Weekly Update (9/19/25 - 9/25/25)

Anthias Labs would like to provide an update on market performance over the past week for Core markets on Base, OP mainnet, Moonbeam, and Moonriver. Data from 9/19/25 to 9/25/25. More information can be found on our monitoring dashboard.

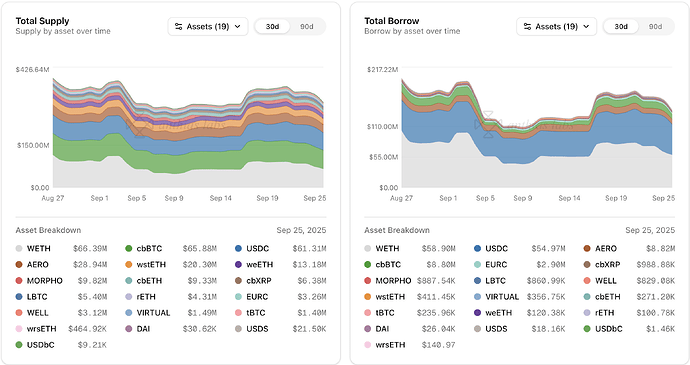

Base

| Asset | Current Borrow Cap | Current Supply Cap | Average Borrow Cap Usage (Past Week) | Average Supply Cap Usage (Past Week) | Average Utilization |

|---|---|---|---|---|---|

| USDS | 690.00K | 750.00K | 2.64% | 2.67% | 91.03% |

| USDC | 184.00M | 200.00M | 31.44% | 32.20% | 89.83% |

| DAI | 300.00K | 400.00K | 8.90% | 7.58% | 88.01% |

| WETH | 64.00K | 96.00K | 27.81% | 21.12% | 87.78% |

| EURC | 21.00M | 21.90M | 11.70% | 13.32% | 84.53% |

| AERO | 25.00M | 70.00M | 36.12% | 38.06% | 33.96% |

| VIRTUAL | 2.30M | 4.50M | 15.81% | 31.87% | 25.48% |

| WELL | 75.00M | 220.00M | 58.69% | 81.60% | 24.58% |

| LBTC | 38.00 | 95.00 | 32.83% | 55.83% | 23.50% |

| tBTC | 36.00 | 90.00 | 6.58% | 13.71% | 19.17% |

| cbXRP | 1.60M | 3.00M | 26.36% | 76.18% | 18.46% |

| cbBTC | 640.00 | 1.50K | 16.86% | 42.44% | 16.95% |

| USDbC | 1.00 | 1.00 | 146.47K% | 955.14K% | 15.35% |

| MORPHO | 1.00M | 6.00M | 52.26% | 79.79% | 14.54% |

| cbETH | 6.40K | 16.00K | 0.97% | 15.16% | 2.55% |

| rETH | 900.00 | 2.60K | 2.54% | 37.79% | 2.33% |

| wstETH | 4.80K | 14.40K | 1.96% | 30.24% | 2.16% |

| weETH | 700.00 | 4.00K | 4.24% | 77.45% | 0.96% |

| wrsETH | 430.00 | 1.00K | 0.01% | 11.46% | 0.03% |

Week-over-Week Changes

| Asset | Total Borrow | Total Supply | Utilization |

|---|---|---|---|

| USDS | -4% from 18.34K USDS to 17.69K USDS | -3% from 20.19K USDS to 19.64K USDS | -1% from 90.83% to 90.07% |

| USDC | +17% from 54.34M USDC to 63.51M USDC | +17% from 60.44M USDC to 70.87M USDC | -0% from 89.91% to 89.62% |

| DAI | -4% from 27.00K DAI to 25.97K DAI | +1% from 30.23K DAI to 30.53K DAI | -5% from 89.31% to 85.06% |

| WETH | +3% from 17.57K WETH to 18.11K WETH | +2% from 20.09K WETH to 20.45K WETH | +1% from 87.42% to 88.56% |

| EURC | +3% from 2.43M EURC to 2.52M EURC | +6% from 2.71M EURC to 2.86M EURC | -2% from 89.97% to 88.08% |

| AERO | -2% from 8.97M AERO to 8.77M AERO | +11% from 25.72M AERO to 28.46M AERO | -12% from 34.88% to 30.80% |

| VIRTUAL | +12% from 313.90K VIRTUAL to 350.65K VIRTUAL | -10% from 1.61M VIRTUAL to 1.45M VIRTUAL | +24% from 19.56% to 24.24% |

| WELL | +7% from 35.77M WELL to 38.26M WELL | +7% from 171.77M WELL to 182.97M WELL | +0% from 20.82% to 20.91% |

| LBTC | +6% from 12.11 LBTC to 12.79 LBTC | +3% from 52.50 LBTC to 53.82 LBTC | +3% from 23.06% to 23.77% |

| tBTC | +3% from 2.08 tBTC to 2.15 tBTC | +5% from 11.80 tBTC to 12.41 tBTC | -2% from 17.65% to 17.36% |

| cbXRP | -15% from 460.39K cbXRP to 389.84K cbXRP | +1% from 2.28M cbXRP to 2.29M cbXRP | -16% from 20.23% to 17.00% |

| cbBTC | -6% from 106.32 cbBTC to 99.97 cbBTC | -1% from 629.03 cbBTC to 623.87 cbBTC | -5% from 16.90% to 16.02% |

| USDbC | -0% from 1.46K USDbC to 1.46K USDbC | -7% from 9.87K USDbC to 9.21K USDbC | +7% from 14.84% to 15.90% |

| MORPHO | +9% from 489.20K MORPHO to 534.73K MORPHO | +272% from 1.61M MORPHO to 6.00M MORPHO | -71% from 30.33% to 8.91% |

| cbETH | +4% from 61.11 cbETH to 63.69 cbETH | -3% from 2.41K cbETH to 2.34K cbETH | +8% from 2.53% to 2.73% |

| rETH | +0% from 22.86 rETH to 22.86 rETH | -1% from 985.73 rETH to 976.72 rETH | +1% from 2.32% to 2.34% |

| wstETH | -55% from 189.91 wstETH to 85.11 wstETH | -1% from 4.37K wstETH to 4.34K wstETH | -55% from 4.35% to 1.96% |

| weETH | -0% from 29.78 weETH to 29.67 weETH | +5% from 3.01K weETH to 3.17K weETH | -5% from 0.99% to 0.94% |

| wrsETH | -13% from 0.04 wrsETH to 0.03 wrsETH | +0% from 114.55 wrsETH to 114.60 wrsETH | -14% from 0.04% to 0.03% |

Notable Trends

- MORPHO supply increased 272% from 1.61M to 6.00M MORPHO

- wstETH borrows decreased 55% from 189.91 to 85.11 wstETH

- USDC supply increased 17% from 60.44M to 70.87M USDC

- USDC borrows increased 17% from 54.34M to 63.51M USDC

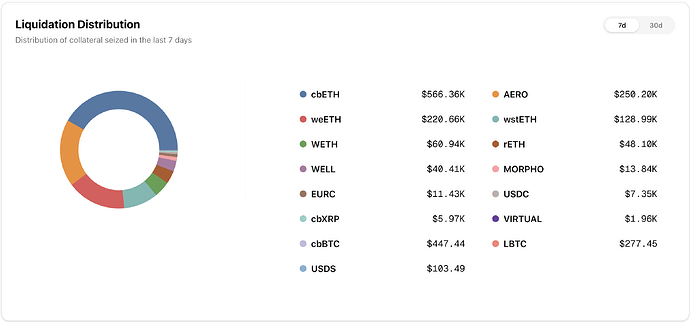

Liquidations

- Total liquidations: 145

- Total Collateral Seized (USD): $1,316,794.81

- Total Debt Repaid (USD): $1,197,086.19

- Total Liquidation Bonus (USD): $119,708.62

- Total Liquidator Bonus (USD): $83,796.03

- Total Protocol Bonus (USD): $35,912.59

| Asset | Total Seized (Tokens) | Total Seized (USD) | Debt Repaid (USD) | Liquidation Bonus (USD) | Liquidator Bonus (USD) | Protocol Bonus (USD) | Liquidation Count |

|---|---|---|---|---|---|---|---|

| cbETH | 123.774187 | $561,968.39 | $510,880.35 | $51,088.04 | $35,761.62 | $15,326.41 | 7 |

| AERO | 222,544.177520 | $243,569.49 | $221,426.81 | $22,142.68 | $15,499.88 | $6,642.80 | 35 |

| weETH | 49.731102 | $220,526.85 | $200,478.96 | $20,047.90 | $14,033.53 | $6,014.37 | 3 |

| wstETH | 25.770254 | $128,958.05 | $117,234.59 | $11,723.46 | $8,206.42 | $3,517.04 | 3 |

| WETH | 13.815455 | $57,351.38 | $52,137.61 | $5,213.76 | $3,649.63 | $1,564.13 | 63 |

| rETH | 10.221700 | $48,101.10 | $43,728.27 | $4,372.83 | $3,060.98 | $1,311.85 | 1 |

| WELL | 753,459.117000 | $16,597.49 | $15,088.63 | $1,508.86 | $1,056.20 | $452.66 | 6 |

| MORPHO | 8,107.327000 | $13,836.91 | $12,579.01 | $1,257.90 | $880.53 | $377.37 | 4 |

| EURC | 9,731.367000 | $11,430.33 | $10,391.21 | $1,039.12 | $727.38 | $311.74 | 5 |

| USDC | 7,311.829765 | $7,310.13 | $6,645.57 | $664.56 | $465.19 | $199.37 | 7 |

| cbXRP | 2,149.436130 | $5,966.62 | $5,424.20 | $542.42 | $379.69 | $162.73 | 3 |

| VIRTUAL | 347.412000 | $419.36 | $381.24 | $38.12 | $26.69 | $11.44 | 3 |

| cbBTC | 0.003330 | $377.78 | $343.44 | $34.34 | $24.04 | $10.30 | 2 |

| LBTC | 0.002422 | $277.45 | $252.23 | $25.22 | $17.66 | $7.57 | 1 |

| USDS | 103.505000 | $103.49 | $94.08 | $9.41 | $6.59 | $2.82 | 2 |

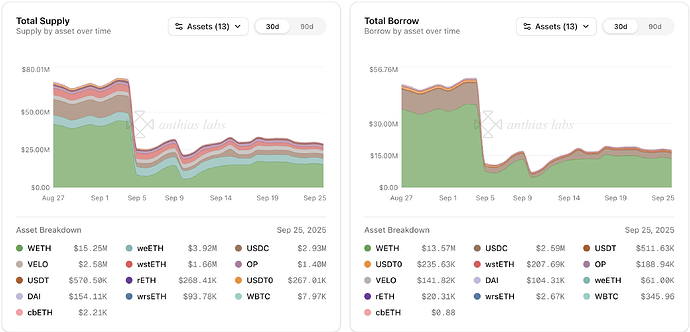

Optimism

| Asset | Current Borrow Cap | Current Supply Cap | Average Borrow Cap Usage (Past Week) | Average Supply Cap Usage (Past Week) | Average Utilization |

|---|---|---|---|---|---|

| USDT | 18.40M | 22.60M | 2.51% | 2.29% | 89.16% |

| USDC | 34.00M | 36.40M | 7.89% | 8.30% | 88.85% |

| WETH | 30.00K | 32.00K | 11.14% | 11.79% | 88.56% |

| USDT0 | 8.00M | 10.00M | 2.75% | 2.64% | 83.45% |

| DAI | 4.50M | 4.80M | 2.96% | 4.20% | 66.02% |

| OP | 650.00K | 5.60M | 40.85% | 36.98% | 12.82% |

| wstETH | 1.50K | 5.00K | 2.60% | 7.77% | 10.33% |

| rETH | 340.00 | 750.00 | 1.12% | 8.20% | 6.34% |

| VELO | 20.00M | 68.00M | 15.64% | 85.07% | 5.41% |

| WBTC | 0.00 | 0.00 | 0.00% | 0.00% | 4.34% |

| wrsETH | 160.00 | 400.00 | 0.40% | 5.56% | 2.85% |

| weETH | 220.00 | 1.20K | 3.47% | 78.87% | 0.80% |

| cbETH | 0.00 | 10.00 | 0.00% | 5.03% | 0.03% |

Week-over-Week Changes

| Asset | Total Borrow | Total Supply | Utilization |

|---|---|---|---|

| USDT | +56% from 327.44K USDT to 510.72K USDT | +53% from 374.50K USDT to 574.40K USDT | +2% from 87.43% to 88.91% |

| USDC | +5% from 2.46M USDC to 2.58M USDC | +2% from 2.79M USDC to 2.85M USDC | +3% from 88.34% to 90.65% |

| WETH | +15% from 2.96K WETH to 3.40K WETH | +14% from 3.34K WETH to 3.81K WETH | +1% from 88.54% to 89.22% |

| USDT0 | +16% from 202.22K USDT0 to 233.59K USDT0 | -1% from 264.02K USDT0 to 262.41K USDT0 | +16% from 76.59% to 89.02% |

| DAI | -27% from 139.12K DAI to 102.13K DAI | -25% from 205.27K DAI to 154.10K DAI | -2% from 67.77% to 66.27% |

| OP | +5% from 269.06K OP to 283.60K OP | +2% from 2.06M OP to 2.09M OP | +4% from 13.06% to 13.54% |

| wstETH | +32% from 32.07 wstETH to 42.17 wstETH | -29% from 482.39 wstETH to 341.10 wstETH | +86% from 6.65% to 12.36% |

| rETH | +148% from 1.79 rETH to 4.44 rETH | +1% from 57.88 rETH to 58.62 rETH | +145% from 3.09% to 7.57% |

| VELO | +2% from 3.09M VELO to 3.16M VELO | +2% from 57.31M VELO to 58.63M VELO | -0% from 5.40% to 5.40% |

| WBTC | 0% from 0.00 WBTC to 0.00 WBTC | 0% from 0.07 WBTC to 0.07 WBTC | 0% from 4.34% to 4.34% |

| wrsETH | 0% from 0.63 wrsETH to 0.63 wrsETH | -0% from 22.24 wrsETH to 22.24 wrsETH | +0% from 2.85% to 2.85% |

| weETH | +1014% from 1.20 weETH to 13.32 weETH | +2% from 894.35 weETH to 910.58 weETH | +994% from 0.13% to 1.46% |

| cbETH | 0% from 0.00 cbETH to 0.00 cbETH | 0% from 0.50 cbETH to 0.50 cbETH | 0% from 0.03% to 0.03% |

Notable Trends

- USDT supply increased 53% from 374.50K to 574.40K USDT

- USDT borrows increased 56% from 327.44K to 510.72K USDT

- wstETH supply decreased 29% from 482.39 to 341.10 wstETH

Liquidations

- Total liquidations: 5

- Total Collateral Seized (USD): $2,581.93

- Total Debt Repaid (USD): $2,347.21

- Total Liquidation Bonus (USD): $234.72

- Total Liquidator Bonus (USD): $164.30

- Total Protocol Bonus (USD): $70.42

| Asset | Total Seized (Tokens) | Total Seized (USD) | Debt Repaid (USD) | Liquidation Bonus (USD) | Liquidator Bonus (USD) | Protocol Bonus (USD) | Liquidation Count |

|---|---|---|---|---|---|---|---|

| VELO | 55,822.930000 | $2,478.43 | $2,253.12 | $225.31 | $157.72 | $67.59 | 2 |

| wstETH | 0.017892 | $86.32 | $78.47 | $7.85 | $5.49 | $2.35 | 1 |

| OP | 25.372400 | $16.92 | $15.39 | $1.54 | $1.08 | $0.46 | 1 |

| USDT0 | 0.255216 | $0.26 | $0.23 | $0.02 | $0.02 | $0.01 | 1 |

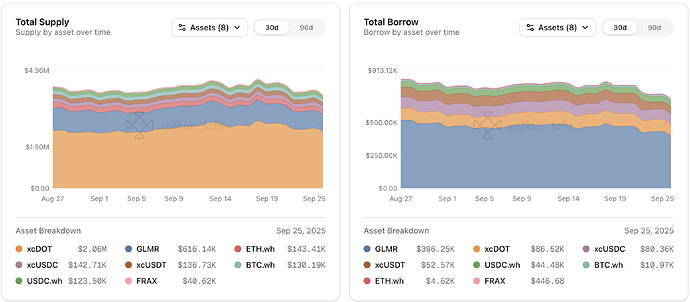

Moonbeam

| Asset | Current Borrow Cap | Average Borrow Cap Usage (Past Week) | Average Utilization |

|---|---|---|---|

| xcDOT | 0.10 | 22.55M% | 100.00% |

| GLMR | 0.10 | 7031.99M% | 65.11% |

| xcUSDC | 0.10 | 80.45M% | 59.08% |

| xcUSDT | 0.10 | 66.78M% | 47.67% |

| FRAX | 0.10 | 448.00K% | 44.91% |

| USDC.wh | 0.10 | 44.39M% | 36.14% |

| BTC.wh | 0.10 | 100.26% | 8.35% |

| ETH.wh | 0.10 | 1.20K% | 3.24% |

Week-over-Week Changes

| Asset | Total Borrow | Total Supply | Utilization |

|---|---|---|---|

| xcDOT | -0% from 22.55K xcDOT to 22.54K xcDOT | -0% from 535.96K xcDOT to 535.95K xcDOT | +0% from 100.00% to 100.00% |

| GLMR | +1% from 6.99M GLMR to 7.07M GLMR | +1% from 10.86M GLMR to 11.00M GLMR | -0% from 64.42% to 64.30% |

| xcUSDC | -1% from 81.12K xcUSDC to 80.36K xcUSDC | +6% from 134.24K xcUSDC to 142.71K xcUSDC | -7% from 60.43% to 56.31% |

| xcUSDT | -29% from 73.87K xcUSDT to 52.51K xcUSDT | -3% from 140.16K xcUSDT to 136.60K xcUSDT | -27% from 52.71% to 38.45% |

| FRAX | +0% from 448.00 FRAX to 448.02 FRAX | -0% from 40.76K FRAX to 40.75K FRAX | +0% from 44.91% to 44.93% |

| USDC.wh | +1% from 44.22K USDC.wh to 44.52K USDC.wh | -4% from 129.06K USDC.wh to 123.26K USDC.wh | +5% from 34.26% to 36.12% |

| BTC.wh | +0% from 0.10 BTC.wh to 0.10 BTC.wh | -2% from 1.21 BTC.wh to 1.19 BTC.wh | +2% from 8.25% to 8.43% |

| ETH.wh | -1% from 1.20 ETH.wh to 1.20 ETH.wh | +0% from 37.14 ETH.wh to 37.14 ETH.wh | -1% from 3.24% to 3.23% |

Liquidations

- Total liquidations: 10

- Total Collateral Seized (USD): $352.52

- Total Debt Repaid (USD): $320.47

- Total Liquidation Bonus (USD): $32.05

- Total Liquidator Bonus (USD): $22.43

- Total Protocol Bonus (USD): $9.61

| Asset | Total Seized (Tokens) | Total Seized (USD) | Debt Repaid (USD) | Liquidation Bonus (USD) | Liquidator Bonus (USD) | Protocol Bonus (USD) | Liquidation Count |

|---|---|---|---|---|---|---|---|

| GLMR | 5,974.651900 | $352.18 | $320.16 | $32.02 | $22.41 | $9.60 | 9 |

| FRAX | 0.346812 | $0.35 | $0.31 | $0.03 | $0.02 | $0.01 | 1 |

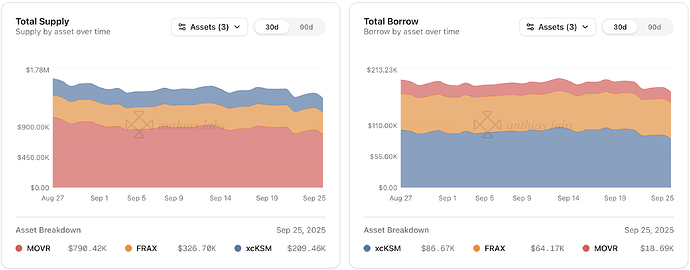

Moonriver

| Asset | Current Borrow Cap | Average Borrow Cap Usage (Past Week) | Average Utilization |

|---|---|---|---|

| xcKSM | 0.10 | 6.53M% | 42.65% |

| FRAX | 0.10 | 64.29M% | 19.63% |

| MOVR | 0.10 | 3.57M% | 2.36% |

Week-over-Week Changes

| Asset | Total Borrow | Total Supply | Utilization |

|---|---|---|---|

| xcKSM | +0% from 6.53K xcKSM to 6.54K xcKSM | +3% from 15.29K xcKSM to 15.80K xcKSM | -3% from 42.69% to 41.38% |

| FRAX | +0% from 64.28K FRAX to 64.30K FRAX | -0% from 327.47K FRAX to 327.36K FRAX | +0% from 19.63% to 19.64% |

| MOVR | +0% from 3.57K MOVR to 3.57K MOVR | -0% from 151.70K MOVR to 150.96K MOVR | +0% from 2.35% to 2.36% |

Liquidations

- Total liquidations: 1

- Total Collateral Seized (USD): $0.63

- Total Debt Repaid (USD): $0.57

- Total Liquidation Bonus (USD): $0.06

- Total Liquidator Bonus (USD): $0.04

- Total Protocol Bonus (USD): $0.02

| Asset | Total Seized (Tokens) | Total Seized (USD) | Debt Repaid (USD) | Liquidation Bonus (USD) | Liquidator Bonus (USD) | Protocol Bonus (USD) | Liquidation Count |

|---|---|---|---|---|---|---|---|

| MOVR | 0.119066 | $0.63 | $0.57 | $0.06 | $0.04 | $0.02 | 1 |