Weekly Update (8/22/25 - 8/28/25)

Anthias Labs would like to provide an update on market performance over the past week for Core markets on Base, OP mainnet, Moonbeam, and Moonriver. Data from 8/22/25 to 8/28/25. More information can be found on our monitoring dashboard.

Base

| Asset | Current Borrow Cap | Current Supply Cap | Average Borrow Cap Usage (Past Week) | Average Supply Cap Usage (Past Week) | Average Utilization |

|---|---|---|---|---|---|

| USDC | 184.00M | 200.00M | 29.70% | 30.73% | 88.98% |

| WETH | 64.00K | 96.00K | 29.99% | 23.11% | 86.48% |

| USDS | 690.00K | 750.00K | 2.55% | 2.75% | 85.42% |

| EURC | 21.00M | 21.90M | 11.48% | 13.37% | 82.47% |

| DAI | 300.00K | 400.00K | 6.21% | 7.74% | 60.19% |

| VIRTUAL | 2.30M | 4.50M | 33.59% | 40.80% | 42.26% |

| AERO | 25.00M | 70.00M | 40.27% | 38.09% | 37.79% |

| WELL | 75.00M | 220.00M | 62.69% | 75.07% | 28.47% |

| cbBTC | 640.00 | 1.50K | 20.62% | 45.06% | 19.53% |

| LBTC | 38.00 | 95.00 | 25.13% | 54.15% | 18.60% |

| cbXRP | 1.60M | 3.00M | 20.26% | 60.51% | 17.85% |

| tBTC | 36.00 | 90.00 | 5.17% | 12.94% | 16.61% |

| USDbC | 1.00 | 1.00 | 148.18K% | 1.00M% | 14.79% |

| MORPHO | 1.00M | 6.00M | 53.20% | 97.58% | 9.08% |

| wrsETH | 430.00 | 1.00K | 0.74% | 12.04% | 2.66% |

| cbETH | 6.40K | 16.00K | 0.98% | 15.08% | 2.60% |

| rETH | 900.00 | 2.60K | 2.57% | 39.82% | 2.23% |

| wstETH | 4.80K | 14.40K | 2.04% | 31.00% | 2.20% |

| weETH | 700.00 | 4.00K | 4.80% | 75.48% | 1.11% |

Week-over-Week Changes

| Asset | Total Borrow | Total Supply | Utilization |

|---|---|---|---|

| USDC | +4% from 56.04M USDC to 58.38M USDC | -1% from 62.70M USDC to 61.81M USDC | +6% from 89.38% to 94.46% |

| WETH | -2% from 18.60K WETH to 18.30K WETH | -1% from 21.60K WETH to 21.45K WETH | -1% from 86.14% to 85.34% |

| USDS | -6% from 18.54K USDS to 17.42K USDS | +1% from 20.40K USDS to 20.65K USDS | -7% from 90.89% to 84.36% |

| EURC | -1% from 2.31M EURC to 2.30M EURC | -7% from 2.97M EURC to 2.77M EURC | +7% from 77.96% to 83.03% |

| DAI | -10% from 20.33K DAI to 18.29K DAI | -0% from 31.01K DAI to 30.86K DAI | -10% from 65.57% to 59.27% |

| VIRTUAL | -10% from 950.36K VIRTUAL to 853.36K VIRTUAL | -25% from 2.50M VIRTUAL to 1.87M VIRTUAL | +20% from 38.00% to 45.55% |

| AERO | +2% from 9.90M AERO to 10.14M AERO | -1% from 26.83M AERO to 26.46M AERO | +4% from 36.90% to 38.31% |

| WELL | -3% from 50.08M WELL to 48.57M WELL | +6% from 161.06M WELL to 171.39M WELL | -9% from 31.09% to 28.34% |

| cbBTC | -7% from 136.82 cbBTC to 127.33 cbBTC | +0% from 676.72 cbBTC to 679.47 cbBTC | -7% from 20.22% to 18.74% |

| LBTC | +6% from 9.20 LBTC to 9.73 LBTC | +19% from 43.51 LBTC to 51.58 LBTC | -11% from 21.15% to 18.87% |

| cbXRP | +28% from 257.11K cbXRP to 328.32K cbXRP | +13% from 1.68M cbXRP to 1.90M cbXRP | +13% from 15.29% to 17.31% |

| tBTC | +5% from 1.78 tBTC to 1.88 tBTC | +50% from 9.50 tBTC to 14.29 tBTC | -30% from 18.77% to 13.15% |

| USDbC | +0% from 1.48K USDbC to 1.48K USDbC | -0% from 10.03K USDbC to 10.02K USDbC | +0% from 14.77% to 14.79% |

| MORPHO | -9% from 608.76K MORPHO to 553.37K MORPHO | +0% from 5.92M MORPHO to 5.94M MORPHO | -9% from 10.28% to 9.32% |

| wrsETH | -0% from 3.20 wrsETH to 3.20 wrsETH | +0% from 120.37 wrsETH to 120.46 wrsETH | -0% from 2.66% to 2.65% |

| cbETH | -22% from 74.22 cbETH to 57.73 cbETH | +0% from 2.39K cbETH to 2.39K cbETH | -22% from 3.10% to 2.41% |

| rETH | -1% from 23.18 rETH to 23.06 rETH | -3% from 1.05K rETH to 1.02K rETH | +2% from 2.21% to 2.27% |

| wstETH | -54% from 200.91 wstETH to 91.92 wstETH | -0% from 4.46K wstETH to 4.44K wstETH | -54% from 4.51% to 2.07% |

| weETH | +2% from 33.34 weETH to 33.84 weETH | -0% from 3.02K weETH to 3.01K weETH | +2% from 1.10% to 1.12% |

Notable Trends

- VIRTUAL supply decreased 25% from 2.50M to 1.87M VIRTUAL

- tBTC supply increased 50% from 9.50 to 14.29 tBTC

- cbXRP borrows increased 28% from 257.11K to 328.32K cbXRP

- wstETH borrows decreased 54% from 200.91 to 91.92 wstETH

Liquidations

- Total liquidations: 119

- Total Collateral Seized (USD): $1,971,411.93

- Total Debt Repaid (USD): $1,792,192.66

- Total Liquidation Bonus (USD): $179,219.27

- Total Liquidator Bonus (USD): $125,453.49

- Total Protocol Bonus (USD): $53,765.78

| Asset | Total Seized (Tokens) | Total Seized (USD) | Debt Repaid (USD) | Liquidation Bonus (USD) | Liquidator Bonus (USD) | Protocol Bonus (USD) | Liquidation Count |

|---|---|---|---|---|---|---|---|

| USDC | 1,838,031.8197 | $1,837,788.72 | $1,670,717.02 | $167,071.70 | $116,950.19 | $50,121.51 | 34 |

| AERO | 75,415.474802 | $97,789.84 | $88,899.86 | $8,889.99 | $6,222.99 | $2,667.00 | 18 |

| WETH | 2.646941 | $11,495.00 | $10,450.00 | $1,045.00 | $731.50 | $313.50 | 25 |

| cbBTC | 0.097611 | $10,932.05 | $9,938.23 | $993.82 | $695.68 | $298.15 | 13 |

| WELL | 249,529.2 | $7,281.72 | $6,619.74 | $661.97 | $463.38 | $198.59 | 6 |

| EURC | 2,663.009 | $3,109.12 | $2,826.47 | $282.65 | $197.85 | $84.79 | 4 |

| cbXRP | 467.093 | $1,368.68 | $1,244.25 | $124.43 | $87.10 | $37.33 | 2 |

| VIRTUAL | 597.91354 | $691.29 | $628.44 | $62.84 | $43.99 | $18.85 | 7 |

| cbETH | 0.075168 | $392.36 | $356.69 | $35.67 | $24.97 | $10.70 | 1 |

| weETH | 0.056265 | $279.93 | $254.48 | $25.45 | $17.81 | $7.63 | 1 |

| wstETH | 0.035563 | $198.82 | $180.74 | $18.07 | $12.65 | $5.42 | 2 |

| LBTC | 0.000508 | $58.96 | $53.60 | $5.36 | $3.75 | $1.61 | 4 |

| tBTC | 0.000206 | $23.44 | $21.31 | $2.13 | $1.49 | $0.64 | 1 |

| DAI | 2.016010 | $2.02 | $1.83 | $0.18 | $0.13 | $0.05 | 1 |

OP Mainnet

| Asset | Current Borrow Cap | Current Supply Cap | Average Borrow Cap Usage (Past Week) | Average Supply Cap Usage (Past Week) | Average Utilization |

|---|---|---|---|---|---|

| USDC | 34.00M | 36.40M | 23.93% | 25.00% | 89.43% |

| WETH | 30.00K | 32.00K | 21.70% | 22.79% | 89.34% |

| USDT0 | 8.00M | 10.00M | 12.66% | 11.69% | 86.59% |

| USDT | 18.40M | 22.60M | 2.34% | 2.20% | 86.48% |

| DAI | 4.50M | 4.80M | 6.34% | 6.98% | 84.87% |

| OP | 650.00K | 5.60M | 45.36% | 40.41% | 13.04% |

| rETH | 340.00 | 750.00 | 1.68% | 14.65% | 5.56% |

| wstETH | 1.50K | 5.00K | 2.47% | 15.91% | 4.67% |

| WBTC | 0.00 | 0.00 | 0.00% | 0.00% | 4.33% |

| VELO | 20.00M | 68.00M | 10.02% | 77.37% | 3.82% |

| wrsETH | 160.00 | 400.00 | 0.40% | 6.00% | 2.64% |

| weETH | 220.00 | 1.20K | 6.20% | 100.01% | 1.14% |

| cbETH | 0.00 | 10.00 | 0.00% | 8.07% | 0.02% |

Week-over-Week Changes

| Asset | Total Borrow | Total Supply | Utilization |

|---|---|---|---|

| USDC | -4% from 9.81M USDC to 9.43M USDC | -4% from 10.98M USDC to 10.57M USDC | -0% from 89.36% to 89.23% |

| WETH | +6% from 7.49K WETH to 7.95K WETH | +7% from 8.47K WETH to 9.10K WETH | -1% from 88.38% to 87.40% |

| USDT0 | +2% from 934.32K USDT0 to 953.65K USDT0 | -4% from 1.12M USDT0 to 1.07M USDT0 | +7% from 83.22% to 88.79% |

| USDT | -7% from 373.49K USDT to 348.86K USDT | -6% from 443.55K USDT to 417.78K USDT | -1% from 84.21% to 83.50% |

| DAI | +75% from 252.81K DAI to 443.06K DAI | +62% from 303.24K DAI to 491.90K DAI | +8% from 83.37% to 90.07% |

| OP | -1% from 296.07K OP to 293.06K OP | +5% from 2.16M OP to 2.28M OP | -6% from 13.72% to 12.88% |

| rETH | -38% from 7.32 rETH to 4.55 rETH | -16% from 101.20 rETH to 85.35 rETH | -26% from 7.23% to 5.34% |

| wstETH | +14% from 35.15 wstETH to 40.03 wstETH | -7% from 840.85 wstETH to 784.26 wstETH | +22% from 4.18% to 5.10% |

| WBTC | 0% from 0.00 WBTC to 0.00 WBTC | 0% from 0.07 WBTC to 0.07 WBTC | +0% from 4.33% to 4.33% |

| VELO | -6% from 2.14M VELO to 2.01M VELO | +7% from 50.01M VELO to 53.37M VELO | -12% from 4.29% to 3.76% |

| wrsETH | 0% from 0.63 wrsETH to 0.63 wrsETH | +0% from 24.01 wrsETH to 24.01 wrsETH | +0% from 2.64% to 2.64% |

| weETH | +7% from 13.10 weETH to 13.98 weETH | +0% from 1.20K weETH to 1.20K weETH | +7% from 1.09% to 1.16% |

| cbETH | 0% from 0.00 cbETH to 0.00 cbETH | -1% from 0.81 cbETH to 0.81 cbETH | +1% from 0.02% to 0.02% |

Notable Trends

- DAI supply increased 62% from 303.24K to 491.90K DAI

- DAI borrows increased 75% from 252.81K to 443.06K DAI

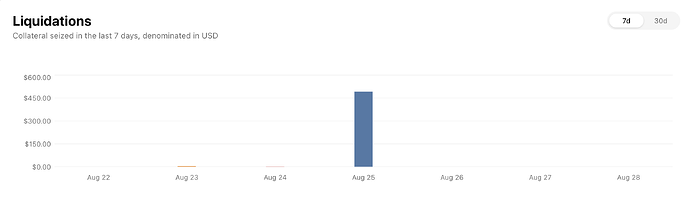

Liquidations

- Total liquidations: 3

- Total Collateral Seized (USD): $498.15

- Total Debt Repaid (USD): $452.86

- Total Liquidation Bonus (USD): $45.29

- Total Liquidator Bonus (USD): $31.70

- Total Protocol Bonus (USD): $13.59

| Asset | Total Seized (Tokens) | Total Seized (USD) | Debt Repaid (USD) | Liquidation Bonus (USD) | Liquidator Bonus (USD) | Protocol Bonus (USD) | Liquidation Count |

|---|---|---|---|---|---|---|---|

| USDC | 492.059 | $492.01 | $447.29 | $44.73 | $31.31 | $13.42 | 1 |

| WETH | 0.000998 | $4.71 | $4.28 | $0.43 | $0.30 | $0.13 | 1 |

| DAI | 1.42638 | $1.43 | $1.30 | $0.13 | $0.09 | $0.04 | 1 |

Moonbeam

| Asset | Current Borrow Cap | Average Borrow Cap Usage (Past Week) | Average Utilization |

|---|---|---|---|

| xcUSDC | 0.10 | 89.72M% | 66.17% |

| GLMR | 0.10 | 6783.27M% | 63.50% |

| xcUSDT | 0.10 | 77.94M% | 51.91% |

| USDC_wh | 0.10 | 42.64M% | 36.71% |

| BTC_wh | 0.10 | 99.99% | 8.40% |

| xcDOT | 0.10 | 23.17M% | 100% |

| ETH_wh | 0.10 | 1.22K% | 2.61% |

| FRAX | 0.10 | 447.94K% | 44.90% |

Week-over-Week Changes

| Asset | Total Borrow | Total Supply | Utilization |

|---|---|---|---|

| xcUSDC | -7% from 91.24K xcUSDC to 84.55K xcUSDC | -14% from 163.31K xcUSDC to 139.77K xcUSDC | +8% from 55.87% to 60.50% |

| GLMR | +1% from 6.75M GLMR to 6.81M GLMR | +0% from 10.70M GLMR to 10.75M GLMR | +0% from 63.14% to 63.41% |

| xcUSDT | -8% from 80.92K xcUSDT to 74.50K xcUSDT | -22% from 178.48K xcUSDT to 139.04K xcUSDT | +18% from 45.34% to 53.58% |

| USDC_wh | +1% from 42.33K USDC_wh to 42.84K USDC_wh | +1% from 115.59K USDC_wh to 117.02K USDC_wh | -0% from 36.62% to 36.61% |

| BTC_wh | -0% from 0.10 BTC_wh to 0.10 BTC_wh | +0% from 1.19 BTC_wh to 1.19 BTC_wh | -0% from 8.41% to 8.40% |

| xcDOT | +0% from 23.17K xcDOT to 23.17K xcDOT | +0% from 536.58K xcDOT to 536.58K xcDOT | +0% from 100% to 100% |

| ETH_wh | -2% from 1.24 ETH_wh to 1.21 ETH_wh | -14% from 46.99 ETH_wh to 40.43 ETH_wh | +14% from 2.63% to 3.00% |

| FRAX | 0% from 447.94 FRAX to 447.94 FRAX | 0% from 40.77K FRAX to 40.77K FRAX | +0% from 44.90% to 44.90% |

Liquidations

- Total liquidations: 1

- Total Collateral Seized (USD): $128.83

- Total Debt Repaid (USD): $117.12

- Total Liquidation Bonus (USD): $11.71

- Total Liquidator Bonus (USD): $8.20

- Total Protocol Bonus (USD): $3.51

| Asset | Total Seized (Tokens) | Total Seized (USD) | Debt Repaid (USD) | Liquidation Bonus (USD) | Liquidator Bonus (USD) | Protocol Bonus (USD) | Liquidation Count |

|---|---|---|---|---|---|---|---|

| GLMR | 1,642.150000 | $128.83 | $117.12 | $11.71 | $8.20 | $3.51 | 1 |

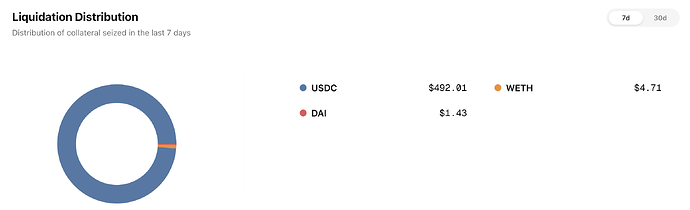

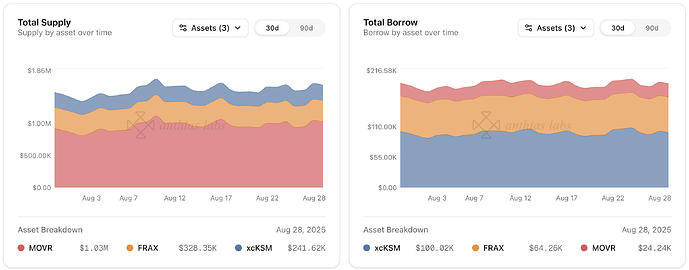

Moonriver

| Asset | Current Borrow Cap | Average Borrow Cap Usage (Past Week) | Average Utilization |

|---|---|---|---|

| xcKSM | 0.10 | 6.57M% | 42.48% |

| FRAX | 0.10 | 64.39M% | 19.57% |

| MOVR | 0.10 | 3.57M% | 2.38% |

Week-over-Week Changes

| Asset | Total Borrow | Total Supply | Utilization |

|---|---|---|---|

| xcKSM | -1% from 6.59K xcKSM to 6.51K xcKSM | +4% from 15.06K xcKSM to 15.72K xcKSM | -5% from 43.76% to 41.39% |

| FRAX | 0% from 64.39K FRAX to 64.39K FRAX | 0% from 329.00K FRAX to 329.00K FRAX | 0% from 19.57% to 19.57% |

Liquidations

No liquidations on Moonriver this week.