Weekly Update (10/3/25 - 10/9/25)

Anthias Labs would like to provide an update on market performance over the past week for Core markets on Base, OP mainnet, Moonbeam, and Moonriver. Data from 10/3/25 to 10/9/25. More information can be found on our monitoring dashboard.

Base

| Asset | Current Borrow Cap | Current Supply Cap | Average Borrow Cap Usage (Past Week) | Average Supply Cap Usage (Past Week) | Average Utilization |

|---|---|---|---|---|---|

| USDS | 690.00K | 750.00K | 2.87% | 2.92% | 90.37% |

| USDC | 184.00M | 200.00M | 31.00% | 31.83% | 89.61% |

| EURC | 21.00M | 21.90M | 11.52% | 12.66% | 87.23% |

| DAI | 300.00K | 400.00K | 8.62% | 7.78% | 83.04% |

| WETH | 64.00K | 96.00K | 17.67% | 16.26% | 72.43% |

| AERO | 25.00M | 70.00M | 33.77% | 38.00% | 31.91% |

| WELL | 100.00M | 250.00M | 39.49% | 63.92% | 24.69% |

| cbXRP | 1.60M | 5.00M | 31.60% | 51.00% | 19.82% |

| LBTC | 38.00 | 95.00 | 24.06% | 50.69% | 18.99% |

| tBTC | 36.00 | 90.00 | 6.16% | 13.18% | 18.70% |

| VIRTUAL | 2.30M | 4.50M | 16.51% | 48.56% | 17.36% |

| USDbC | 1.00 | 1.00 | 145.46K% | 918.69K% | 15.83% |

| cbBTC | 640.00 | 1.50K | 13.35% | 38.91% | 14.63% |

| MORPHO | 1.00M | 6.00M | 56.48% | 99.85% | 9.43% |

| weETH | 700.00 | 5.40K | 4.06% | 14.66% | 7.90% |

| cbETH | 6.40K | 16.00K | 0.94% | 13.55% | 2.76% |

| rETH | 900.00 | 2.60K | 2.54% | 37.18% | 2.37% |

| wstETH | 4.80K | 14.40K | 1.97% | 30.59% | 2.15% |

| wrsETH | 430.00 | 1.00K | 0.01% | 11.45% | 0.03% |

Week-over-Week Changes

| Asset | Total Borrow | Total Supply | Utilization |

|---|---|---|---|

| USDS | +11% from 18.06K USDS to 20.13K USDS | +7% from 20.84K USDS to 22.30K USDS | +4% from 86.68% to 90.24% |

| USDC | -1% from 55.15M USDC to 54.63M USDC | +1% from 61.35M USDC to 61.92M USDC | -2% from 89.89% to 88.21% |

| EURC | -13% from 2.55M EURC to 2.22M EURC | -7% from 2.86M EURC to 2.68M EURC | -7% from 88.86% to 82.82% |

| DAI | -6% from 26.26K DAI to 24.69K DAI | +1% from 30.78K DAI to 31.08K DAI | -7% from 85.31% to 79.45% |

| WETH | +25% from 10.34K WETH to 12.92K WETH | +22% from 14.59K WETH to 17.84K WETH | +2% from 70.91% to 72.41% |

| AERO | +12% from 7.66M AERO to 8.59M AERO | -14% from 29.51M AERO to 25.36M AERO | +31% from 25.95% to 33.87% |

| WELL | -38% from 58.33M WELL to 36.29M WELL | -4% from 162.84M WELL to 156.91M WELL | -35% from 35.82% to 23.13% |

| cbXRP | +17% from 464.79K cbXRP to 542.29K cbXRP | +2% from 2.54M cbXRP to 2.60M cbXRP | +14% from 18.32% to 20.88% |

| LBTC | -3% from 9.34 LBTC to 9.08 LBTC | -4% from 49.14 LBTC to 47.41 LBTC | +1% from 19.00% to 19.16% |

| tBTC | +8% from 2.15 tBTC to 2.33 tBTC | -4% from 12.08 tBTC to 11.57 tBTC | +13% from 17.82% to 20.12% |

| VIRTUAL | +29% from 275.49K VIRTUAL to 356.76K VIRTUAL | +3% from 2.14M VIRTUAL to 2.20M VIRTUAL | +26% from 12.86% to 16.19% |

| USDbC | +0% from 1.45K USDbC to 1.45K USDbC | -0% from 9.19K USDbC to 9.18K USDbC | +0% from 15.83% to 15.85% |

| cbBTC | -9% from 85.86 cbBTC to 78.23 cbBTC | -6% from 592.00 cbBTC to 554.12 cbBTC | -3% from 14.50% to 14.12% |

| MORPHO | +5% from 540.41K MORPHO to 567.51K MORPHO | +0% from 6.00M MORPHO to 6.00M MORPHO | +5% from 9.00% to 9.45% |

| weETH | -4% from 28.29 weETH to 27.28 weETH | -85% from 1.25K weETH to 183.00 weETH | +559% from 2.26% to 14.91% |

| cbETH | -10% from 63.17 cbETH to 57.16 cbETH | -1% from 2.18K cbETH to 2.15K cbETH | -8% from 2.90% to 2.66% |

| rETH | +0% from 22.87 rETH to 22.89 rETH | -0% from 967.07 rETH to 964.83 rETH | +0% from 2.36% to 2.37% |

| wstETH | +124% from 81.65 wstETH to 182.73 wstETH | +1% from 4.40K wstETH to 4.44K wstETH | +122% from 1.86% to 4.11% |

| wrsETH | 0% from 0.04 wrsETH to 0.04 wrsETH | +0% from 114.41 wrsETH to 114.47 wrsETH | -0% from 0.03% to 0.03% |

Notable Trends

- WETH supply +22% (14.59K → 17.84K WETH)

- WETH borrows +25% (10.34K → 12.92K WETH)

- weETH supply -85% (1.25K → 183.00 weETH)

- AERO supply -14% (29.51M → 25.36M AERO)

- cbBTC supply -6% (592.00 → 554.12 cbBTC)

- AERO borrows +12% (7.66M → 8.59M AERO)

Liquidations

- Total liquidations: 58

- Total Collateral Seized (USD): $124,422.94

- Total Debt Repaid (USD): $113,111.77

- Total Liquidation Bonus (USD): $11,311.18

- Total Liquidator Bonus (USD): $7,917.82

- Total Protocol Bonus (USD): $3,393.35

| Asset | Total Seized (Tokens) | Total Seized (USD) | Debt Repaid (USD) | Liquidation Bonus (USD) | Liquidator Bonus (USD) | Protocol Bonus (USD) | Liquidation Count |

|---|---|---|---|---|---|---|---|

| cbXRP | 31,453.683751 | $91,491.43 | $83,174.03 | $8,317.40 | $5,822.18 | $2,495.22 | 12 |

| AERO | 24,393.42788 | $27,182.17 | $24,711.06 | $2,471.11 | $1,729.77 | $741.33 | 13 |

| cbBTC | 0.02454 | $2,954.55 | $2,685.96 | $268.60 | $188.02 | $80.58 | 3 |

| VIRTUAL | 931.631666 | $1,029.98 | $936.34 | $93.63 | $65.54 | $28.09 | 9 |

| wstETH | 0.120938 | $674.36 | $613.05 | $61.31 | $42.91 | $18.39 | 5 |

| WETH | 0.099245 | $443.59 | $403.27 | $40.33 | $28.23 | $12.10 | 10 |

| EURC | 155.227 | $182.23 | $165.66 | $16.57 | $11.60 | $4.97 | 1 |

| USDC | 172.144060 | $172.11 | $156.46 | $15.65 | $10.95 | $4.69 | 3 |

| LBTC | 0.001288 | $156.00 | $141.82 | $14.18 | $9.93 | $4.25 | 1 |

| cbETH | 0.027480 | $136.52 | $124.11 | $12.41 | $8.69 | $3.72 | 1 |

Optimism

| Asset | Current Borrow Cap | Current Supply Cap | Average Borrow Cap Usage (Past Week) | Average Supply Cap Usage (Past Week) | Average Utilization |

|---|---|---|---|---|---|

| USDC | 34.00M | 36.40M | 7.26% | 7.68% | 88.36% |

| USDT0 | 8.00M | 10.00M | 2.70% | 2.49% | 87.05% |

| DAI | 4.50M | 4.80M | 5.77% | 6.43% | 82.32% |

| USDT | 18.40M | 22.60M | 1.92% | 1.88% | 79.26% |

| WETH | 30.00K | 32.00K | 9.93% | 12.00% | 77.61% |

| wstETH | 1.50K | 5.00K | 2.61% | 6.30% | 12.44% |

| OP | 650.00K | 5.60M | 37.98% | 37.56% | 11.74% |

| rETH | 340.00 | 750.00 | 1.28% | 7.98% | 7.24% |

| VELO | 20.00M | 80.00M | 21.34% | 96.99% | 5.50% |

| weETH | 220.00 | 1.20K | 8.41% | 33.13% | 4.65% |

| WBTC | 0.00 | 0.00 | 0.00% | 0.00% | 4.34% |

| wrsETH | 160.00 | 400.00 | 0.39% | 5.37% | 2.94% |

| cbETH | 0.00 | 10.00 | 0.00% | 4.28% | 0.04% |

Week-over-Week Changes

| Asset | Total Borrow | Total Supply | Utilization |

|---|---|---|---|

| USDC | +11% from 2.37M USDC to 2.63M USDC | +9% from 2.70M USDC to 2.94M USDC | +2% from 87.49% to 89.30% |

| USDT0 | -1% from 221.06K USDT0 to 219.10K USDT0 | -5% from 253.30K USDT0 to 240.40K USDT0 | +4% from 87.27% to 91.14% |

| DAI | -39% from 243.77K DAI to 147.82K DAI | -29% from 284.99K DAI to 202.68K DAI | -15% from 85.54% to 72.93% |

| USDT | -63% from 380.39K USDT to 139.06K USDT | -50% from 437.95K USDT to 219.62K USDT | -27% from 86.86% to 63.32% |

| WETH | +1% from 2.97K WETH to 2.99K WETH | -4% from 3.92K WETH to 3.78K WETH | +5% from 75.67% to 79.24% |

| wstETH | +4% from 37.54 wstETH to 39.21 wstETH | +6% from 306.99 wstETH to 324.77 wstETH | -1% from 12.23% to 12.07% |

| OP | -17% from 264.09K OP to 218.03K OP | +0% from 2.10M OP to 2.11M OP | -18% from 12.57% to 10.34% |

| rETH | +28% from 3.94 rETH to 5.05 rETH | +5% from 58.74 rETH to 61.43 rETH | +23% from 6.70% to 8.23% |

| VELO | +12% from 3.91M VELO to 4.38M VELO | +1% from 76.57M VELO to 77.22M VELO | +11% from 5.11% to 5.67% |

| weETH | +30% from 15.82 weETH to 20.55 weETH | +3% from 391.35 weETH to 404.74 weETH | +26% from 4.04% to 5.08% |

| WBTC | 0% from 0.00 WBTC to 0.00 WBTC | 0% from 0.07 WBTC to 0.07 WBTC | 0% from 4.34% to 4.34% |

| wrsETH | 0% from 0.63 wrsETH to 0.63 wrsETH | -11% from 24.24 wrsETH to 21.47 wrsETH | +13% from 2.60% to 2.94% |

| cbETH | 0% from 0.00 cbETH to 0.00 cbETH | -20% from 0.47 cbETH to 0.38 cbETH | +26% from 0.03% to 0.04% |

Notable Trends

- USDC borrows +11% (2.37M → 2.63M USDC)

- USDT borrows -63% (380.39K → 139.06K USDT)

- USDC supply +9% (2.70M → 2.94M USDC)

- USDT supply -50% (437.95K → 219.62K USDT)

Liquidations

- Total liquidations: 2

- Total Collateral Seized (USD): $45.19

- Total Debt Repaid (USD): $41.08

- Total Liquidation Bonus (USD): $4.11

- Total Liquidator Bonus (USD): $2.88

- Total Protocol Bonus (USD): $1.23

| Asset | Total Seized (Tokens) | Total Seized (USD) | Debt Repaid (USD) | Liquidation Bonus (USD) | Liquidator Bonus (USD) | Protocol Bonus (USD) | Liquidation Count |

|---|---|---|---|---|---|---|---|

| VELO | 1,010.2 | $44.98 | $40.89 | $4.09 | $2.86 | $1.23 | 1 |

| DAI | 0.210687 | $0.21 | $0.19 | $0.02 | $0.01 | $0.01 | 1 |

Moonbeam

| Asset | Current Borrow Cap | Average Borrow Cap Usage (Past Week) | Average Utilization |

|---|---|---|---|

| GLMR | 0.10 | 7190.77M% | 65.47% |

| xcDOT | 0.10 | 21.70M% | 59.46% |

| xcUSDC | 0.10 | 79.98M% | 57.70% |

| FRAX | 0.10 | 446.23K% | 45.65% |

| xcUSDT | 0.10 | 49.84M% | 38.82% |

| USDC.wh | 0.10 | 45.10M% | 36.00% |

| ETH.wh | 0.10 | 1.20K% | 3.51% |

| BTC.wh | 0.10 | 37.33% | 3.14% |

Week-over-Week Changes

| Asset | Total Borrow | Total Supply | Utilization |

|---|---|---|---|

| GLMR | +1% from 7.15M GLMR to 7.23M GLMR | +1% from 10.90M GLMR to 10.99M GLMR | +0% from 65.61% to 65.77% |

| xcDOT | -10% from 22.53K xcDOT to 20.25K xcDOT | +141% from 535.93K xcDOT to 1.29M xcDOT | -59% from 100.00% to 41.36% |

| xcUSDC | -2% from 80.71K xcUSDC to 79.17K xcUSDC | -8% from 141.80K xcUSDC to 130.34K xcUSDC | +7% from 56.92% to 60.74% |

| FRAX | 0% from 446.23 FRAX to 446.23 FRAX | 0% from 40.10K FRAX to 40.10K FRAX | 0% from 45.65% to 45.65% |

| xcUSDT | -10% from 52.24K xcUSDT to 46.75K xcUSDT | -28% from 136.16K xcUSDT to 98.06K xcUSDT | +24% from 38.36% to 47.68% |

| USDC.wh | +1% from 44.90K USDC.wh to 45.17K USDC.wh | +3% from 124.03K USDC.wh to 127.46K USDC.wh | -2% from 36.20% to 35.44% |

| ETH.wh | +0% from 1.20 ETH.wh to 1.20 ETH.wh | -0% from 34.14 ETH.wh to 34.12 ETH.wh | +0% from 3.51% to 3.51% |

| BTC.wh | -79% from 0.07 BTC.wh to 0.01 BTC.wh | -0% from 1.19 BTC.wh to 1.19 BTC.wh | -79% from 5.47% to 1.14% |

Notable Trends

- xcDOT supply +141% (535.93K → 1.29M xcDOT)

- xcUSDT supply -28% (136.16K → 98.06K xcUSDT)

Liquidations

- Total liquidations: 12

- Total Collateral Seized (USD): $2,070.58

- Total Debt Repaid (USD): $1,882.35

- Total Liquidation Bonus (USD): $188.23

- Total Liquidator Bonus (USD): $131.76

- Total Protocol Bonus (USD): $56.47

| Asset | Total Seized (Tokens) | Total Seized (USD) | Debt Repaid (USD) | Liquidation Bonus (USD) | Liquidator Bonus (USD) | Protocol Bonus (USD) | Liquidation Count |

|---|---|---|---|---|---|---|---|

| xcDOT | 450.051 | $1,932.26 | $1,756.60 | $175.66 | $122.96 | $52.70 | 1 |

| ETH.wh | 0.025909 | $111.16 | $101.05 | $10.11 | $7.07 | $3.03 | 5 |

| GLMR | 460.48538 | $27.16 | $24.69 | $2.47 | $1.73 | $0.74 | 6 |

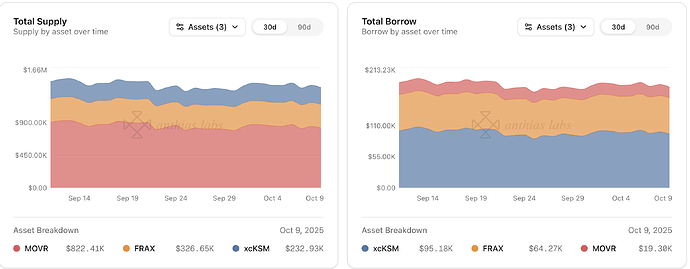

Moonriver

| Asset | Current Borrow Cap | Average Borrow Cap Usage (Past Week) | Average Utilization |

|---|---|---|---|

| xcKSM | 0.10 | 6.55M% | 41.34% |

| FRAX | 0.10 | 64.37M% | 19.67% |

| MOVR | 0.10 | 3.57M% | 2.35% |

Week-over-Week Changes

| Asset | Total Borrow | Total Supply | Utilization |

|---|---|---|---|

| xcKSM | +0% from 6.54K xcKSM to 6.55K xcKSM | +1% from 15.80K xcKSM to 16.03K xcKSM | -1% from 41.43% to 40.86% |

| FRAX | +0% from 64.35K FRAX to 64.40K FRAX | -0% from 327.40K FRAX to 327.30K FRAX | +0% from 19.65% to 19.68% |

| MOVR | +0% from 3.57K MOVR to 3.57K MOVR | +0% from 152.02K MOVR to 152.10K MOVR | -0% from 2.35% to 2.35% |

Liquidations

No liquidation events this week.