Proposal: Upgrade Moonwell’s Liquidation Incentive Recapture on Optimism’s ETH/USD Market

Replace Solidity Labs’ Flat-Fee Wrapper with Api3’s Auction-Based OEV Network

Author: Dave Connor, API3

Related Discussions: Switching Moonwell's GLMR Market to using API3's OEV Enabled Data Feed for GLMR

Moonwell Governance Call: December 2024

Submission Date: 16/07/2025

Summary

Moonwell currently operates two distinct Oracle Extractable Value (OEV) recapture systems. On Moonbeam, Api3’s auction-based OEV Network is live and consistently returns significant revenue to the protocol. On Base and Optimism, Moonwell relies on a Solidity Labs-designed wrapper that charges a fixed, gas-derived tax to unlock oracle updates early.

After running both systems in parallel for several months, Api3 has significantly outperformed the Solidity Labs feed wrapper, both in terms of protocol revenue and systemic design. The flat-fee wrapper has recaptured surprisingly little value, while Api3 has returned over 70% of liquidation MEV from a single low-TVL, low-liquidity market.

This proposal recommends migrating the ETH/USD price feed on Optimism to Api3, to act as a proof of concept for Api3’s OEV solution in a larger TVL Moonwell market, and allow for a comparison to the current implementation of the Solidity Labs wrapper and any upcoming changes suggested (i.e. to fix the current underperformance).

Background: Two Systems in Parallel

In February 2025, Moonwell integrated Solidity Labs’ OEV wrapper on Base and Optimism. This system delays oracle updates for a configured period, currently 10 seconds, unless a liquidator pays to “unlock” the price early. The fee required is calculated as (tx.gasprice - block.basefee) * feeMultiplier, meaning it is tied entirely to gas volatility, not liquidation value.

In April 2025, Moonwell adopted Api3’s auction-based OEV Network on Moonbeam. Api3’s design enables searchers to bid competitively for the right to trigger a fresh price update and execute a liquidation with real-time data. Api3 then returns 80% of the bid revenue back to the protocol.

A more detailed description of how API3’s OEV solution works can be found in the previous proposal, and in Api3’s docs. There is also a video which looks into the differing approaches to OEV design between Solidity Labs and API3 in more detail.

Issues with the Flat Fee Model for Onchain OEV

- Raising the unlock fee doesn’t solve the problem

Moonwell could try to improve value recapture by simply raising the unlock fee. But this overlooks the core flaw: the fee is calculated based on gas volatility, not the economic value of the liquidation it enables.

This disconnect could lead to unintended outcomes when the fee is simply raised, for example, requiring a $1,000 payment to unlock a price that only allows for a $500 incentive. In these situations, no rational liquidator engages, and the protocol gains nothing. The liquidation still happens, just after a delay, and with no value returned to Moonwell.

The problem isn’t that the fee is too low, it’s that the pricing logic is fundamentally misaligned with the opportunity it’s meant to capture. No adjustment to the fee multiplier can fix a mechanism that’s priced on the wrong variable.

2. Pegging fees to opportunity value doesn’t reliably work either

You might wonder: why not solve the problem by simply tying the flat fee to the value of the liquidation? For example, the protocol could charge a fixed percentage of the incentive (e.g. 99%) and retain nearly all of the upside.

But this approach breaks down under real-world execution.

Imagine a liquidation that, on paper, yields a $1,000 reward. A 99% fee would leave the liquidator with $10. In theory, that’s still profitable.

But in practice, performing the liquidation means the liquidator must swap the seized collateral, which can incur slippage. If that slippage is large enough the $1,000 opportunity might actually only be worth $900. That means the liquidator is paying $990 to earn $900, which is a guaranteed loss. As a result, the liquidation won’t happen through early access; it will simply occur later, after the delay period and with no value returned to the protocol.

The root issue is that the wrapper has no awareness of what actually happens onchain. It can’t account for execution costs like slippage, so it misprices the opportunity. The fee ends up being disconnected from the value it’s trying to capture.

This disconnect becomes more pronounced with larger liquidations, where execution costs scale with position size. Even setting the fee to something more conservative (like 50% of the estimated incentive) might ensure the liquidation is profitable, but would still leave significant value on the table.

By contrast, Api3’s system lets liquidators bid based on what they expect to realize after costs. This ensures the protocol captures value that actually exists and isn’t just theoretical upside, thus avoiding pricing itself out of its own opportunities.

3. Auctions are the prevailing design

Across the MEV ecosystem, there is a clear trend toward auction-based mechanisms as the preferred way to allocate value and prioritize transactions. Different systems apply this principle in different ways:

-

Flashbots uses auctions to bundle and prioritize transactions during block building

-

Arbitrum uses Timeboost, an auction-based ordering mechanism

-

Api3’s OEV Network uses auctions to determine who can trigger a prioritized oracle update

While the implementations vary, the underlying principle is consistent: letting participants compete based on what they can actually realize leads to better outcomes, for protocols, searchers, and end users alike.

Comparative Performance: Solidity Labs vs Api3

Solidity Labs (Feb 25 – Jul 7, 2025)

Base - Base Dune dashboard![]()

-

Total MEV: $537,634.77

-

Protocol revenue: $7.00

-

Capture rate: 0.0013%

-

Total liquidations: 7,515

-

OEV-enabled (early unlocks): 223

-

Over 97% of liquidations were executed with a delay (not using OEV)

Optimism - Optimism Dune dashboard![]()

-

Total MEV: $97,121.80

-

Protocol revenue: $0.55

-

Capture rate: 0.0005%

-

Total liquidations: 448

-

OEV-enabled: 75

-

~83% of liquidations were executed with a delay (not using OEV)

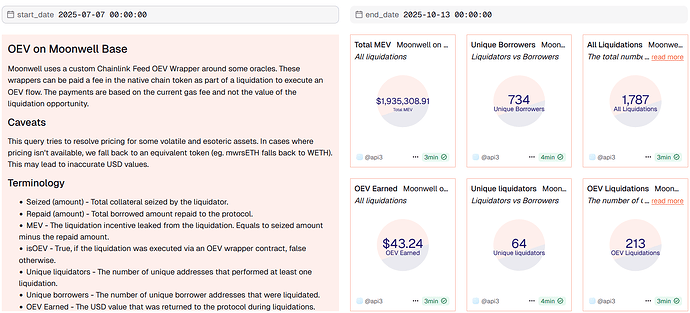

Api3 (Apr 18 – Jul 7, 2025, GLMR/USD only on Moonbeam) - OEV dashboard for Moonbeam GLMR/USD market

-

Total MEV: $4,829.57

-

Processed via OEV auctions: $3,568.42

-

Protocol revenue: $2,556.16

-

Capture rate: ~70%

Value returned per $ TVL secured

Solidity Labs: $0.000000025

Api3: $0.005

Despite operating on a single feed with significantly lower TVL, in a liquidity-constrained environment, Api3 returned thousands of times more value than the Solidity Labs system.

What the Protocol Missed

The cost of continuing with the current system is not abstract, it’s measurable. If Api3’s auction-based OEV Network had been live on Base and Optimism during the same time period, Moonwell could have recaptured an estimated $400,000 in additional protocol revenue. That revenue wouldn’t just have gone unclaimed, it would have translated directly into stronger protocol economics.

Based on historical token pricing and acquisition patterns, this additional value could have enabled Moonwell to acquire approximately 13 million more WELL tokens through reverse auctions. During the same period, 31 million WELL was acquired under the existing setup. With Api3’s system in place, that number could have risen to 44 million WELL, representing a 42% increase.

This isn’t a hypothetical improvement. It reflects a tangible, quantifiable opportunity lost due to the limitations of the current fee model. Limiting the initial switch to Optimism, and to a single market is designed to allow continued comparisons to be made with the Solidity Labs designed OEV solution in production, and prove to the Moonwell community the benefits of switching more feeds in future.

Why Api3?

Api3’s OEV Network has been live with Moonwell on Moonbeam since April, where it has consistently delivered strong value recapture, despite initially operating on a single feed in an environment with thin liquidity, high slippage, and poor routing. These conditions are suboptimal for MEV searchers, yet the system has still performed well. An integration on a single feed on Optimism would provide a risk-minimized approach to demonstrating the potential returns that swapping more feeds to Api3 would bring.

Api3 has already distributed nearly $300,000 in OEV revenue to integrated protocols, including Yei Finance, a lending market with over $400M in TVL on the Sei Network, and Compound Finance on Mantle.

Api3 supports hybrid feeds (like wstETH/USD) that are currently unsupported by the Solidity Labs wrapper. It also operates across more than 40 EVM chains, giving Moonwell flexibility to expand its markets without needing new infrastructure.

The system has already proven that it works under pressure. On chains like Base and Optimism, where liquidity is deeper, routing is better, and searcher activity is higher, the system is expected to perform more successfully.

Implementation Plan

-

Replace current ETH price feed on Optimism with Api3’s price feed

-

Api3 will manage feed deployments and updates

-

Monthly OEV revenue (80%) is returned to Moonwell (e.g., via addReserves)

-

A monthly report will be published and shared on the forum with complete liquidation and revenue data

-

A public dashboard for Api3’s performance on Optimism will go live shortly after proposal execution, and will be shared on the forum (a similar dashboard for Moonwell on Moonbeam is here OEV Dashboard)

This upgrade requires no changes to the core protocol and can be executed with minimal coordination.

Conclusion

The Solidity Labs wrapper was an interesting attempt to build an onchain-only OEV solution, but the data and logic show it has not performed as intended:

-

It fails to price liquidations accurately

-

It leaves most value on the table

-

It does not support hybrid feeds

By contrast, Api3’s auction-based system has already outperformed in difficult environments, including the extreme volatility seen during February 2025, not only operating flawlessly but successfully returning value to users.

Api3 has already been shown to work without issues and return value to Moonwell through the Moonbeam deployment. Switching the ETH/USD feed on Optimism to Api3 will allow for more direct comparisons to be made between the Solidity Labs solution and Api3, and show the Moonwell community the benefits of a wider switch to Api3.

Improving protocol revenue will further help increase security by improving yield paid to safety module stakers, encouraging more WELL to be staked. Using Api3 also gives Moonwell the ability to scale cross chain easily to any Api3 supported chain, regardless of MEV presence, and without having to wait for any additional infrastructure to be deployed.

Vote Options

-

Yay – Replace the Solidity Labs wrapper with Api3’s data feed address for the ETH/USD feed on Optimism, enabling Api3 to recapture OEV

-

Nay – Retain the current system and continue with negligible OEV recapture

-

Abstain – No opinion