Total Seized (USD)

Liquidation Count

xcDOT

11.191500

$38.05

1

GLMR

56.495400

$3.53

1

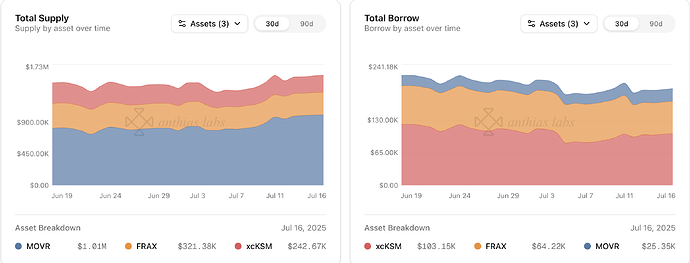

Asset

Current Borrow Cap

Average Borrow Cap Usage (Past Week)

Average Supply Cap Usage (Past Week)

Average Utilization

xcKSM

0.10

8.43M%

0.00%

41.27%

FRAX

0.10

76.85M%

0.00%

21.69%

MOVR

0.10

3.80M%

0.00%

2.51%

Asset

Total Borrow

Total Supply

Utilization

xcKSM

+0% from 8.43K xcKSM to 8.43K xcKSM

-2% from 20.42K xcKSM to 20.06K xcKSM

+2% from 41.27% to 42.01%

FRAX

-0% from 77.00K FRAX to 76.78K FRAX

-0% from 354.47K FRAX to 354.43K FRAX

-0% from 21.72% to 21.66%

MOVR

+0% from 3.80K MOVR to 3.80K MOVR

-1% from 151.26K MOVR to 150.43K MOVR

+1% from 2.51% to 2.53%

No liquidation events on Moonriver this week.

3 Likes

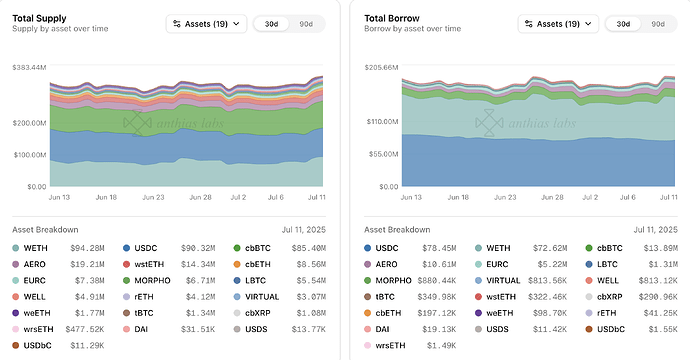

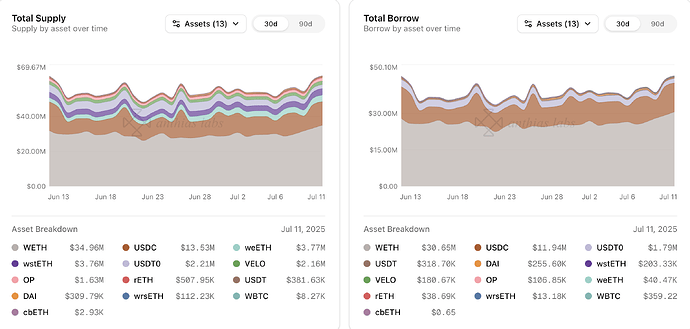

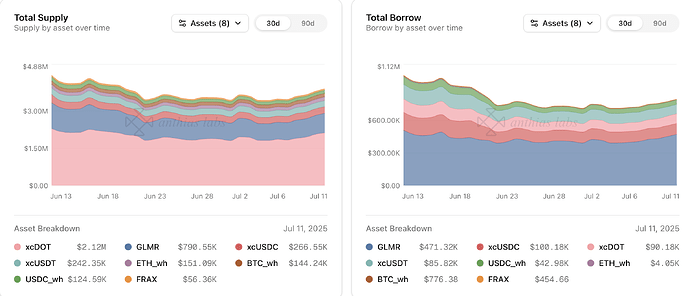

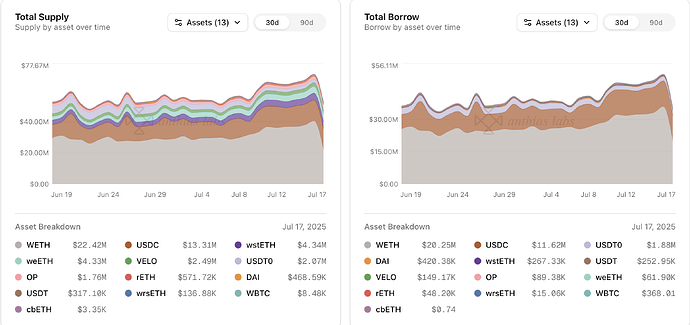

Anthias Labs would like to provide an update on market performance over the past week for Core markets on Base, Optimism, Moonbeam, and Moonriver. Data from 7/5/25 to 7/12/25. More information can be found on our monitoring dashboard: link .

Asset

Current Borrow Cap

Current Supply Cap

Average Borrow Cap Usage (Past Week)

Average Supply Cap Usage (Past Week)

Average Utilization

USDC

184.00M

200.00M

43.17%

44.58%

89.10%

USDS

690.00K

750.00K

1.46%

1.55%

86.90%

WETH

64.00K

96.00K

37.53%

30.92%

80.93%

EURC

21.00M

21.90M

20.12%

28.21%

68.42%

DAI

300.00K

400.00K

6.33%

7.90%

60.05%

AERO

25.00M

70.00M

52.83%

34.48%

54.71%

cbXRP

500.00K

1.00M

21.11%

34.23%

31.72%

VIRTUAL

2.30M

4.50M

23.86%

40.71%

29.84%

tBTC

36.00

90.00

8.43%

13.42%

25.18%

LBTC

38.00

95.00

28.69%

50.00%

22.95%

cbBTC

640.00

1.50K

18.74%

48.63%

16.44%

WELL

75.00M

150.00M

26.80%

97.74%

13.70%

MORPHO

1.00M

4.00M

53.22%

98.92%

13.45%

USDbC

1.00

1.00

155.05K%

1.16M%

13.38%

cbETH

6.40K

16.00K

1.08%

16.53%

2.62%

wstETH

4.80K

14.40K

1.93%

31.22%

2.06%

weETH

700.00

4.00K

4.45%

45.84%

2.02%

rETH

900.00

2.60K

2.35%

47.33%

1.72%

wrsETH

430.00

1.00K

0.15%

15.16%

0.42%

Asset

Total Borrow

Total Supply

Utilization

USDC

-5% from 82.75M USDC to 78.44M USDC

-3% from 92.52M USDC to 89.68M USDC

-2% from 89.44% to 87.47%

USDS

+27% from 9.27K USDS to 11.79K USDS

+23% from 11.23K USDS to 13.77K USDS

+4% from 82.54% to 85.63%

WETH

+10% from 23.31K WETH to 25.62K WETH

+13% from 28.42K WETH to 32.07K WETH

-3% from 82.03% to 79.87%

EURC

+26% from 4.05M EURC to 5.09M EURC

+3% from 6.27M EURC to 6.47M EURC

+22% from 64.66% to 78.75%

DAI

+1% from 18.94K DAI to 19.13K DAI

-1% from 31.71K DAI to 31.51K DAI

+2% from 59.71% to 60.71%

AERO

+3% from 12.24M AERO to 12.63M AERO

+0% from 24.07M AERO to 24.15M AERO

+3% from 50.84% to 52.30%

cbXRP

+0% from 109.42K cbXRP to 109.48K cbXRP

+52% from 287.48K cbXRP to 435.71K cbXRP -34% from 38.06% to 25.13%

VIRTUAL

+7% from 413.17K VIRTUAL to 440.19K VIRTUAL

+4% from 1.70M VIRTUAL to 1.77M VIRTUAL

+2% from 24.34% to 24.85%

tBTC

-21% from 3.04 tBTC to 2.40 tBTC

-12% from 12.63 tBTC to 11.08 tBTC

-10% from 24.06% to 21.67%

LBTC

+20% from 9.41 LBTC to 11.33 LBTC

+4% from 46.06 LBTC to 47.82 LBTC

+16% from 20.43% to 23.70%

cbBTC

+1% from 118.16 cbBTC to 119.24 cbBTC

+2% from 725.50 cbBTC to 742.98 cbBTC

-1% from 16.29% to 16.05%

WELL

+51% from 16.40M WELL to 24.82M WELL +4% from 143.49M WELL to 148.79M WELL

+46% from 11.43% to 16.68%

MORPHO

-0% from 526.06K MORPHO to 523.59K MORPHO

-1% from 4.00M MORPHO to 3.96M MORPHO

+1% from 13.15% to 13.23%

USDbC

+0% from 1.55K USDbC to 1.55K USDbC

-9% from 11.73K USDbC to 10.65K USDbC

+10% from 13.21% to 14.55%

cbETH

-17% from 72.67 cbETH to 60.38 cbETH

-2% from 2.66K cbETH to 2.61K cbETH

-15% from 2.73% to 2.32%

wstETH

+92% from 90.15 wstETH to 172.88 wstETH +6% from 4.60K wstETH to 4.85K wstETH

+82% from 1.96% to 3.57%

weETH

+0% from 31.15 weETH to 31.16 weETH

-72% from 1.99K weETH to 559.74 weETH +256% from 1.57% to 5.57%

rETH

-47% from 23.22 rETH to 12.24 rETH -1% from 1.23K rETH to 1.22K rETH

-47% from 1.88% to 1.00%

wrsETH

-21% from 0.61 wrsETH to 0.48 wrsETH

+2% from 151.25 wrsETH to 154.04 wrsETH

-22% from 0.40% to 0.31%

WELL borrows increased 51% from 16.4M to 24.82M WELL

wstETH borrows increased 92% from 90.15 to 172.88 wstETH

cbXRP supply increased 52% from 287.48K to 435.71K cbXRP

weETH supply decreased 72% from 1.99K to 559.74 weETH

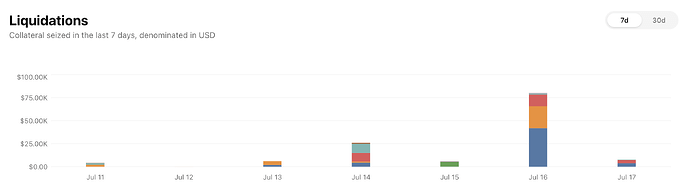

Total liquidations: 71Total Collateral Seized (USD): $202,509.72

Asset

Total Seized (Tokens)

Total Seized (USD)

Liquidation Count

cbBTC

1.275812

$137,638.00

3

USDC

26,956.978949

$26,953.99

27

AERO

14,283.068200

$10,416.70

8

wstETH

3.288692

$10,020.54

3

WETH

3.802628

$9,551.61

21

LBTC

0.029133

$3,379.89

1

VIRTUAL

1,872.323000

$3,059.24

2

cbXRP

591.310000

$1,379.11

2

EURC

91.782930

$107.16

2

WELL

114.443000

$3.23

1

weETH

0.000077

$0.25

1

Asset

Current Borrow Cap

Current Supply Cap

Average Borrow Cap Usage (Past Week)

Average Supply Cap Usage (Past Week)

Average Utilization

WETH

30.00K

32.00K

34.43%

36.56%

88.30%

USDC

34.00M

36.40M

26.72%

28.68%

87.09%

DAI

4.50M

4.80M

6.96%

7.49%

85.64%

USDT

18.40M

22.60M

1.90%

1.82%

83.21%

USDT0

8.00M

10.00M

28.08%

29.75%

75.55%

wrsETH

160.00

400.00

2.66%

9.04%

11.79%

VELO

20.00M

68.00M

16.51%

58.54%

8.29%

rETH

340.00

750.00

3.38%

19.97%

7.69%

OP

650.00K

5.60M

24.36%

44.00%

6.43%

wstETH

1.50K

5.00K

3.60%

20.84%

5.18%

WBTC

0.00

0.00

0.00%

0.00%

4.31%

weETH

220.00

1.20K

5.96%

98.89%

1.11%

cbETH

0.00

10.00

0.00%

9.00%

0.02%

Asset

Total Borrow

Total Supply

Utilization

WETH

+4% from 10.40K WETH to 10.79K WETH

+4% from 11.88K WETH to 12.31K WETH

+0% from 87.57% to 87.69%

USDC

+20% from 9.03M USDC to 10.80M USDC

+19% from 10.51M USDC to 12.52M USDC

+0% from 85.89% to 86.28%

DAI

-30% from 473.01K DAI to 330.95K DAI

-26% from 518.77K DAI to 385.01K DAI

-6% from 91.18% to 85.96%

USDT

+76% from 306.50K USDT to 538.63K USDT +63% from 368.95K USDT to 599.92K USDT +8% from 83.07% to 89.78%

USDT0

-31% from 2.54M USDT0 to 1.76M USDT0

-36% from 3.41M USDT0 to 2.17M USDT0

+9% from 74.52% to 81.33%

wrsETH

-1% from 4.29 wrsETH to 4.26 wrsETH

+3% from 35.17 wrsETH to 36.26 wrsETH

-4% from 12.20% to 11.74%

VELO

+4% from 3.00M VELO to 3.12M VELO

+2% from 39.03M VELO to 39.87M VELO

+2% from 7.68% to 7.83%

rETH

+0% from 11.49 rETH to 11.50 rETH

+39% from 108.85 rETH to 150.91 rETH

-28% from 10.56% to 7.62%

OP

+11% from 145.05K OP to 161.50K OP

-1% from 2.49M OP to 2.46M OP

+13% from 5.83% to 6.56%

wstETH

+16% from 49.29 wstETH to 57.04 wstETH

+10% from 1.01K wstETH to 1.11K wstETH

+5% from 4.90% to 5.16%

WBTC

0% from 0.00 WBTC to 0.00 WBTC

0% from 0.07 WBTC to 0.07 WBTC

+0% from 4.31% to 4.32%

weETH

-35% from 13.69 weETH to 8.85 weETH

-1% from 1.20K weETH to 1.19K weETH

-35% from 1.14% to 0.74%

cbETH

0% from 0.00 cbETH to 0.00 cbETH

0% from 0.90 cbETH to 0.90 cbETH

+0% from 0.02% to 0.02%

USDT borrows increased 76% from 306.50K to 538.63K USDT

USDT supply increased 63% from 368.95K to 599.92K USDT

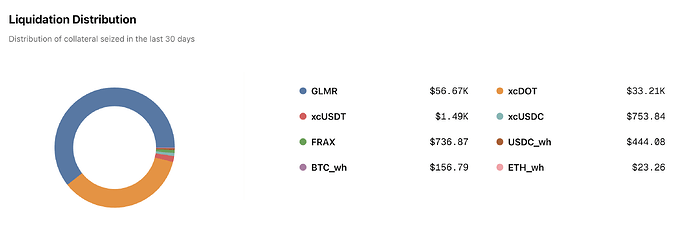

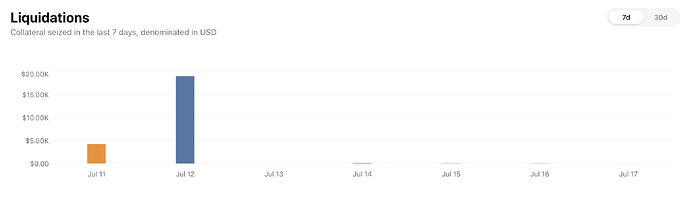

Total liquidations: 6Total Collateral Seized (USD): $17,425.71

Asset

Total Seized (Tokens)

Total Seized (USD)

Liquidation Count

USDT0

131.993058

$13,203.21

3

USDC

4,222.530000

$4,222.12

1

OP

5,207,780,000.000000

$0.27

1

WETH

0.000045

$0.12

1

Asset

Current Borrow Cap

Current Supply Cap

Average Borrow Cap Usage (Past Week)

Average Utilization

GLMR

0.10

0.00

6444.00M%

58.51%

xcUSDC

0.10

0.00

100.34M%

38.61%

xcUSDT

0.10

0.00

90.79M%

37.21%

USDC_wh

0.10

0.00

43.27M%

34.75%

xcDOT

0.10

0.00

23.37M%

4.27%

ETH_wh

0.10

0.00

1.39K%

2.71%

FRAX

0.10

0.00

455.11K%

0.80%

BTC_wh

0.10

0.00

9.28%

0.74%

Asset

Total Borrow

Total Supply

Utilization

GLMR

+0% from 6.43M GLMR to 6.46M GLMR

-6% from 11.15M GLMR to 10.49M GLMR

+7% from 57.67% to 61.61%

xcUSDC

-1% from 100.64K xcUSDC to 99.97K xcUSDC

+5% from 254.10K xcUSDC to 267.72K xcUSDC

-6% from 39.61% to 37.34%

xcUSDT

-7% from 92.57K xcUSDT to 85.73K xcUSDT

+18% from 241.11K xcUSDT to 283.53K xcUSDT

-21% from 38.40% to 30.24%

USDC_wh

-1% from 43.33K USDC_wh to 42.92K USDC_wh

+0% from 124.44K USDC_wh to 124.61K USDC_wh

-1% from 34.82% to 34.44%

xcDOT

-0% from 23.37K xcDOT to 23.37K xcDOT

+1% from 545.51K xcDOT to 548.51K xcDOT

-1% from 4.28% to 4.26%

ETH_wh

-2% from 1.41 ETH_wh to 1.37 ETH_wh

+0% from 51.30 ETH_wh to 51.30 ETH_wh

-2% from 2.74% to 2.68%

FRAX

+0% from 455.10 FRAX to 455.12 FRAX

-10% from 56.32K FRAX to 50.52K FRAX

+11% from 0.81% to 0.90%

BTC_wh

-34% from 0.01 BTC_wh to 0.01 BTC_wh

0% from 1.24 BTC_wh to 1.24 BTC_wh

-34% from 0.82% to 0.54%

Total liquidations: 2Total Collateral Seized (USD): $38.59

Asset

Total Seized (Tokens)

Total Seized (USD)

Liquidation Count

GLMR

567.755860

$38.59

2

Asset

Current Borrow Cap

Current Supply Cap

Average Borrow Cap Usage (Past Week)

Average Utilization

xcKSM

0.10

0.00

6.89M%

37.18%

FRAX

0.10

0.00

76.87M%

23.78%

MOVR

0.10

0.00

3.80M%

2.53%

Asset

Total Borrow

Total Supply

Utilization

xcKSM

-20% from 8.43K xcKSM to 6.78K xcKSM

-10% from 20.06K xcKSM to 18.15K xcKSM

-11% from 42.01% to 37.34%

FRAX

+0% from 76.78K FRAX to 77.03K FRAX

-9% from 354.43K FRAX to 321.42K FRAX

+11% from 21.66% to 23.96%

MOVR

+0% from 3.80K MOVR to 3.80K MOVR

+0% from 150.43K MOVR to 150.47K MOVR

-0% from 2.53% to 2.53%

No liquidations on Moonriver this week.

2 Likes

Anthias Labs would like to provide an update on market performance over the past week for Core markets on Base, Optimism, Moonbeam, and Moonriver. Data from 7/11/25 to 7/17/25. More information can be found on our monitoring dashboard .

Asset

Current Borrow Cap

Current Supply Cap

Average Borrow Cap Usage (Past Week)

Average Supply Cap Usage (Past Week)

Average Utilization

USDC

184.00M

200.00M

42.72%

44.41%

88.53%

USDS

690.00K

750.00K

1.47%

1.63%

83.00%

WETH

64.00K

96.00K

38.22%

31.86%

79.94%

EURC

21.00M

21.90M

22.19%

27.47%

77.41%

DAI

300.00K

400.00K

6.12%

7.87%

58.32%

AERO

25.00M

70.00M

50.60%

34.78%

51.97%

VIRTUAL

2.30M

4.50M

24.39%

39.54%

31.53%

cbXRP

500.00K

1.00M

26.35%

46.56%

28.27%

LBTC

38.00

95.00

30.90%

50.46%

24.49%

tBTC

36.00

90.00

7.51%

12.61%

23.87%

WELL

75.00M

150.00M

35.40%

99.26%

17.83%

cbBTC

640.00

1.50K

19.34%

47.84%

17.27%

USDbC

1.00

1.00

153.23K%

1.07M%

14.32%

MORPHO

1.00M

4.00M

52.02%

99.06%

13.13%

weETH

700.00

4.00K

4.39%

15.74%

5.03%

wstETH

4.80K

14.40K

4.47%

33.39%

4.44%

cbETH

6.40K

16.00K

1.00%

16.53%

2.41%

rETH

900.00

2.60K

1.41%

49.11%

1.00%

wrsETH

430.00

1.00K

0.10%

15.37%

0.28%

Asset

Total Borrow

Total Supply

Utilization

USDC

+1% from 77.31M USDC to 78.45M USDC

-1% from 87.90M USDC to 87.28M USDC

+2% from 87.95% to 89.89%

USDS

-14% from 10.96K USDS to 9.40K USDS

-18% from 13.77K USDS to 11.29K USDS

+5% from 79.60% to 83.32%

WETH

-19% from 26.67K WETH to 21.53K WETH

-16% from 31.92K WETH to 26.82K WETH

-4% from 83.54% to 80.29%

EURC

-9% from 4.39M EURC to 3.98M EURC

-8% from 6.12M EURC to 5.64M EURC

-2% from 71.68% to 70.53%

DAI

-9% from 19.14K DAI to 17.40K DAI

-0% from 31.53K DAI to 31.43K DAI

-9% from 60.70% to 55.35%

AERO

-20% from 13.82M AERO to 11.09M AERO

+1% from 24.30M AERO to 24.45M AERO

-20% from 56.85% to 45.35%

VIRTUAL

-15% from 485.49K VIRTUAL to 412.62K VIRTUAL

-5% from 1.85M VIRTUAL to 1.76M VIRTUAL

-11% from 26.29% to 23.41%

cbXRP

+46% from 108.88K cbXRP to 159.04K cbXRP +35% from 428.00K cbXRP to 579.34K cbXRP

+8% from 25.44% to 27.45%

LBTC

+28% from 11.33 LBTC to 14.45 LBTC

+4% from 47.84 LBTC to 49.86 LBTC

+22% from 23.69% to 28.98%

tBTC

+1% from 3.02 tBTC to 3.05 tBTC

+9% from 11.57 tBTC to 12.62 tBTC

-8% from 26.13% to 24.15%

WELL

+16% from 24.50M WELL to 28.49M WELL

+3% from 145.66M WELL to 149.49M WELL

+13% from 16.82% to 19.06%

cbBTC

+10% from 121.32 cbBTC to 133.13 cbBTC

-3% from 732.51 cbBTC to 709.63 cbBTC

+13% from 16.56% to 18.76%

USDbC

-2% from 1.55K USDbC to 1.52K USDbC

-6% from 11.29K USDbC to 10.64K USDbC

+4% from 13.74% to 14.27%

MORPHO

-5% from 538.77K MORPHO to 509.45K MORPHO

+1% from 3.95M MORPHO to 4.00M MORPHO

-7% from 13.64% to 12.73%

weETH

+0% from 31.16 weETH to 31.23 weETH

-65% from 2.00K weETH to 709.40 weETH +183% from 1.56% to 4.40%

wstETH

+0% from 88.32 wstETH to 88.74 wstETH

+16% from 4.49K wstETH to 5.21K wstETH

-13% from 1.97% to 1.70%

cbETH

+9% from 60.43 cbETH to 65.57 cbETH

+5% from 2.63K cbETH to 2.76K cbETH

+3% from 2.30% to 2.37%

rETH

+28% from 12.24 rETH to 15.71 rETH

+6% from 1.22K rETH to 1.29K rETH

+21% from 1.00% to 1.22%

wrsETH

-69% from 0.75 wrsETH to 0.23 wrsETH +1% from 152.77 wrsETH to 153.64 wrsETH

-69% from 0.49% to 0.15%

46% increase in cbXRP borrows from 108.88K to 159.04K cbXRP

35% increase in cbXRP supply from 428.00K to 579.34K cbXRP

65% decrease in weETH supply from 2.00K to 709.40 weETH

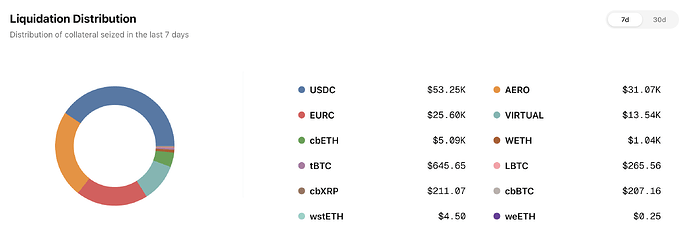

Total liquidations: 105Total Collateral Seized (USD): $129,994.06

Asset

Total Seized (Tokens)

Total Seized (USD)

Liquidation Count

USDC

52,321.254381

$52,315.14

46

AERO

34,774.850200

$31,071.68

12

EURC

21,983.782700

$25,600.00

11

VIRTUAL

7,631.545000

$13,540.36

8

cbETH

1.559843

$5,094.95

2

WETH

0.348942

$1,037.75

12

tBTC

55,242,400.000000

$645.65

2

LBTC

0.002234

$265.56

1

cbXRP

76.268000

$211.07

1

cbBTC

0.001766

$207.16

8

wstETH

0.001105

$4.50

1

weETH

0.000077

$0.25

1

Asset

Current Borrow Cap

Current Supply Cap

Average Borrow Cap Usage (Past Week)

Average Supply Cap Usage (Past Week)

Average Utilization

WETH

30.00K

32.00K

34.20%

36.42%

88.16%

USDC

34.00M

36.40M

34.10%

36.16%

88.13%

USDT0

8.00M

10.00M

23.46%

21.77%

86.39%

USDT

18.40M

22.60M

2.09%

1.98%

84.79%

DAI

4.50M

4.80M

6.49%

7.17%

84.35%

wrsETH

160.00

400.00

2.66%

9.13%

11.66%

rETH

340.00

750.00

3.55%

19.47%

8.44%

VELO

20.00M

68.00M

14.30%

59.24%

7.11%

OP

650.00K

5.60M

23.60%

43.87%

6.25%

wstETH

1.50K

5.00K

3.87%

21.80%

5.33%

WBTC

0.00

0.00

0.00%

0.00%

4.32%

weETH

220.00

1.20K

5.14%

99.37%

0.95%

cbETH

0.00

10.00

0.00%

9.00%

0.02%

Asset

Total Borrow

Total Supply

Utilization

WETH

-32% from 10.38K WETH to 7.11K WETH

-33% from 11.83K WETH to 7.87K WETH

+3% from 87.73% to 90.31%

USDC

-2% from 11.93M USDC to 11.69M USDC

-1% from 13.51M USDC to 13.31M USDC

-1% from 88.32% to 87.79%

USDT0

+10% from 1.78M USDT0 to 1.96M USDT0

-1% from 2.22M USDT0 to 2.19M USDT0

+11% from 80.24% to 89.30%

USDT

+49% from 255.30K USDT to 380.26K USDT +39% from 319.19K USDT to 443.41K USDT

+7% from 79.99% to 85.76%

DAI

+98% from 255.59K DAI to 507.32K DAI +80% from 309.78K DAI to 556.09K DAI +11% from 82.51% to 91.23%

wrsETH

+0% from 4.26 wrsETH to 4.26 wrsETH

+7% from 36.26 wrsETH to 38.72 wrsETH

-6% from 11.74% to 11.00%

rETH

+44% from 11.49 rETH to 16.54 rETH -36% from 150.92 rETH to 95.84 rETH

+127% from 7.62% to 17.26%

VELO

-24% from 3.23M VELO to 2.45M VELO

+3% from 39.96M VELO to 41.35M VELO

-27% from 8.08% to 5.93%

OP

-25% from 169.49K OP to 127.45K OP

+2% from 2.46M OP to 2.51M OP

-26% from 6.89% to 5.08%

wstETH

+19% from 57.04 wstETH to 67.87 wstETH

+1% from 1.05K wstETH to 1.06K wstETH

+18% from 5.41% to 6.38%

WBTC

0% from 0.00 WBTC to 0.00 WBTC

0% from 0.07 WBTC to 0.07 WBTC

+0% from 4.32% to 4.32%

weETH

+76% from 9.79 weETH to 17.20 weETH +1% from 1.19K weETH to 1.20K weETH

+74% from 0.82% to 1.43%

cbETH

0% from 0.00 cbETH to 0.00 cbETH

0% from 0.90 cbETH to 0.90 cbETH

0% from 0.02% to 0.02%

49% increase in USDT borrows from 255.30K to 380.26K USDT

39% increase in USDT supply from 319.19K to 443.41K USDT

98% increase in DAI borrows from 255.59K to 507.32K DAI

80% increase in DAI supply from 309.78K to 556.09K DAI

32% decrease in WETH borrows from 10.38K to 7.11K WETH

33% decrease in WETH supply from 11.83K to 7.87K WETH

Total liquidations: 9Total Collateral Seized (USD): $23,455.97

Asset

Total Seized (Tokens)

Total Seized (USD)

Liquidation Count

wstETH

5.325800

$19,012.40

1

USDC

4,222.530000

$4,222.12

1

USDT

220.8137

$220.84

5

USDT0

0.6051

$0.61

2

Asset

Current Borrow Cap

Average Borrow Cap Usage (Past Week)

Average Utilization

GLMR

0.10

6475.90M%

60.48%

xcUSDC

0.10

99.80M%

37.31%

USDC_wh

0.10

42.34M%

33.95%

xcUSDT

0.10

84.89M%

30.14%

xcDOT

0.10

23.21M%

4.30%

ETH_wh

0.10

1.37K%

2.68%

FRAX

0.10

455.12K%

0.99%

BTC_wh

0.10

6.70%

0.54%

Asset

Total Borrow

Total Supply

Utilization

GLMR

+1% from 6.45M GLMR to 6.49M GLMR

+2% from 10.83M GLMR to 11.00M GLMR

-1% from 59.59% to 59.03%

xcUSDC

-0% from 100.18K xcUSDC to 99.77K xcUSDC

+1% from 265.47K xcUSDC to 267.67K xcUSDC

-1% from 37.74% to 37.27%

USDC_wh

-3% from 42.98K USDC_wh to 41.58K USDC_wh

+0% from 124.59K USDC_wh to 124.87K USDC_wh

-3% from 34.50% to 33.30%

xcUSDT

-2% from 85.81K xcUSDT to 83.91K xcUSDT

+18% from 241.17K xcUSDT to 285.29K xcUSDT

-17% from 35.58% to 29.41%

xcDOT

-1% from 23.37K xcDOT to 23.18K xcDOT

-2% from 548.57K xcDOT to 536.61K xcDOT

+1% from 4.26% to 4.32%

ETH_wh

-4% from 1.37 ETH_wh to 1.32 ETH_wh

-2% from 51.30 ETH_wh to 50.46 ETH_wh

-2% from 2.68% to 2.62%

FRAX

+0% from 455.12 FRAX to 455.12 FRAX

-26% from 56.42K FRAX to 41.68K FRAX

+35% from 0.81% to 1.09%

BTC_wh

0% from 0.01 BTC_wh to 0.01 BTC_wh

0% from 1.24 BTC_wh to 1.24 BTC_wh

-0% from 0.54% to 0.54%

Total liquidations: 9Total Collateral Seized (USD): $237.29

Asset

Total Seized (Tokens)

Total Seized (USD)

Liquidation Count

xcDOT

31.502100

$131.99

1

GLMR

1,377.943960

$105.30

8

Asset

Current Borrow Cap

Average Borrow Cap Usage (Past Week)

Average Utilization

xcKSM

0.10

6.78M%

41.29%

FRAX

0.10

67.47M%

20.98%

MOVR

0.10

3.80M%

2.52%

Asset

Total Borrow

Total Supply

Utilization

xcKSM

+0% from 6.78K xcKSM to 6.78K xcKSM

-13% from 18.44K xcKSM to 15.96K xcKSM

+16% from 36.76% to 42.50%

FRAX

-17% from 77.03K FRAX to 64.30K FRAX

+0% from 321.42K FRAX to 321.69K FRAX

-17% from 23.96% to 19.99%

MOVR

+0% from 3.80K MOVR to 3.80K MOVR

+0% from 150.48K MOVR to 151.09K MOVR

-0% from 2.53% to 2.52%

No liquidations on Moonriver this week.

3 Likes

To Whom It May Concern,

I’m unable to withdraw my 57k xcDOT on Moonbeam, even though utilization is only 4.32%, and I haven’t borrowed anything

the latest market report shows that over 536k xcDOT is supplied and only ~23k is borrowed - so there should be plenty of liquidity

I also didn’t enable my DOT to be used as collateral. can you clarify why my DOT is locked and not withdrawable?

screenshot and wallet address can be provided if needed

I’d appreciate your support in helping me understand or resolve this issue as soon as possible.

Thanks in advance!

4 Likes

Hey @nakadot , it appears our backend indexing service, which reads on-chain data directly, is correctly indexing these numbers. However, as Moonwell contributors have informed us, there are outstanding bad-debt positions from the Nomad exploit in 2022 which count separately to available liquidity. More specifically our metrics show total supply and total borrows where total supply is the sum of supply plus reserves, and total borrows is simply the amount borrowed. Available liquidity works a bit differently, however, as it factors in bad debt. The main reason for the confusion seems to be that there are two different utilization metrics, of which our weekly report only focuses on one.

Market utilization: borrows / (supplied + reserves)

Liquidity utilization: (borrows + bad debt) / (supplied + reserves)

Below are the full metrics for the xcDOT market on Moonbeam, which hopefully clears things up.

supplied: 491,171.84 xcDOTreserves: 45,418.81 xcDOTborrowed: 23,182.19 xcDOTbad debt: 513,407.02 xcDOTliquidity: (supplied + reserves) - (borrows + badDebt)liquidity: (536,590.65 xcDOT) - (536,589.21 xcDOT)liquidity: 1.44 xcDOT

You can find more information about the bad-debt situation in this forum post , and read the above values directly from the contract here .

4 Likes

Let me be very clear:

If the protocol continues to lock new user deposits to cover legacy bad debt, without any compensation, notice, or user-level risk isolation, this is a violation of user trust and could be considered misrepresentation of available liquidity.

Therefore, I kindly request:

A clear timeline or plan for how and when the liquidity issue will be resolved.

Consideration of user refunds, compensation, or other recovery options for affected depositors.

Immediate implementation of better transparency on real withdrawable liquidity (i.e., excluding bad debt).

I hope to resolve this professionally and without escalation, but I reserve the right to take further steps if this matter remains unaddressed.

Thank you for your time and attention. I look forward to your response.

10 Likes

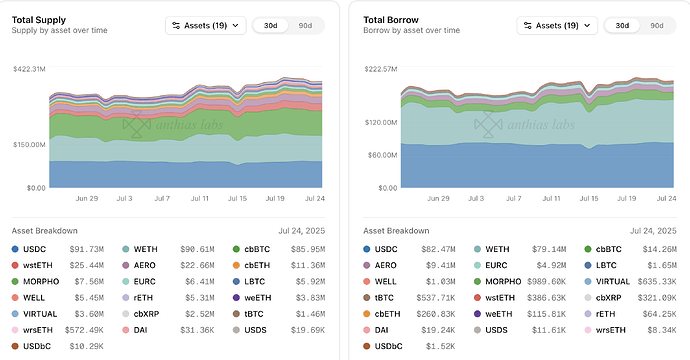

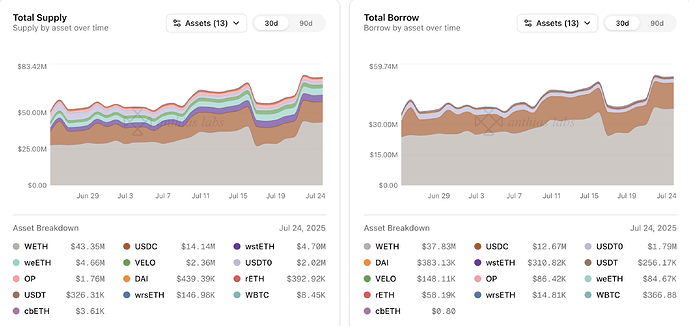

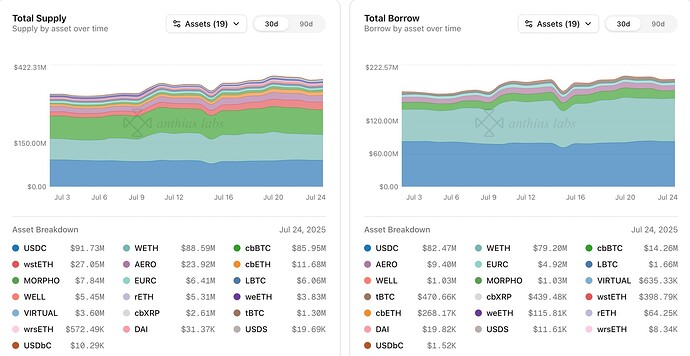

Anthias Labs would like to provide an update on market performance over the past week for Core markets on Base, Optimism, Moonbeam, and Moonriver. Data from 7/18/25 to 7/24/25. More information can be found on our monitoring dashboard .

Asset

Current Borrow Cap

Current Supply Cap

Average Borrow Cap Usage (Past Week)

Average Supply Cap Usage (Past Week)

Average Utilization

USDC

184.00M

200.00M

43.98%

45.03%

89.85%

WETH

64.00K

96.00K

34.29%

27.31%

83.76%

USDS

690.00K

750.00K

1.46%

1.91%

75.76%

EURC

21.00M

21.90M

19.57%

25.71%

73.13%

DAI

300.00K

400.00K

6.27%

7.84%

59.96%

AERO

25.00M

70.00M

42.76%

35.52%

43.03%

tBTC

36.00

90.00

10.54%

13.60%

31.00%

LBTC

38.00

95.00

36.91%

52.39%

28.17%

cbXRP

500.00K

1.00M

29.71%

65.43%

22.97%

WELL

75.00M

150.00M

38.37%

100.45%

19.10%

cbBTC

640.00

1.50K

21.87%

49.04%

19.01%

VIRTUAL

2.30M

4.50M

16.06%

44.69%

18.49%

USDbC

1.00

1.00

151.93K%

1.06M%

14.37%

MORPHO

1.00M

4.00M

50.94%

100.00%

12.73%

weETH

700.00

4.00K

4.42%

23.97%

3.42%

cbETH

6.40K

16.00K

1.02%

17.26%

2.36%

wstETH

4.80K

14.40K

1.88%

39.19%

1.60%

rETH

900.00

2.60K

1.74%

50.02%

1.21%

wrsETH

430.00

1.00K

0.24%

15.27%

0.69%

Asset

Total Borrow

Total Supply

Utilization

USDC

-4% from 78.44M USDC to 75.55M USDC

-4% from 87.14M USDC to 83.71M USDC

+0% from 90.01% to 90.25%

WETH

+24% from 21.57K WETH to 26.71K WETH

+12% from 26.78K WETH to 29.97K WETH

+11% from 80.57% to 89.13%

USDS

+43% from 9.40K USDS to 13.42K USDS +61% from 11.29K USDS to 18.19K USDS -11% from 83.32% to 73.78%

EURC

+7% from 4.03M EURC to 4.30M EURC

-5% from 5.71M EURC to 5.41M EURC

+13% from 70.68% to 79.60%

DAI

+15% from 17.40K DAI to 19.94K DAI

-0% from 31.43K DAI to 31.36K DAI

+15% from 55.35% to 63.60%

AERO

-7% from 11.15M AERO to 10.37M AERO

+8% from 24.42M AERO to 26.41M AERO

-14% from 45.64% to 39.26%

tBTC

+30% from 3.05 tBTC to 3.96 tBTC

-6% from 12.50 tBTC to 11.72 tBTC

+39% from 24.39% to 33.78%

LBTC

-4% from 14.45 LBTC to 13.93 LBTC

+2% from 49.86 LBTC to 50.79 LBTC

-5% from 28.98% to 27.42%

cbXRP

-13% from 154.72K cbXRP to 134.81K cbXRP

+39% from 578.29K cbXRP to 803.53K cbXRP

-37% from 26.76% to 16.78%

WELL

-6% from 28.50M WELL to 26.69M WELL

+1% from 149.44M WELL to 151.25M WELL

-7% from 19.07% to 17.64%

cbBTC

-7% from 129.94 cbBTC to 120.21 cbBTC

+3% from 704.67 cbBTC to 725.01 cbBTC

-10% from 18.44% to 16.58%

VIRTUAL

-6% from 396.20K VIRTUAL to 372.99K VIRTUAL

+16% from 1.79M VIRTUAL to 2.07M VIRTUAL

-19% from 22.17% to 18.05%

USDbC

+0% from 1.52K USDbC to 1.52K USDbC

-3% from 10.64K USDbC to 10.29K USDbC

+3% from 14.27% to 14.77%

MORPHO

+3% from 508.76K MORPHO to 522.73K MORPHO

+0% from 4.00M MORPHO to 4.00M MORPHO

+3% from 12.71% to 13.06%

weETH

-4% from 31.23 weETH to 29.97 weETH

+206% from 709.40 weETH to 2.17K weETH -69% from 4.40% to 1.38%

cbETH

-1% from 65.57 cbETH to 65.16 cbETH

+3% from 2.76K cbETH to 2.84K cbETH

-3% from 2.37% to 2.30%

wstETH

-0% from 88.74 wstETH to 88.48 wstETH

+20% from 5.19K wstETH to 6.24K wstETH

-17% from 1.71% to 1.42%

rETH

-0% from 15.71 rETH to 15.67 rETH

+0% from 1.29K rETH to 1.30K rETH

-0% from 1.22% to 1.21%

wrsETH

+856% from 0.23 wrsETH to 2.21 wrsETH -1% from 153.64 wrsETH to 152.03 wrsETH

+866% from 0.15% to 1.46%

WETH borrows increased by 24% from 21.57K to 26.71K WETH

cbXRP supply increased by 39% from 578.29K to 803.53K cbXRP

weETH supply increased by 206% from 709.40 to 2.17K weETH

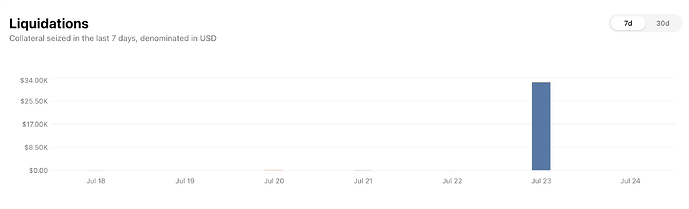

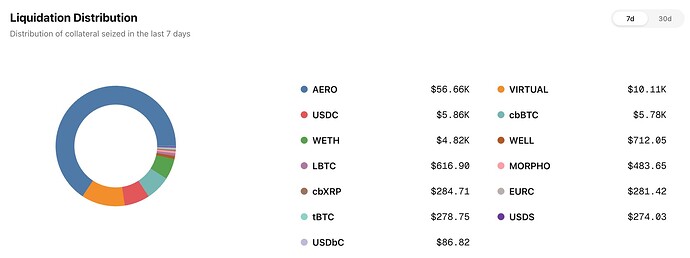

Total liquidations: 96Total Collateral Seized (USD): $202,689.34Total Debt Repaid (USD): $184,263.03Total Liquidation Bonus (USD): $18,426.30Total Liquidator Bonus (USD): $12,898.41Total Protocol Bonus (USD): $5,527.89

Asset

Total Seized (Tokens)

Total Seized (USD)

Debt Repaid (USD)

Liquidation Bonus (USD)

Liquidator Bonus (USD)

Protocol Bonus (USD)

Liquidation Count

cbXRP

25,957.019600

$87,115.94

$79,196.31

$7,919.63

$5,543.74

$2,375.89

4

USDC

79,939.384259

$79,929.07

$72,662.79

$7,266.28

$5,086.40

$2,179.88

26

AERO

19,701.629300

$17,614.12

$16,012.84

$1,601.28

$1,120.90

$480.39

11

WELL

273,298.897900

$8,498.24

$7,725.68

$772.57

$540.80

$231.77

5

cbBTC

0.023151

$2,713.39

$2,466.72

$246.67

$172.67

$74.00

10

EURC

2,279.412000

$2,667.06

$2,424.60

$242.46

$169.72

$72.74

3

VIRTUAL

1,454.376200

$2,626.95

$2,388.14

$238.81

$167.17

$71.64

10

cbETH

0.177105

$698.09

$634.62

$63.46

$44.42

$19.04

1

WETH

0.133389

$492.43

$447.67

$44.77

$31.34

$13.43

14

tBTC

0.001419

$168.49

$153.17

$15.32

$10.72

$4.60

5

LBTC

0.001034

$124.46

$113.15

$11.31

$7.92

$3.39

4

wstETH

0.007456

$32.65

$29.68

$2.97

$2.08

$0.89

1

USDS

7.702760

$7.70

$7.00

$0.70

$0.49

$0.21

1

DAI

0.745667

$0.75

$0.68

$0.07

$0.05

$0.02

1

Asset

Current Borrow Cap

Current Supply Cap

Average Borrow Cap Usage (Past Week)

Average Supply Cap Usage (Past Week)

Average Utilization

USDC

34.00M

36.40M

32.79%

34.28%

89.38%

WETH

30.00K

32.00K

28.01%

29.57%

89.05%

USDT0

8.00M

10.00M

21.41%

19.55%

87.56%

DAI

4.50M

4.80M

8.78%

9.41%

87.38%

USDT

18.40M

22.60M

1.73%

1.70%

81.88%

rETH

340.00

750.00

4.25%

12.81%

15.04%

wrsETH

160.00

400.00

2.51%

9.68%

10.38%

wstETH

1.50K

5.00K

4.67%

21.26%

6.58%

VELO

20.00M

68.00M

13.46%

62.73%

6.31%

OP

650.00K

5.60M

19.45%

45.42%

4.97%

WBTC

0.00

0.00

0.00%

0.00%

4.32%

weETH

220.00

1.20K

9.17%

99.88%

1.68%

cbETH

0.00

10.00

0.00%

9.00%

0.02%

Asset

Total Borrow

Total Supply

Utilization

USDC

+8% from 11.69M USDC to 12.65M USDC

+6% from 13.31M USDC to 14.12M USDC

+2% from 87.77% to 89.58%

WETH

+47% from 7.10K WETH to 10.42K WETH +52% from 7.85K WETH to 11.95K WETH -4% from 90.49% to 87.23%

USDT0

-8% from 1.96M USDT0 to 1.79M USDT0

-9% from 2.19M USDT0 to 2.00M USDT0

+1% from 89.26% to 89.86%

DAI

-24% from 506.72K DAI to 383.15K DAI

-21% from 556.10K DAI to 439.42K DAI

-4% from 91.12% to 87.20%

USDT

-33% from 380.27K USDT to 256.11K USDT

-26% from 442.71K USDT to 326.33K USDT

-9% from 85.90% to 78.48%

rETH

-15% from 16.54 rETH to 14.08 rETH

-1% from 95.84 rETH to 95.08 rETH

-14% from 17.26% to 14.81%

wrsETH

-8% from 4.26 wrsETH to 3.90 wrsETH

+0% from 38.72 wrsETH to 38.72 wrsETH

-8% from 11.00% to 10.08%

wstETH

+5% from 67.95 wstETH to 71.03 wstETH

+1% from 1.06K wstETH to 1.07K wstETH

+4% from 6.40% to 6.63%

VELO

+12% from 2.45M VELO to 2.75M VELO

+4% from 41.27M VELO to 42.81M VELO

+8% from 5.94% to 6.42%

OP

-2% from 127.45K OP to 124.96K OP

+2% from 2.51M OP to 2.56M OP

-4% from 5.08% to 4.88%

WBTC

0% from 0.00 WBTC to 0.00 WBTC

0% from 0.07 WBTC to 0.07 WBTC

+0% from 4.32% to 4.32%

weETH

+27% from 17.20 weETH to 21.82 weETH

+0% from 1.20K weETH to 1.20K weETH

+26% from 1.44% to 1.82%

cbETH

0% from 0.00 cbETH to 0.00 cbETH

0% from 0.90 cbETH to 0.90 cbETH

0% from 0.02% to 0.02%

WETH supply increased by 52% from 7.85K to 11.95K WETH

WETH borrows increased by 47% from 7.10K to 10.42K WETH

USDT supply decreased by 26% from 442.71K USDT to 326.33K USDT

USDT borrows decreased by 33% from 380.27K to 256.11K USDT

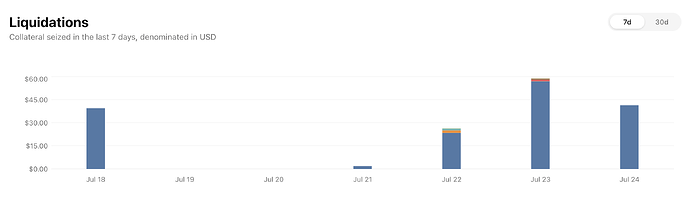

Total liquidations: 17Total Collateral Seized (USD): $32,742.00Total Debt Repaid (USD): $29,765.45Total Liquidation Bonus (USD): $2,976.55Total Liquidator Bonus (USD): $2,083.58Total Protocol Bonus (USD): $892.96

Asset

Total Seized (Tokens)

Total Seized (USD)

Debt Repaid (USD)

Liquidation Bonus (USD)

Liquidator Bonus (USD)

Protocol Bonus (USD)

Liquidation Count

wstETH

7.582620

$32,333.40

$29,394.00

$2,939.40

$2,057.58

$881.82

1

VELO

3,866.096000

$227.02

$206.39

$20.64

$14.45

$6.19

4

USDC

96.599300

$96.59

$87.81

$8.78

$6.15

$2.63

2

WETH

0.008875

$33.38

$30.35

$3.03

$2.12

$0.91

1

OP

36.695800

$28.36

$25.78

$2.58

$1.80

$0.77

1

USDT0

16.032102

$16.04

$14.59

$1.46

$1.02

$0.44

5

USDT

7.196850

$7.20

$6.54

$0.65

$0.46

$0.20

3

Asset

Current Borrow Cap

Average Borrow Cap Usage (Past Week)

Average Utilization

GLMR

0.10

6518.47M%

62.43%

xcUSDC

0.10

98.77M%

58.02%

xcUSDT

0.10

83.95M%

44.82%

USDC_wh

0.10

41.46M%

33.19%

xcDOT

0.10

23.19M%

4.32%

ETH_wh

0.10

1.31K%

2.70%

FRAX

0.10

454.49K%

1.10%

BTC_wh

0.10

6.70%

0.54%

Asset

Total Borrow

Total Supply

Utilization

GLMR

+1% from 6.49M GLMR to 6.55M GLMR

-6% from 11.00M GLMR to 10.32M GLMR

+7% from 59.03% to 63.40%

xcUSDC

-1% from 99.77K xcUSDC to 98.60K xcUSDC

-37% from 267.67K xcUSDC to 168.60K xcUSDC

+57% from 37.27% to 58.48%

xcUSDT

+0% from 83.91K xcUSDT to 83.98K xcUSDT

-35% from 285.29K xcUSDT to 185.31K xcUSDT

+54% from 29.41% to 45.32%

USDC_wh

-0% from 41.58K USDC_wh to 41.49K USDC_wh

+0% from 124.87K USDC_wh to 124.94K USDC_wh

-0% from 33.30% to 33.21%

xcDOT

+0% from 23.18K xcDOT to 23.19K xcDOT

-0% from 536.61K xcDOT to 536.60K xcDOT

+0% from 4.32% to 4.32%

ETH_wh

-2% from 1.32 ETH_wh to 1.29 ETH_wh

-5% from 50.46 ETH_wh to 47.96 ETH_wh

+3% from 2.62% to 2.70%

FRAX

-1% from 455.12 FRAX to 451.37 FRAX

-2% from 41.68K FRAX to 40.77K FRAX

+1% from 1.09% to 1.11%

BTC_wh

0% from 0.01 BTC_wh to 0.01 BTC_wh

-1% from 1.24 BTC_wh to 1.24 BTC_wh

+1% from 0.54% to 0.54%

xcUSDC supply decreased by 37% from 267.67K to 168.60K xcUSDC

xcUSDT supply decreased by 35% from 285.29K to 185.31K xcUSDT

Total liquidations: 77Total Collateral Seized (USD): $167.85Total Debt Repaid (USD): $152.59Total Liquidation Bonus (USD): $15.26Total Liquidator Bonus (USD): $10.68Total Protocol Bonus (USD): $4.58

Asset

Total Seized (Tokens)

Total Seized (USD)

Debt Repaid (USD)

Liquidation Bonus (USD)

Liquidator Bonus (USD)

Protocol Bonus (USD)

Liquidation Count

GLMR

2,115.189055

$162.98

$148.16

$14.82

$10.37

$4.44

59

USDC_wh

1.815999

$1.82

$1.65

$0.17

$0.12

$0.05

10

xcUSDC

1.147642

$1.15

$1.04

$0.10

$0.07

$0.03

2

FRAX

1.069776

$1.07

$0.97

$0.10

$0.07

$0.03

2

xcDOT

0.125611

$0.54

$0.49

$0.05

$0.03

$0.01

2

xcUSDT

0.299774

$0.30

$0.27

$0.03

$0.02

$0.01

2

Asset

Current Borrow Cap

Average Borrow Cap Usage (Past Week)

Average Utilization

xcKSM

0.10

6.79M%

42.93%

FRAX

0.10

64.33M%

19.64%

MOVR

0.10

3.80M%

2.52%

Asset

Total Borrow

Total Supply

Utilization

xcKSM

+0% from 6.78K xcKSM to 6.79K xcKSM

-1% from 15.96K xcKSM to 15.81K xcKSM

+1% from 42.50% to 42.97%

FRAX

+0% from 64.30K FRAX to 64.34K FRAX

+2% from 321.69K FRAX to 328.58K FRAX

-2% from 19.99% to 19.58%

MOVR

+0% from 3.80K MOVR to 3.80K MOVR

+1% from 151.09K MOVR to 152.15K MOVR

-1% from 2.52% to 2.50%

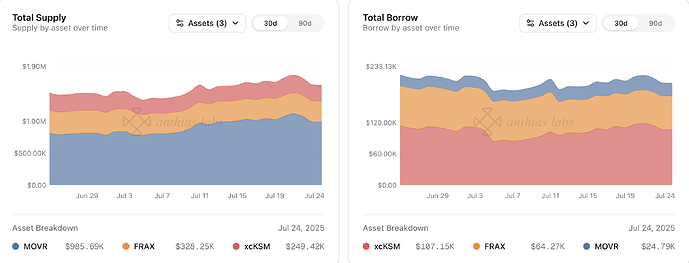

No liquidation events on Moonriver this week.

3 Likes

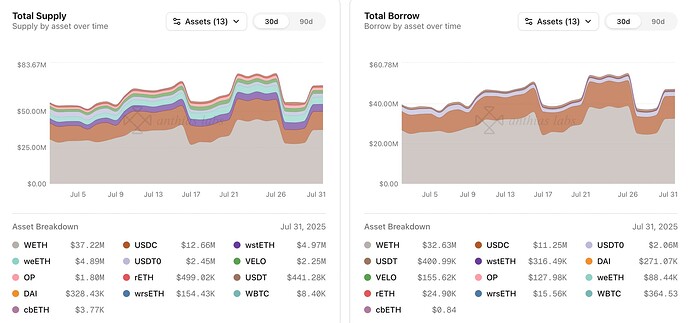

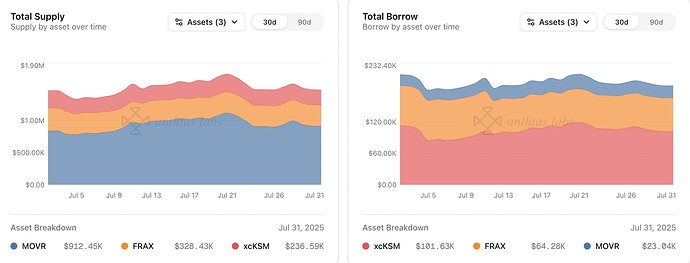

Anthias Labs would like to provide an update on market performance over the past week for Core markets on Base, Optimism, Moonbeam, and Moonriver. Data from 7/25/25 to 7/31/25. More information can be found on our monitoring dashboard .

Asset

Current Borrow Cap

Current Supply Cap

Average Borrow Cap Usage (Past Week)

Average Supply Cap Usage (Past Week)

Average Utilization

USDC

184.00M

200.00M

38.90%

39.82%

89.86%

WETH

64.00K

96.00K

39.65%

29.92%

88.34%

USDS

690.00K

750.00K

3.19%

3.70%

80.62%

EURC

21.00M

21.90M

19.56%

24.21%

77.96%

DAI

300.00K

400.00K

6.46%

7.85%

61.79%

AERO

25.00M

70.00M

41.58%

37.77%

39.32%

tBTC

36.00

90.00

10.21%

11.33%

36.03%

LBTC

38.00

95.00

30.49%

52.05%

23.44%

WELL

75.00M

220.00M

38.51%

70.57%

18.60%

cbXRP

500.00K

2.00M

32.48%

44.92%

17.92%

VIRTUAL

2.30M

4.50M

15.50%

46.29%

17.13%

cbBTC

640.00

1.50K

19.26%

48.46%

16.95%

USDbC

1.00

1.00

151.94K%

1.02M%

14.84%

MORPHO

1.00M

6.00M

52.62%

67.25%

13.04%

wstETH

4.80K

14.40K

3.77%

40.96%

3.07%

cbETH

6.40K

16.00K

1.10%

17.50%

2.51%

weETH

700.00

4.00K

4.89%

52.56%

1.63%

rETH

900.00

2.60K

2.24%

49.53%

1.57%

wrsETH

430.00

1.00K

0.06%

15.16%

0.18%

Asset

Total Borrow

Total Supply

Utilization

USDC

-11% from 76.32M USDC to 68.18M USDC

-10% from 84.26M USDC to 75.62M USDC

-0% from 90.59% to 90.15%

WETH

+0% from 26.41K WETH to 26.42K WETH

-1% from 30.07K WETH to 29.66K WETH

+1% from 87.84% to 89.06%

USDS

-40% from 33.19K USDS to 19.81K USDS -33% from 33.22K USDS to 22.27K USDS

-11% from 99.89% to 88.93%

EURC

-11% from 4.32M EURC to 3.83M EURC

-23% from 5.56M EURC to 4.26M EURC

+15% from 77.74% to 89.75%

DAI

-5% from 19.82K DAI to 18.92K DAI

+0% from 31.37K DAI to 31.40K DAI

-5% from 63.20% to 60.26%

AERO

-9% from 10.37M AERO to 9.42M AERO

+0% from 26.38M AERO to 26.50M AERO

-10% from 39.31% to 35.57%

tBTC

-34% from 3.96 tBTC to 2.60 tBTC

-7% from 10.97 tBTC to 10.19 tBTC

-29% from 36.08% to 25.50%

LBTC

-15% from 13.93 LBTC to 11.79 LBTC

-1% from 50.79 LBTC to 50.24 LBTC

-14% from 27.42% to 23.48%

WELL

+4% from 27.86M WELL to 28.88M WELL

+4% from 151.29M WELL to 157.68M WELL

-1% from 18.41% to 18.31%

cbXRP

+28% from 135.27K cbXRP to 173.64K cbXRP

+24% from 801.92K cbXRP to 996.75K cbXRP

+3% from 16.87% to 17.42%

VIRTUAL

+29% from 381.69K VIRTUAL to 491.30K VIRTUAL

+1% from 2.14M VIRTUAL to 2.16M VIRTUAL

+28% from 17.84% to 22.78%

cbBTC

+10% from 120.31 cbBTC to 132.17 cbBTC

+2% from 724.42 cbBTC to 736.19 cbBTC

+8% from 16.61% to 17.95%

USDbC

+0% from 1.52K USDbC to 1.52K USDbC

-1% from 10.29K USDbC to 10.19K USDbC

+1% from 14.77% to 14.91%

MORPHO

+3% from 527.47K MORPHO to 541.24K MORPHO

+2% from 4.00M MORPHO to 4.09M MORPHO

+0% from 13.18% to 13.24%

wstETH

+135% from 88.48 wstETH to 208.17 wstETH -2% from 6.00K wstETH to 5.86K wstETH

+141% from 1.47% to 3.55%

cbETH

+51% from 65.16 cbETH to 98.64 cbETH -2% from 2.84K cbETH to 2.78K cbETH

+54% from 2.30% to 3.54%

weETH

+49% from 29.97 weETH to 44.56 weETH +4% from 2.17K weETH to 2.25K weETH

+43% from 1.38% to 1.98%

rETH

+29% from 15.67 rETH to 20.17 rETH

-0% from 1.29K rETH to 1.29K rETH

+29% from 1.21% to 1.56%

wrsETH

-90% from 2.21 wrsETH to 0.21 wrsETH -0% from 152.03 wrsETH to 151.67 wrsETH

-90% from 1.46% to 0.14%

wstETH borrows increased 135% from 88.48 to 208.17 wstETH

cbETH borrows increased 51% from 65.16 to 98.64 cbETH

weETH borrows increased 49% from 29.97 to 44.56 weETH

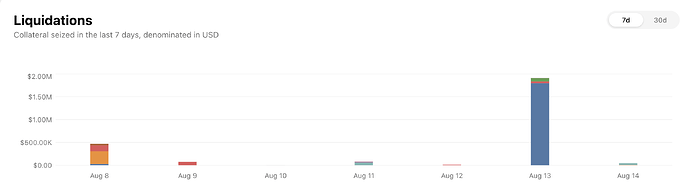

Total liquidations: 84

Total Collateral Seized (USD): $86,191.09

Total Debt Repaid (USD): $78,355.53

Total Liquidation Bonus (USD): $7,835.55

Total Liquidator Bonus (USD): $5,484.89

Total Protocol Bonus (USD): $2,350.67

Asset

Total Seized (Tokens)

Total Seized (USD)

Debt Repaid (USD)

Liquidation Bonus (USD)

Liquidator Bonus (USD)

Protocol Bonus (USD)

Liquidation Count

AERO

68,246.462780

$56,656.39

$51,505.81

$5,150.58

$3,605.41

$1,545.17

20

VIRTUAL

7,669.819780

$10,077.60

$9,161.46

$916.15

$641.30

$274.84

10

USDC

5,861.570950

$5,861.00

$5,328.18

$532.82

$372.97

$159.85

13

cbBTC

0.049880

$5,780.59

$5,255.08

$525.51

$367.86

$157.65

4

WETH

1.276462

$4,797.18

$4,361.07

$436.11

$305.27

$130.83

21

WELL

21,897.860000

$712.05

$647.32

$64.73

$45.31

$19.42

2

LBTC

0.005234

$616.90

$560.82

$56.08

$39.26

$16.82

2

MORPHO

245.111000

$483.65

$439.68

$43.97

$30.78

$13.19

1

cbXRP

93.677970

$284.71

$258.83

$25.88

$18.12

$7.76

2

EURC

246.693600

$281.42

$255.83

$25.58

$17.91

$7.68

2

tBTC

0.002388

$278.75

$253.41

$25.34

$17.74

$7.60

5

USDS

274.060000

$274.03

$249.12

$24.91

$17.44

$7.47

1

USDbC

86.828900

$86.82

$78.92

$7.89

$5.52

$2.37

1

Asset

Current Borrow Cap

Current Supply Cap

Average Borrow Cap Usage (Past Week)

Average Supply Cap Usage (Past Week)

Average Utilization

USDC

34.00M

36.40M

31.82%

33.17%

89.61%

USDT0

8.00M

10.00M

26.08%

23.45%

89.03%

WETH

30.00K

32.00K

28.31%

29.94%

88.81%

DAI

4.50M

4.80M

7.53%

8.26%

85.25%

USDT

18.40M

22.60M

1.75%

2.27%

76.64%

wrsETH

160.00

400.00

2.44%

9.68%

10.08%

rETH

340.00

750.00

3.29%

16.77%

9.05%

wstETH

1.50K

5.00K

4.89%

21.52%

6.82%

VELO

20.00M

68.00M

14.11%

63.08%

6.58%

OP

650.00K

5.60M

25.26%

45.38%

6.46%

WBTC

0.00

0.00

0.00%

0.00%

4.32%

weETH

220.00

1.20K

9.81%

100.00%

1.80%

cbETH

0.00

10.00

0.00%

9.00%

0.02%

Asset

Total Borrow

Total Supply

Utilization

USDC

-26% from 12.65M USDC to 9.33M USDC

-26% from 14.12M USDC to 10.44M USDC

-0% from 89.56% to 89.39%

USDT0

+13% from 1.79M USDT0 to 2.03M USDT0

+13% from 1.99M USDT0 to 2.25M USDT0

+0% from 90.02% to 90.41%

WETH

-33% from 10.42K WETH to 6.95K WETH

-35% from 11.95K WETH to 7.74K WETH

+3% from 87.24% to 89.74%

DAI

-29% from 382.16K DAI to 271.10K DAI

-25% from 439.44K DAI to 328.68K DAI

-5% from 86.96% to 82.48%

USDT

-0% from 256.12K USDT to 255.27K USDT

-2% from 326.34K USDT to 321.26K USDT

+1% from 78.48% to 79.46%

wrsETH

0% from 3.90 wrsETH to 3.90 wrsETH

0% from 38.72 wrsETH to 38.72 wrsETH

0% from 10.08% to 10.08%

rETH

-59% from 14.08 rETH to 5.76 rETH +22% from 95.08 rETH to 115.66 rETH

-66% from 14.81% to 4.98%

wstETH

-3% from 71.03 wstETH to 68.88 wstETH

-2% from 1.07K wstETH to 1.05K wstETH

-1% from 6.63% to 6.57%

VELO

-3% from 2.78M VELO to 2.71M VELO

+2% from 42.52M VELO to 43.38M VELO

-4% from 6.54% to 6.25%

OP

+44% from 124.96K OP to 179.75K OP -1% from 2.56M OP to 2.55M OP

+45% from 4.88% to 7.06%

WBTC

0% from 0.00 WBTC to 0.00 WBTC

0% from 0.07 WBTC to 0.07 WBTC

0% from 4.32% to 4.32%

weETH

-1% from 21.82 weETH to 21.70 weETH

-0% from 1.20K weETH to 1.20K weETH

-1% from 1.82% to 1.81%

cbETH

0% from 0.00 cbETH to 0.00 cbETH

-0% from 0.90 cbETH to 0.90 cbETH

+0% from 0.02% to 0.02%

Total liquidations: 5

Total Collateral Seized (USD): $402.32

Total Debt Repaid (USD): $365.75

Total Liquidation Bonus (USD): $36.57

Total Liquidator Bonus (USD): $25.60

Total Protocol Bonus (USD): $10.97

Asset

Total Seized (Tokens)

Total Seized (USD)

Debt Repaid (USD)

Liquidation Bonus (USD)

Liquidator Bonus (USD)

Protocol Bonus (USD)

Liquidation Count

USDC

355.319060

$355.27

$322.97

$32.30

$22.61

$9.69

2

OP

43.883800

$30.28

$27.53

$2.75

$1.93

$0.83

1

USDT0

16.589300

$16.60

$15.09

$1.51

$1.06

$0.45

1

WETH

0.000046

$0.18

$0.16

$0.02

$0.01

$0.00

1

Asset

Current Borrow Cap

Average Borrow Cap Usage (Past Week)

Average Utilization

GLMR

0.10

6572.71M%

62.70%

xcUSDC

0.10

98.69M%

58.15%

xcUSDT

0.10

83.74M%

45.39%

USDC_wh

0.10

41.48M%

33.43%

xcDOT

0.10

23.16M%

4.32%

ETH_wh

0.10

1.28K%

2.67%

BTC_wh

0.10

22.39%

1.81%

FRAX

0.10

451.37K%

1.11%

Asset

Total Borrow

Total Supply

Utilization

GLMR

+1% from 6.55M GLMR to 6.60M GLMR

+7% from 10.32M GLMR to 11.02M GLMR

-6% from 63.40% to 59.88%

xcUSDC

+0% from 98.60K xcUSDC to 98.76K xcUSDC

+0% from 168.60K xcUSDC to 169.18K xcUSDC

-0% from 58.48% to 58.38%

xcUSDT

-1% from 83.98K xcUSDT to 83.47K xcUSDT

-1% from 185.31K xcUSDT to 184.01K xcUSDT

+0% from 45.32% to 45.36%

USDC_wh

-0% from 41.49K USDC_wh to 41.48K USDC_wh

-1% from 124.94K USDC_wh to 123.96K USDC_wh

+1% from 33.21% to 33.46%

xcDOT

-0% from 23.19K xcDOT to 23.14K xcDOT

-0% from 536.60K xcDOT to 536.55K xcDOT

-0% from 4.32% to 4.31%

ETH_wh

-2% from 1.29 ETH_wh to 1.27 ETH_wh

+0% from 47.96 ETH_wh to 47.96 ETH_wh

-2% from 2.70% to 2.65%

BTC_wh

+1391% from 0.01 BTC_wh to 0.10 BTC_wh -0% from 1.24 BTC_wh to 1.24 BTC_wh

+1390% from 0.54% to 8.09%

FRAX

+0% from 451.37 FRAX to 451.37 FRAX

-0% from 40.77K FRAX to 40.77K FRAX

+0% from 1.11% to 1.11%

Total liquidations: 16

Total Collateral Seized (USD): $124.33

Total Debt Repaid (USD): $113.03

Total Liquidation Bonus (USD): $11.30

Total Liquidator Bonus (USD): $7.91

Total Protocol Bonus (USD): $3.39

Asset

Total Seized (Tokens)

Total Seized (USD)

Debt Repaid (USD)

Liquidation Bonus (USD)

Liquidator Bonus (USD)

Protocol Bonus (USD)

Liquidation Count

GLMR

1,652.792324

$120.32

$109.38

$10.94

$7.66

$3.28

10

xcDOT

1.030632

$4.02

$3.65

$0.37

$0.26

$0.11

6

Asset

Current Borrow Cap

Average Borrow Cap Usage (Past Week)

Average Utilization

xcKSM

0.10

6.79M%

42.96%

FRAX

0.10

64.35M%

19.57%

MOVR

0.10

3.80M%

2.52%

Asset

Total Borrow

Total Supply

Utilization

xcKSM

+0% from 6.79K xcKSM to 6.80K xcKSM

+0% from 15.81K xcKSM to 15.83K xcKSM

-0% from 42.97% to 42.96%

FRAX

+0% from 64.34K FRAX to 64.35K FRAX

+0% from 328.58K FRAX to 328.76K FRAX

-0% from 19.58% to 19.57%

MOVR

+0% from 3.80K MOVR to 3.80K MOVR

-2% from 152.15K MOVR to 149.55K MOVR

+2% from 2.50% to 2.54%

No liquidation events on Moonriver this week.

1 Like

nesde

August 1, 2025, 6:36am

9

Moonwell team is not helping us at all. Can anyone help us get our xcDot back?

3 Likes

what is the moonwell and moonbeam Team doing to provide enough liquidity for all those who supported the moonwell application for a long time. to be able to withdraw?

2 Likes

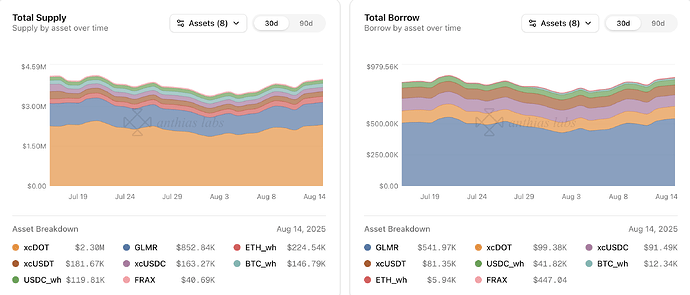

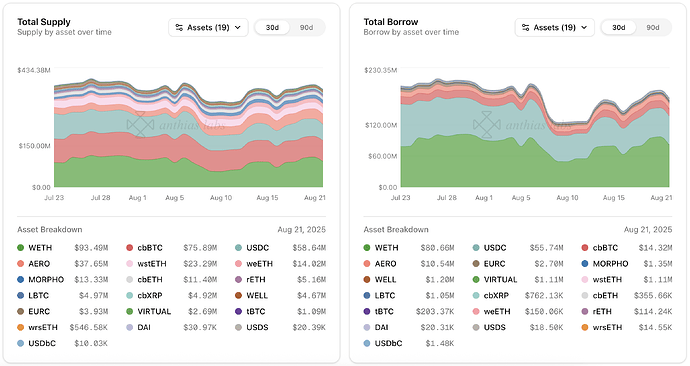

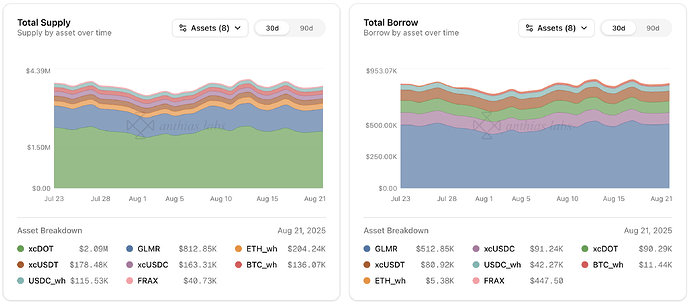

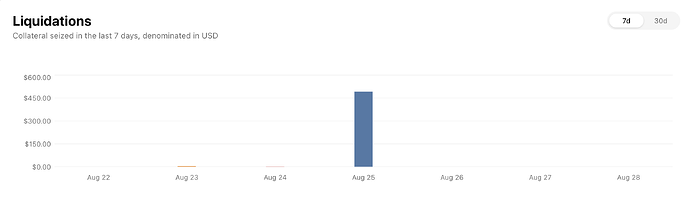

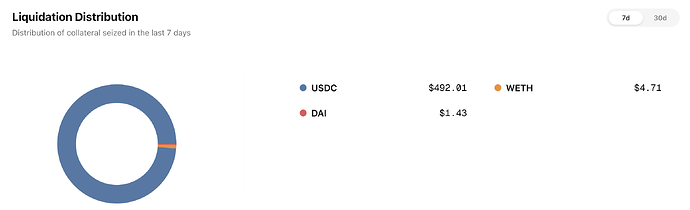

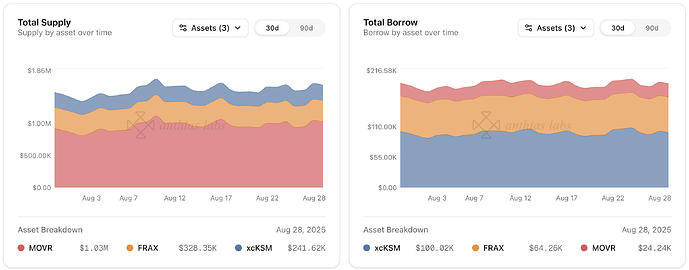

Anthias Labs would like to provide an update on market performance over the past week for Core markets on Base, Optimism, Moonbeam, and Moonriver. Data from 8/1/25 to 8/7/25. More information can be found on our monitoring dashboard .

Asset

Current Borrow Cap

Current Supply Cap

Average Borrow Cap Usage (Past Week)

Average Supply Cap Usage (Past Week)

Average Utilization

USDC

184.00M

200.00M

36.89%

37.69%

90.04%

USDS

690.00K

750.00K

2.66%

2.74%

89.16%

WETH

64.00K

96.00K

39.79%

29.83%

88.94%

EURC

21.00M

21.90M

15.25%

18.71%

78.26%

DAI

300.00K

400.00K

6.51%

7.86%

62.11%

AERO

25.00M

70.00M

36.72%

36.92%

35.55%

tBTC

36.00

90.00

6.93%

10.71%

25.93%

LBTC

38.00

95.00

30.68%

51.90%

23.66%

VIRTUAL

2.30M

4.50M

20.18%

44.47%

23.17%

WELL

75.00M

220.00M

41.57%

74.60%

18.99%

cbBTC

640.00

1.50K

19.81%

49.04%

17.23%

cbXRP

500.00K

2.00M

37.14%

59.07%

15.80%

USDbC

1.00

1.00

151.54K%

1.01M%

15.04%

MORPHO

1.00M

6.00M

56.90%

75.95%

12.84%

cbETH

6.40K

16.00K

1.47%

17.12%

3.42%

wstETH

4.80K

14.40K

3.48%

39.70%

2.91%

weETH

700.00

4.00K

8.03%

54.24%

2.61%

rETH

900.00

2.60K

1.75%

49.52%

1.23%

wrsETH

430.00

1.00K

0.05%

15.13%

0.14%

Asset

Total Borrow

Total Supply

Utilization

USDC

+10% from 67.64M USDC to 74.27M USDC

+10% from 74.78M USDC to 82.31M USDC

-0% from 90.44% to 90.23%

USDS

-32% from 19.81K USDS to 13.42K USDS

-28% from 22.27K USDS to 16.00K USDS

-6% from 88.93% to 83.83%

WETH

-21% from 26.42K WETH to 20.87K WETH

-21% from 29.66K WETH to 23.38K WETH

+0% from 89.07% to 89.27%

EURC

-25% from 3.83M EURC to 2.89M EURC

-20% from 4.27M EURC to 3.41M EURC

-6% from 89.76% to 84.78%

DAI

+4% from 18.92K DAI to 19.62K DAI

+0% from 31.40K DAI to 31.46K DAI

+3% from 60.26% to 62.36%

AERO

-10% from 9.44M AERO to 8.49M AERO

+2% from 26.49M AERO to 27.02M AERO

-12% from 35.65% to 31.43%

tBTC

+25% from 2.60 tBTC to 3.26 tBTC

-7% from 10.18 tBTC to 9.42 tBTC

+36% from 25.53% to 34.60%

LBTC

-3% from 11.79 LBTC to 11.43 LBTC

-9% from 50.24 LBTC to 45.77 LBTC

+6% from 23.48% to 24.96%

VIRTUAL

+7% from 473.04K VIRTUAL to 503.87K VIRTUAL

-4% from 2.14M VIRTUAL to 2.05M VIRTUAL

+11% from 22.14% to 24.60%

WELL

+17% from 28.89M WELL to 33.71M WELL

+6% from 157.86M WELL to 167.56M WELL

+10% from 18.30% to 20.12%

cbBTC

+0% from 132.18 cbBTC to 132.65 cbBTC

+1% from 736.27 cbBTC to 742.17 cbBTC

-0% from 17.95% to 17.87%

cbXRP

+16% from 175.83K cbXRP to 204.24K cbXRP

+32% from 1.00M cbXRP to 1.32M cbXRP

-12% from 17.58% to 15.47%

USDbC

-1% from 1.52K USDbC to 1.51K USDbC

-0% from 10.08K USDbC to 10.07K USDbC

-1% from 15.07% to 14.99%

MORPHO

+25% from 542.13K MORPHO to 680.31K MORPHO

+47% from 4.09M MORPHO to 6.00M MORPHO -14% from 13.26% to 11.34%

cbETH

-32% from 98.64 cbETH to 66.91 cbETH

-12% from 2.78K cbETH to 2.45K cbETH

-23% from 3.54% to 2.73%

wstETH

-45% from 208.17 wstETH to 113.57 wstETH -9% from 5.86K wstETH to 5.35K wstETH

-40% from 3.55% to 2.12%

weETH

-8% from 44.56 weETH to 41.18 weETH

+21% from 2.25K weETH to 2.72K weETH

-23% from 1.98% to 1.52%

rETH

-22% from 20.17 rETH to 15.68 rETH

-2% from 1.29K rETH to 1.27K rETH

-21% from 1.56% to 1.24%

wrsETH

0% from 0.21 wrsETH to 0.21 wrsETH

-1% from 151.67 wrsETH to 150.14 wrsETH

+1% from 0.14% to 0.14%

cbXRP supply increased 32% from 1.00M to 1.32M cbXRP

Morpho supply increaed 47% from 4.09M to 6.00M MORPHO

wstETH borrows decreased 45% from 208.17 to 113.57 wstETH

Total liquidations: 76Total Collateral Seized (USD): $166,535.77Total Debt Repaid (USD): $151,396.16Total Liquidation Bonus (USD): $15,139.62Total Liquidator Bonus (USD): $10,597.73Total Protocol Bonus (USD): $4,541.88

Asset

Total Seized (Tokens)

Total Seized (USD)

Debt Repaid (USD)

Liquidation Bonus (USD)

Liquidator Bonus (USD)

Protocol Bonus (USD)

Liquidation Count

USDC

56,676.294388

$56,663.96

$51,512.69

$5,151.27

$3,605.89

$1,545.38

13

AERO

58,180.786700

$43,209.39

$39,281.26

$3,928.13

$2,749.69

$1,178.44

18

cbXRP

7,654.142200

$22,509.03

$20,462.76

$2,046.28

$1,432.39

$613.88

5

WELL

788,061.104000

$21,844.29

$19,858.45

$1,985.84

$1,390.09

$595.75

8

WETH

3.588529

$12,412.91

$11,284.47

$1,128.45

$789.91

$338.53

17

cbBTC

0.047834

$5,448.59

$4,953.26

$495.33

$346.73

$148.60

5

MORPHO

1,278.998000

$2,228.12

$2,025.56

$202.56

$141.79

$60.77

2

wstETH

0.294369

$1,306.80

$1,188.00

$118.80

$83.16

$35.64

1

cbETH

0.124298

$470.31

$427.55

$42.76

$29.93

$12.83

2

VIRTUAL

266.230370

$303.36

$275.78

$27.58

$19.30

$8.27

2

wrsETH

0.028990

$107.55

$97.77

$9.78

$6.84

$2.93

1

tBTC

0.000153

$17.21

$15.64

$1.56

$1.09

$0.47

1

LBTC

0.000123

$14.24

$12.95

$1.29

$0.91

$0.39

1

Asset

Current Borrow Cap

Current Supply Cap

Average Borrow Cap Usage (Past Week)

Average Supply Cap Usage (Past Week)

Average Utilization

USDT0

8.00M

10.00M

21.90%

19.49%

89.88%

USDC

34.00M

36.40M

28.00%

29.15%

89.70%

WETH

30.00K

32.00K

24.50%

25.62%

89.67%

DAI

4.50M

4.80M

8.87%

9.29%

88.91%

USDT

18.40M

22.60M

2.31%

2.15%

86.76%

wrsETH

160.00

400.00

2.35%

9.25%

10.16%

OP

650.00K

5.60M

23.64%

44.50%

6.16%

VELO

20.00M

68.00M

13.25%

64.58%

6.03%

wstETH

1.50K

5.00K

3.69%

18.90%

5.86%

rETH

340.00

750.00

1.76%

15.96%

5.01%

WBTC

0.00

0.00

0.00%

0.00%

4.32%

weETH

220.00

1.20K

10.04%

100.01%

1.84%

cbETH

0.00

10.00

0.00%

9.00%

0.02%

Asset

Total Borrow

Total Supply

Utilization

USDT0

-26% from 2.03M USDT0 to 1.50M USDT0

-25% from 2.25M USDT0 to 1.68M USDT0

-1% from 90.33% to 89.57%

USDC

+3% from 9.34M USDC to 9.62M USDC

+3% from 10.44M USDC to 10.74M USDC

+0% from 89.44% to 89.62%

WETH

+9% from 6.95K WETH to 7.54K WETH

+9% from 7.74K WETH to 8.41K WETH

-0% from 89.75% to 89.62%

DAI

+73% from 271.10K DAI to 469.75K DAI +57% from 328.68K DAI to 517.54K DAI +10% from 82.48% to 90.77%

USDT

+86% from 255.27K USDT to 474.15K USDT +64% from 321.26K USDT to 528.10K USDT +13% from 79.46% to 89.78%

wrsETH

-6% from 3.90 wrsETH to 3.65 wrsETH

-8% from 38.72 wrsETH to 35.67 wrsETH

+2% from 10.08% to 10.24%

OP

-32% from 179.75K OP to 121.63K OP

-3% from 2.55M OP to 2.47M OP

-30% from 7.06% to 4.92%

VELO

+7% from 2.72M VELO to 2.92M VELO

-2% from 43.42M VELO to 42.77M VELO

+9% from 6.27% to 6.82%

wstETH

-22% from 68.88 wstETH to 53.96 wstETH

-13% from 1.05K wstETH to 908.89 wstETH

-10% from 6.57% to 5.94%

rETH

+13% from 5.76 rETH to 6.49 rETH

+4% from 115.66 rETH to 120.56 rETH

+8% from 4.98% to 5.38%

WBTC

0% from 0.00 WBTC to 0.00 WBTC

0% from 0.07 WBTC to 0.07 WBTC

+0% from 4.32% to 4.32%

weETH

+2% from 21.70 weETH to 22.24 weETH

+0% from 1.20K weETH to 1.20K weETH

+2% from 1.81% to 1.85%

cbETH

0% from 0.00 cbETH to 0.00 cbETH

0% from 0.90 cbETH to 0.90 cbETH

0% from 0.02% to 0.02%

USDT supply increased 64% from 321.26K to 528.10K USDT

USDT borrows increased 86% from 255.27K to 474.15K USDT

DAI supply increased 57% from 328.68K to 517.54K DAI

DAI borrows increased 73% from 271.10K to 469.75K DAI

Total liquidations: 9Total Collateral Seized (USD): $24,941.26Total Debt Repaid (USD): $22,673.87Total Liquidation Bonus (USD): $2,267.39Total Liquidator Bonus (USD): $1,587.17Total Protocol Bonus (USD): $680.22

Asset

Total Seized (Tokens)

Total Seized (USD)

Debt Repaid (USD)

Liquidation Bonus (USD)

Liquidator Bonus (USD)

Protocol Bonus (USD)

Liquidation Count

OP

38,562.253490

$24,616.75

$22,378.86

$2,237.89

$1,566.52

$671.37

2

wstETH

0.032129

$137.60

$125.09

$12.51

$8.76

$3.75

1

USDT0

81.090790

$81.06

$73.69

$7.37

$5.16

$2.21

4

VELO

1,649.840000

$75.56

$68.69

$6.87

$4.81

$2.06

1

WETH

0.008661

$30.29

$27.53

$2.75

$1.93

$0.83

1

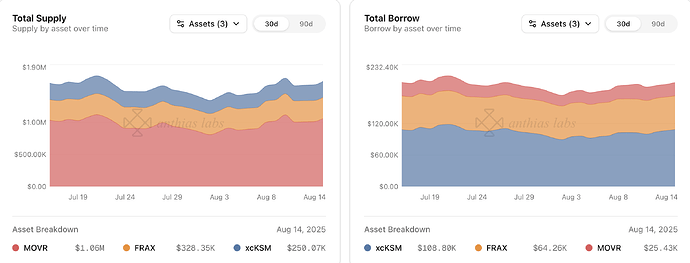

Asset

Current Borrow Cap

Average Borrow Cap Usage (Past Week)

Average Utilization

GLMR

0.10

6617.67M%

60.91%

xcUSDC

0.10

98.37M%

59.13%

xcUSDT

0.10

83.36M%

45.55%

USDC_wh

0.10

41.54M%

33.58%

BTC_wh

0.10

99.99%

8.22%

xcDOT

0.10

23.15M%

100%

ETH_wh

0.10

1.27K%

2.68%

FRAX

0.10

450.32K%

44.90%

Asset

Total Borrow

Total Supply

Utilization

GLMR

+1% from 6.60M GLMR to 6.64M GLMR

-3% from 11.02M GLMR to 10.69M GLMR

+4% from 59.88% to 62.10%

xcUSDC

-1% from 98.76K xcUSDC to 98.03K xcUSDC

-2% from 169.18K xcUSDC to 165.44K xcUSDC

+2% from 58.38% to 59.26%

xcUSDT

-1% from 83.47K xcUSDT to 82.72K xcUSDT

-1% from 184.01K xcUSDT to 181.58K xcUSDT

+0% from 45.36% to 45.55%

USDC_wh

+0% from 41.48K USDC_wh to 41.61K USDC_wh

-3% from 123.96K USDC_wh to 120.22K USDC_wh

+3% from 33.46% to 34.61%

BTC_wh

+0% from 0.10 BTC_wh to 0.10 BTC_wh

-3% from 1.24 BTC_wh to 1.20 BTC_wh

+3% from 8.09% to 8.32%

xcDOT

+0% from 23.14K xcDOT to 23.15K xcDOT

+0% from 536.55K xcDOT to 536.56K xcDOT

+0% from 100% to 100%

ETH_wh

-1% from 1.27 ETH_wh to 1.26 ETH_wh

-2% from 47.96 ETH_wh to 47.01 ETH_wh

+1% from 2.65% to 2.69%

FRAX

-0% from 451.37 FRAX to 450.12 FRAX

+0% from 40.77K FRAX to 40.77K FRAX

-0% from 44.91% to 44.90%

Total liquidations: 10Total Collateral Seized (USD): $37.31Total Debt Repaid (USD): $33.92Total Liquidation Bonus (USD): $3.39Total Liquidator Bonus (USD): $2.37Total Protocol Bonus (USD): $1.02

Asset

Total Seized (Tokens)

Total Seized (USD)

Debt Repaid (USD)

Liquidation Bonus (USD)

Liquidator Bonus (USD)

Protocol Bonus (USD)

Liquidation Count

GLMR

529.010160

$35.92

$32.65

$3.27

$2.29

$0.98

8

xcDOT

0.384574

$1.39

$1.26

$0.13

$0.09

$0.04

2

Asset

Current Borrow Cap

Average Borrow Cap Usage (Past Week)

Average Utilization

xcKSM

0.10

6.80M%

42.95%

FRAX

0.10

64.36M%

19.58%

MOVR

0.10

3.80M%

2.54%

Asset

Total Borrow

Total Supply

Utilization

xcKSM

+0% from 6.80K xcKSM to 6.81K xcKSM