TL;DR:

- This proposal outlines the migration of the existing Apollo Aera vault from Aera V1 to Aera V2, maintaining the same strategy (15% volatility targeting).

- The Aera V1 vault is currently worth $290k, up 16% from an initial allocation of $250k.

- Aera V2 is live in production with multiple users like Compound and Threshold and has new features, including the ability to generate yield on stablecoins, support for a broader range of assets and strategies, an enhanced security framework, and the elimination of Impermanent Loss.

- With Aera V2, we can access new DeFi primitives, such as lending protocols. This proposal includes the option to leverage Aave for generating yield on the USDC holdings in the vault, a decision that voters can support or oppose.

- We will be giving this proposal 7 days in the forum before proceeding to snapshot vote. If the snapshot vote passes, the vault will be migrated from Aera V1 to Aera V2.

Overview

Recently we launched Aera V2, a major improvement over our our existing V1 product. Aera V2 brings a slew of new capabilities in onchain treasury management. With Aera V2, we can now deploy strategies that generate onchain yield, target risk levels via volatility, diversify out of treasury assets, and more. Aera V2 has been audited by Spearbit and is in production with multiple customers (can see more on https://app.aera.finance) including Compound and Threshold.

We are really excited to bring the benefits of Aera V2 to Moonwell Apollo. As a recap, Moonwell Apollo has been using an Aera vault since May of last year to great success. Initially $250k of USDC.multi was deposited into an Aera vault on Polygon (unbridging from moonriver, using the multichain bridge, transferring over to Polygon POS). This $250k has been in a 15% Volatility Targeted vault, and is currently worth $290k and can be seen here, representing a growth of 16%. Fortuitously these funds were bridged over before Multichain was hacked, otherwise, the funds that were previously in Apollo reserves would have been worth close to $0.

Aera V2 represents a step improvement over V1, and to understand this we wanted to elucidate some of the constraints of V1 that motivated us to upgrade our protocol.

How Aera V2 improves on V1

V1 was built on top of Balancer, and while Balancer provided adequate initial capabilities for Aera, it also presented some key constraints as listed below:

- Impermanent Loss (IL) - Balancer is an AMM and as such rebalances using arbitrage mechanics, this inevitably leads to some impermanent loss in the vault and makes large rebalances more challenging to implement at risk of more IL

- Limited asset/strategy support - since everything needs to be held in Balancer itself, the assets and strategies that can be expressed are largely limited to ERC20 assets, and the strategies can’t immediately take advantages of external DeFi protocols like Uniswap, Curve, Aave, Compound, Moonwell, or other protocols. Further, and tied to IL, because rebalancing is done via arbitrage primarily via the Smart Order Routing network in Balancer, the set and notional amount of assets that can be traded is limited to liquidity on Balancer or a strong external arbitrage loop. This further means that taking advantage of various onchain yield venues is challenging and limits what the vault can do.

- Security apparatus - while Balancer itself is safe and battle tested, extending some of the security guarantees proves tricky without significant investment and building on Balancer infrastructure. As we will see below, we have built Aera V2 to have an extensible security framework with customizable onchain guarantees.

In order to continue to best serve DAO treasuries, we needed to build a system that allowed for more expression and robustness while maintaining strong security guarantees for the DAO.

Introducing Aera V2

Aera V2 builds on the challenges above to provide DAOs with more control and the ability to express more robust and varied strategies.

How Aera works

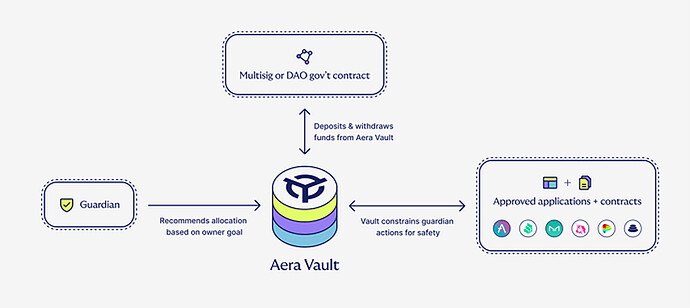

An Owner initially deposits into the vault, selects the objective function (i.e. a Risk managed portfolio via Volatility targeting, a Yield strategy to generate ETH yield via leverage, Asset diversification using onchain exchanges etc.), the set of assets that the vault is allowed to trade, DeFi protocols it’s allowed to interact with. Additionally the Owner can set more constraints on the vault via a customizable hooks module. Some example hooks could be: the vault is not allowed to lose more than 3% of its portfolio value in notional terms in a given day, or the vault must always contain 10,000 of a given token at all times.

Once the Owner deposits into the vault the Guardian begins to optimize it against the objective function prescribed by the DAO.

As above Guardians can implement whatever offchain logic and additional modeling they want to achieve the DAO’s goal, in the case of the DAO choosing a Risk strategy via volatility targeting, the guardian may build ETLs and models to fetch asset price data and compute volatility. They could extend this to fetch implied volatility from deribit or other centralized venues if this is helpful for achieving the DAOs objective.

From here on, the Guardian submits rebalance operations against the vault on a regular cadence (i.e. daily, weekly) in a continuous optimization process.

The Guardian is limited in what it can do at a smart contract level. The Guardian is not able to withdraw assets from the vault or do anything that will break the invariants set up in the vault via the hooks module. All operations must happen onchain and leverage other DeFi protocols, making Aera strongly transparent. Critically, the constraints of the Vault prescribed in the smart contract logic, means that Guardians need to strongly automate their strategies. This gives the Treasury Owner stronger guarantees and confidence around achieving the objective, while minimizing the surface area for mistakes and other risks. Automation drives consistency and removes logistical overhead for the DAO.

Due to this blend of onchain constraints and offchain logic, Owners using Aera get a system that is non-custodial, transparent, and efficient at achieving their goal. In summary, Aera is a robust and composable protocol that can support a variety of objectives for DAOs:

- Treasury Diversification

- Risk Managed Portfolio Management (via volatility targeting)

- Runway Management

- Yield Generation

Aera V2 for Moonwell Apollo

We would like to propose to the DAO an upgrade to Aera V2. Specifically we would like to upgrade Moonwell Apollo to an Aera V2 with the same strategy: a 15% volatility targeted portfolio. However, here some key differences are

- Instead of WETH the vault will hold wstETH

- (Optional) instead of holding USDC, the vault will hold aUSDC (supply side Aave USDC which generates yield). We mark this as optional as we would like community input on whether they would like to leverage Aave as part of their vault.

This strategy is live for multiple other customers, including Threshold and Compound.

Threshold has been using this strategy for 5 months and has been generating yield on their vault as a result of this implementation. Their vault can be seen here https://app.aera.finance/1/vault/v2/0x9ecf0d8dcc0076dd153749bece0762acae1c9049. In terms of yield they have generated, while it has varied based on staking rates and utilization, it has been in the range of 4%-10% APY.

From a security perspective, the Moonwell Apollo Vault will have constraints on both the assets that can be traded (only USDC, WETH, wstETH and potentially aUSDC), the protocols it can engage with (Uniswap, Curve, potentially Aave), and invariants at the smart contract level that will prevent more than 3% daily loss from occurring as a result of Guardian rebalance operations.

With these major advancements to Aera V2, we are excited to bring these new capabilities to the DAO.

Most importantly, Moonwell Apollo DAO being the first customer on Aera, holds a special place in the Aera protocol, and we would like to extend this upgrade to the DAO completely for free. No fees will be charged as a result of using Aera V2 as part of this migration.

Beyond an initial migration

Should the community express interest in this we would love to extend our engagement with Moonwell DAO, and are excited to explore further opportunities (for example Moonwell on Base). We have been thrilled to support the Moonwell Apollo DAO as the first customer to get onboarded into Aera, and even more excited that we could help the DAO by preventing $250k of losses due to the Multichain hack.

Once the initial migration is over we would be happy to discuss deeper integrations with the DAO!

Next steps

Should the community be interested in upgrading to Aera V2, we would propose a period of 7 days for forum discussion followed by a snapshot vote consisting of the following:

- Yae, upg. to Aera V2 with Aave USDC

- Yae, upg. to Aera V2 w/o Aave USDC

- Nae don’t upg. to Aera V2

This will be single choice vote, and should the sum of 1 and 2 be larger than 3 we will treat this as a Yae vote and will select the more preferred option between 1 and 2. For clarity:

- If 1+2>3 then max(1,2)

- Else 3

Excited to hear community feedback!