Weekly Update (10/10/25 - 10/16/25)

Anthias Labs would like to provide an update on market performance over the past week for Core markets on Base, OP mainnet, Moonbeam, and Moonriver. Data from 10/10/25 to 10/16/25. More information can be found on our monitoring dashboard. Additionally, stay tuned as we will be providing a more in depth analysis on the recent market volatility that occurred on October 10th, and the effect it had on the Moonwell Core markets shortly.

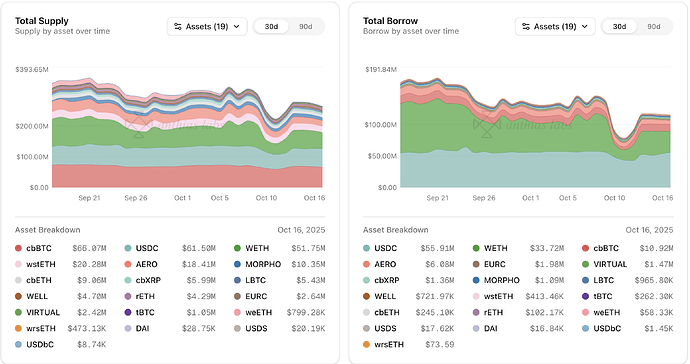

Base

| Asset | Current Borrow Cap | Current Supply Cap | Average Borrow Cap Usage (Past Week) | Average Supply Cap Usage (Past Week) | Average Utilization |

|---|---|---|---|---|---|

| USDC | 184.00M | 200.00M | 26.68% | 27.45% | 89.41% |

| USDS | 690.00K | 750.00K | 2.61% | 2.75% | 87.40% |

| EURC | 21.00M | 21.90M | 8.07% | 10.27% | 75.38% |

| VIRTUAL | 1.50M | 4.50M | 109.74% | 60.58% | 59.72% |

| WETH | 64.00K | 96.00K | 11.85% | 13.29% | 57.96% |

| DAI | 300.00K | 400.00K | 5.42% | 7.42% | 54.79% |

| AERO | 8.00M | 70.00M | 96.28% | 33.08% | 33.31% |

| WELL | 100.00M | 250.00M | 37.60% | 72.89% | 21.53% |

| cbXRP | 1.60M | 5.00M | 29.69% | 46.08% | 20.44% |

| tBTC | 36.00 | 90.00 | 5.17% | 10.53% | 19.43% |

| USDbC | 1.00 | 1.00 | 145.15K% | 895.45K% | 16.22% |

| LBTC | 38.00 | 95.00 | 18.75% | 51.73% | 14.24% |

| cbBTC | 640.00 | 1.50K | 12.31% | 38.14% | 13.55% |

| MORPHO | 600.00K | 6.00M | 91.91% | 96.00% | 9.56% |

| weETH | 700.00 | 5.40K | 2.12% | 3.54% | 7.75% |

| wstETH | 4.80K | 14.40K | 3.67% | 29.65% | 4.13% |

| cbETH | 6.40K | 16.00K | 0.88% | 13.12% | 2.69% |

| rETH | 900.00 | 2.60K | 2.54% | 36.89% | 2.38% |

| wrsETH | 430.00 | 1.00K | 0.01% | 11.45% | 0.02% |

Week-over-Week Changes

| Asset | Total Borrow | Total Supply | Utilization |

|---|---|---|---|

| USDC | -5% from 55.78M USDC to 52.79M USDC | -6% from 62.42M USDC to 58.48M USDC | +1% from 89.37% to 90.26% |

| USDS | -12% from 19.99K USDS to 17.62K USDS | -9% from 22.30K USDS to 20.19K USDS | -3% from 89.61% to 87.28% |

| EURC | -22% from 2.17M EURC to 1.70M EURC | -16% from 2.70M EURC to 2.26M EURC | -6% from 80.15% to 75.09% |

| VIRTUAL | +661% from 248.14K VIRTUAL to 1.89M VIRTUAL | +43% from 2.20M VIRTUAL to 3.14M VIRTUAL | +434% from 11.26% to 60.07% |

| WETH | -37% from 12.92K WETH to 8.13K WETH | -25% from 17.81K WETH to 13.43K WETH | -17% from 72.57% to 60.58% |

| DAI | -13% from 19.26K DAI to 16.84K DAI | -8% from 31.11K DAI to 28.75K DAI | -5% from 61.90% to 58.57% |

| AERO | -20% from 8.61M AERO to 6.88M AERO | -10% from 25.35M AERO to 22.83M AERO | -11% from 33.94% to 30.14% |

| WELL | +5% from 36.30M WELL to 38.00M WELL | +59% from 155.53M WELL to 247.46M WELL | -34% from 23.34% to 15.36% |

| cbXRP | +1% from 551.64K cbXRP to 559.72K cbXRP | -2% from 2.58M cbXRP to 2.54M cbXRP | +3% from 21.35% to 22.02% |

| tBTC | +4% from 2.33 tBTC to 2.41 tBTC | -16% from 11.41 tBTC to 9.62 tBTC | +23% from 20.40% to 25.09% |

| USDbC | -0% from 1.45K USDbC to 1.45K USDbC | -5% from 9.18K USDbC to 8.74K USDbC | +5% from 15.85% to 16.60% |

| LBTC | -0% from 9.07 LBTC to 9.05 LBTC | +6% from 47.41 LBTC to 50.26 LBTC | -6% from 19.14% to 18.00% |

| cbBTC | +37% from 73.98 cbBTC to 101.19 cbBTC | +10% from 552.91 cbBTC to 610.34 cbBTC | +24% from 13.38% to 16.58% |

| MORPHO | +5% from 571.59K MORPHO to 600.02K MORPHO | -5% from 6.00M MORPHO to 5.70M MORPHO | +11% from 9.52% to 10.52% |

| weETH | -29% from 19.38 weETH to 13.80 weETH | +3% from 183.00 weETH to 189.10 weETH | -31% from 10.59% to 7.30% |

| wstETH | -52% from 182.73 wstETH to 88.37 wstETH | -4% from 4.44K wstETH to 4.26K wstETH | -50% from 4.12% to 2.08% |

| cbETH | -1% from 57.16 cbETH to 56.81 cbETH | -1% from 2.14K cbETH to 2.11K cbETH | +1% from 2.67% to 2.69% |

| rETH | -0% from 22.89 rETH to 22.80 rETH | -1% from 963.73 rETH to 958.36 rETH | +0% from 2.38% to 2.38% |

| wrsETH | -49% from 0.04 wrsETH to 0.02 wrsETH | -0% from 114.47 wrsETH to 114.44 wrsETH | -49% from 0.03% to 0.02% |

Notable Trends

- WETH borrows -37% (12.92K → 8.13K WETH)

- WETH supply -25% (17.81K → 13.43K WETH)

- cbBTC supply +10% (552.91 → 610.34 cbBTC)

- cbBTC borrows +37% (73.98 → 101.19 cbBTC)

- WELL supply +59% (155.53M → 247.46M WELL)

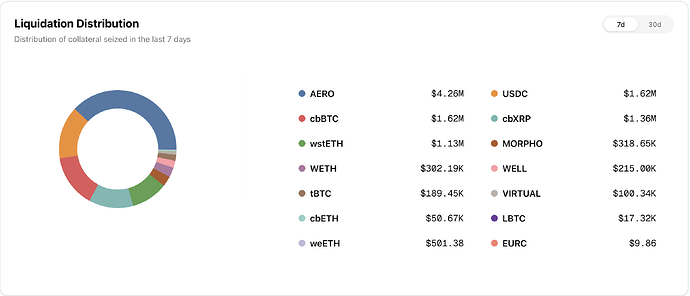

Liquidations

- Total liquidations: 1,151

- Total Collateral Seized (USD): $12,692,539.49

- Total Debt Repaid (USD): $11,538,672.27

- Total Liquidation Bonus (USD): $1,153,867.23

- Total Liquidator Bonus (USD): $807,707.06

- Total Protocol Bonus (USD): $346,160.17

| Asset | Total Seized (Tokens) | Total Seized (USD) | Debt Repaid (USD) | Liquidation Bonus (USD) | Liquidator Bonus (USD) | Protocol Bonus (USD) | Liquidation Count |

|---|---|---|---|---|---|---|---|

| AERO | 6,477,208.937670 | $4,272,914.58 | $3,884,467.80 | $388,446.78 | $271,912.75 | $116,534.03 | 517 |

| cbBTC | 26.933888 | $2,965,465.91 | $2,695,878.10 | $269,587.81 | $188,711.47 | $80,876.34 | 171 |

| USDC | 1,706,843.129970 | $1,706,365.69 | $1,551,241.53 | $155,124.15 | $108,586.91 | $46,537.25 | 22 |

| cbXRP | 687,411.602230 | $1,390,405.18 | $1,264,004.71 | $126,400.47 | $88,480.33 | $37,920.14 | 126 |

| wstETH | 265.738512 | $1,130,711.23 | $1,027,919.30 | $102,791.93 | $71,954.35 | $30,837.58 | 11 |

| WETH | 88.094916 | $321,716.49 | $292,469.54 | $29,246.95 | $20,472.87 | $8,774.09 | 109 |

| MORPHO | 348,656.941330 | $318,650.63 | $289,682.39 | $28,968.24 | $20,277.77 | $8,690.47 | 23 |

| WELL | 11,258,251.436700 | $224,765.36 | $204,332.15 | $20,433.21 | $14,303.25 | $6,129.96 | 26 |

| tBTC | 1.857700 | $189,450.00 | $172,227.27 | $17,222.73 | $12,055.91 | $5,166.82 | 1 |

| VIRTUAL | 195,273.604780 | $102,647.84 | $93,316.22 | $9,331.62 | $6,532.14 | $2,799.49 | 130 |

| cbETH | 12.845483 | $51,606.79 | $46,915.26 | $4,691.53 | $3,284.07 | $1,407.46 | 10 |

| LBTC | 0.164579 | $17,323.00 | $15,748.18 | $1,574.82 | $1,102.37 | $472.45 | 1 |

| weETH | 0.130004 | $501.38 | $455.80 | $45.58 | $31.91 | $13.67 | 1 |

| EURC | 11.848420 | $13.75 | $12.50 | $1.25 | $0.87 | $0.37 | 2 |

| USDS | 1.666910 | $1.67 | $1.52 | $0.15 | $0.11 | $0.05 | 1 |

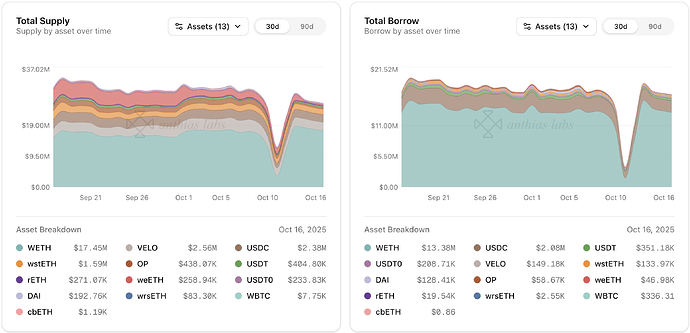

Optimism

| Asset | Current Borrow Cap | Current Supply Cap | Average Borrow Cap Usage (Past Week) | Average Supply Cap Usage (Past Week) | Average Utilization |

|---|---|---|---|---|---|

| USDT0 | 8.00M | 10.00M | 2.61% | 2.36% | 88.44% |

| USDC | 34.00M | 36.40M | 5.73% | 6.18% | 85.78% |

| USDT | 18.40M | 22.60M | 1.38% | 1.33% | 83.23% |

| WETH | 30.00K | 32.00K | 8.55% | 10.44% | 72.02% |

| DAI | 4.50M | 4.80M | 2.31% | 3.44% | 61.97% |

| rETH | 340.00 | 750.00 | 1.44% | 8.15% | 8.02% |

| wstETH | 1.50K | 5.00K | 1.64% | 6.43% | 7.64% |

| OP | 650.00K | 5.60M | 15.97% | 27.50% | 7.45% |

| VELO | 20.00M | 80.00M | 21.90% | 92.07% | 5.95% |

| weETH | 220.00 | 1.20K | 3.68% | 24.32% | 5.23% |

| WBTC | 0.00 | 0.00 | 0.00% | 0.00% | 4.34% |

| wrsETH | 160.00 | 400.00 | 0.39% | 5.26% | 2.94% |

| cbETH | 0.00 | 10.00 | 0.00% | 2.99% | 0.06% |

Week-over-Week Changes

| Asset | Total Borrow | Total Supply | Utilization |

|---|---|---|---|

| USDT0 | -4% from 216.21K USDT0 to 208.33K USDT0 | -3% from 240.38K USDT0 to 233.82K USDT0 | -1% from 89.94% to 89.10% |

| USDC | -21% from 2.63M USDC to 2.08M USDC | -19% from 2.95M USDC to 2.38M USDC | -2% from 89.07% to 87.37% |

| USDT | +153% from 139.06K USDT to 351.18K USDT | +84% from 219.62K USDT to 404.80K USDT | +37% from 63.32% to 86.75% |

| WETH | +14% from 2.99K WETH to 3.41K WETH | +18% from 3.78K WETH to 4.45K WETH | -3% from 79.22% to 76.68% |

| DAI | -13% from 147.82K DAI to 128.41K DAI | -5% from 202.68K DAI to 192.76K DAI | -9% from 72.93% to 66.62% |

| rETH | -14% from 5.05 rETH to 4.36 rETH | -2% from 61.43 rETH to 60.41 rETH | -12% from 8.23% to 7.21% |

| wstETH | -28% from 39.21 wstETH to 28.08 wstETH | +2% from 324.77 wstETH to 332.48 wstETH | -30% from 12.07% to 8.45% |

| OP | -39% from 218.04K OP to 133.04K OP | -53% from 2.11M OP to 993.37K OP | +30% from 10.34% to 13.39% |

| VELO | +0% from 4.38M VELO to 4.39M VELO | -2% from 77.12M VELO to 75.21M VELO | +3% from 5.68% to 5.83% |

| weETH | -46% from 20.55 weETH to 11.10 weETH | -85% from 404.74 weETH to 61.17 weETH | +257% from 5.08% to 18.14% |

| WBTC | 0% from 0.00 WBTC to 0.00 WBTC | 0% from 0.07 WBTC to 0.07 WBTC | +0% from 4.34% to 4.35% |

| wrsETH | -2% from 0.63 wrsETH to 0.62 wrsETH | -6% from 21.44 wrsETH to 20.12 wrsETH | +4% from 2.94% to 3.06% |

| cbETH | 0% from 0.00 cbETH to 0.00 cbETH | -27% from 0.38 cbETH to 0.27 cbETH | +37% from 0.04% to 0.06% |

Notable Trends

- WETH supply +18% (3.78K → 4.45K WETH)

- WETH borrows +14% (2.99K → 3.41K WETH)

- weETH supply -85% (404.74 → 61.17 weETH**)

- OP supply -53% (2.11M → 993.37K OP**)

Liquidations

- Total liquidations: 212

- Total Collateral Seized (USD): $401,068.12

- Total Debt Repaid (USD): $364,607.38

- Total Liquidation Bonus (USD): $36,460.74

- Total Liquidator Bonus (USD): $25,522.52

- Total Protocol Bonus (USD): $10,938.22

| Asset | Total Seized (Tokens) | Total Seized (USD) | Debt Repaid (USD) | Liquidation Bonus (USD) | Liquidator Bonus (USD) | Protocol Bonus (USD) | Liquidation Count |

|---|---|---|---|---|---|---|---|

| VELO | 11,059,224.120200 | $296,662.67 | $269,693.34 | $26,969.33 | $18,878.53 | $8,090.80 | 97 |

| OP | 184,562.055170 | $66,152.70 | $60,138.82 | $6,013.88 | $4,209.72 | $1,804.16 | 82 |

| wstETH | 4.779821 | $20,692.42 | $18,811.29 | $1,881.13 | $1,316.79 | $564.34 | 11 |

| WETH | 3.798008 | $14,267.53 | $12,970.48 | $1,297.05 | $907.93 | $389.11 | 12 |

| wrsETH | 0.504927 | $2,032.16 | $1,847.42 | $184.74 | $129.32 | $55.42 | 2 |

| USDC | 1,025.598596 | $1,025.51 | $932.28 | $93.23 | $65.26 | $27.97 | 4 |

| weETH | 0.055009 | $213.36 | $193.96 | $19.40 | $13.58 | $5.82 | 2 |

| USDT | 21.736030 | $21.77 | $19.79 | $1.98 | $1.39 | $0.59 | 2 |

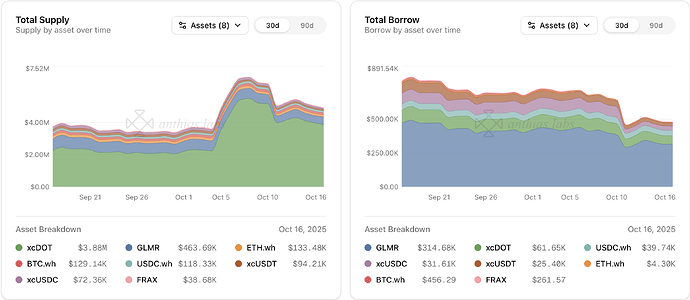

Moonbeam

| Asset | Current Borrow Cap | Average Utilization |

|---|---|---|

| GLMR | 0.10 | 66.93% |

| FRAX | 0.10 | 46.53% |

| xcDOT | 0.10 | 42.07% |

| xcUSDC | 0.10 | 36.12% |

| USDC.wh | 0.10 | 33.43% |

| xcUSDT | 0.10 | 30.73% |

| ETH.wh | 0.10 | 3.27% |

| BTC.wh | 0.10 | 0.65% |

Week-over-Week Changes

| Asset | Total Borrow | Total Supply | Utilization |

|---|---|---|---|

| GLMR | +1% from 7.23M GLMR to 7.32M GLMR | -2% from 10.99M GLMR to 10.78M GLMR | +3% from 65.77% to 67.86% |

| FRAX | -41% from 446.23 FRAX to 262.35 FRAX | -3% from 40.10K FRAX to 38.80K FRAX | +2% from 45.65% to 46.71% |

| xcDOT | -1% from 20.25K xcDOT to 20.02K xcDOT | -2% from 1.29M xcDOT to 1.26M xcDOT | +2% from 41.36% to 42.36% |

| xcUSDC | -60% from 79.17K xcUSDC to 31.61K xcUSDC | -44% from 130.34K xcUSDC to 72.36K xcUSDC | -28% from 60.74% to 43.68% |

| USDC.wh | -12% from 45.17K USDC.wh to 39.74K USDC.wh | -7% from 127.46K USDC.wh to 118.33K USDC.wh | -5% from 35.44% to 33.58% |

| xcUSDT | -46% from 46.75K xcUSDT to 25.40K xcUSDT | -4% from 98.06K xcUSDT to 94.21K xcUSDT | -43% from 47.68% to 26.96% |

| ETH.wh | -9% from 1.20 ETH.wh to 1.09 ETH.wh | -0% from 34.12 ETH.wh to 33.97 ETH.wh | -8% from 3.51% to 3.22% |

| BTC.wh | -69% from 0.01 BTC.wh to 0.00 BTC.wh | -0% from 1.19 BTC.wh to 1.19 BTC.wh | -69% from 1.14% to 0.36% |

Notable Trends

- xcUSDC supply -44% (130.34K → 72.36K xcUSDC**)

- xcUSDC borrows -60% (79.17K → 31.61K xcUSDC**)

- xcUSDT borrows -46% (46.75K → 25.40K xcUSDT**)

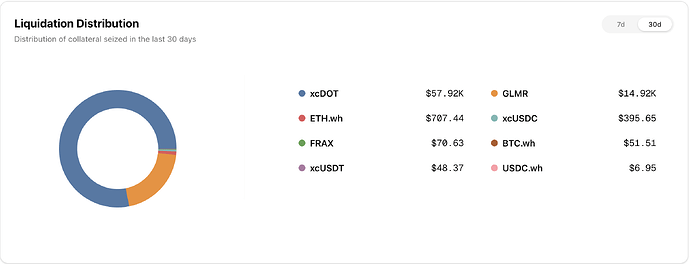

Liquidations

- Total liquidations: 644

- Total Collateral Seized (USD): $71,549.53

- Total Debt Repaid (USD): $65,045.03

- Total Liquidation Bonus (USD): $6,504.50

- Total Liquidator Bonus (USD): $4,553.15

- Total Protocol Bonus (USD): $1,951.35

| Asset | Total Seized (Tokens) | Total Seized (USD) | Debt Repaid (USD) | Liquidation Bonus (USD) | Liquidator Bonus (USD) | Protocol Bonus (USD) | Liquidation Count |

|---|---|---|---|---|---|---|---|

| xcDOT | 22,669.334164 | $55,983.22 | $50,893.84 | $5,089.38 | $3,562.57 | $1,526.82 | 204 |

| GLMR | 468,150.826784 | $14,398.23 | $13,089.30 | $1,308.93 | $916.25 | $392.68 | 374 |

| ETH.wh | 0.152945 | $596.28 | $542.08 | $54.21 | $37.95 | $16.26 | 29 |

| xcUSDC | 395.654710 | $395.65 | $359.69 | $35.97 | $25.18 | $10.79 | 21 |

| FRAX | 70.256520 | $70.05 | $63.68 | $6.37 | $4.46 | $1.91 | 7 |

| BTC.wh | 0.000494 | $51.51 | $46.83 | $4.68 | $3.28 | $1.40 | 1 |

| xcUSDT | 47.505578 | $47.63 | $43.30 | $4.33 | $3.03 | $1.30 | 6 |

| USDC.wh | 6.952570 | $6.95 | $6.32 | $0.63 | $0.44 | $0.19 | 2 |

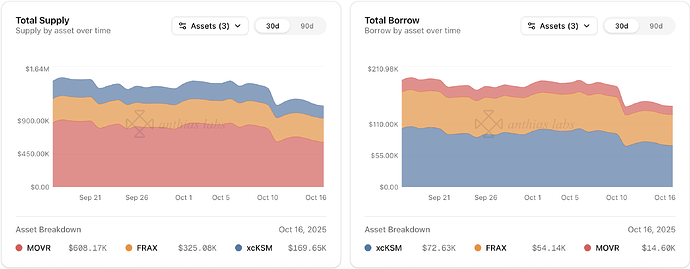

Moonriver

| Asset | Current Borrow Cap | Average Utilization |

|---|---|---|

| xcKSM | 0.10 | 41.93% |

| FRAX | 0.10 | 17.14% |

| MOVR | 0.10 | 2.39% |

Week-over-Week Changes

| Asset | Total Borrow | Total Supply | Utilization |

|---|---|---|---|

| xcKSM | -0% from 6.55K xcKSM to 6.55K xcKSM | -5% from 16.03K xcKSM to 15.30K xcKSM | +5% from 40.86% to 42.81% |

| FRAX | -16% from 64.40K FRAX to 54.31K FRAX | -0% from 327.30K FRAX to 326.06K FRAX | -15% from 19.68% to 16.66% |

| MOVR | +0% from 3.57K MOVR to 3.57K MOVR | -2% from 152.10K MOVR to 148.70K MOVR | +2% from 2.35% to 2.40% |

Notable Trends

- FRAX borrows -16% (64.40K → 54.31K FRAX)

Liquidations

- Total liquidations: 74

- Total Collateral Seized (USD): $11,138.34

- Total Debt Repaid (USD): $10,125.76

- Total Liquidation Bonus (USD): $1,012.58

- Total Liquidator Bonus (USD): $708.80

- Total Protocol Bonus (USD): $303.77

| Asset | Total Seized (Tokens) | Total Seized (USD) | Debt Repaid (USD) | Liquidation Bonus (USD) | Liquidator Bonus (USD) | Protocol Bonus (USD) | Liquidation Count |

|---|---|---|---|---|---|---|---|

| MOVR | 2,964.786005 | $9,057.77 | $8,234.34 | $823.43 | $576.40 | $247.03 | 56 |

| xcKSM | 304.564304 | $1,792.99 | $1,629.99 | $163.00 | $114.10 | $48.90 | 16 |

| FRAX | 288.297200 | $287.57 | $261.43 | $26.14 | $18.30 | $7.84 | 2 |