Token: cbDOGE

Contract Address (Base): 0xcbD06E5A2B0C65597161de254AA074E489dEb510

We are pleased to present a proposal for adding Coinbase Wrapped DOGE (cbDOGE) to Moonwell’s Base Core Markets. cbDOGE is a fully‑collateralised, ERC‑20 representation of DOGE that is minted and redeemed 1‑for‑1 through Coinbase. The listing would bring one of crypto’s most recognizable retail assets to the protocol, deepen liquidity on Moonwell, and attract new and perhaps more “degen” users familiar with DOGE.

Similar to cbXRP, cbDOGE is new, but has shown promise to be a listed asset for the future.

Benefits to the Moonwell Community

- Enhanced Liquidity & Volume: Coinbase issuance immediately bootstrapped > $1.8 M market cap and ~ $300 k first‑day volume on Base DEXs.

- New User Acquisition: Dogecoin’s X account counts > 3.7 M followers, offering exposure for Moonwell.

- Diversification: Introduces a PoW meme‑coin collateral un‑correlated with ETH/L2 governance tokens.

Resources and Socials

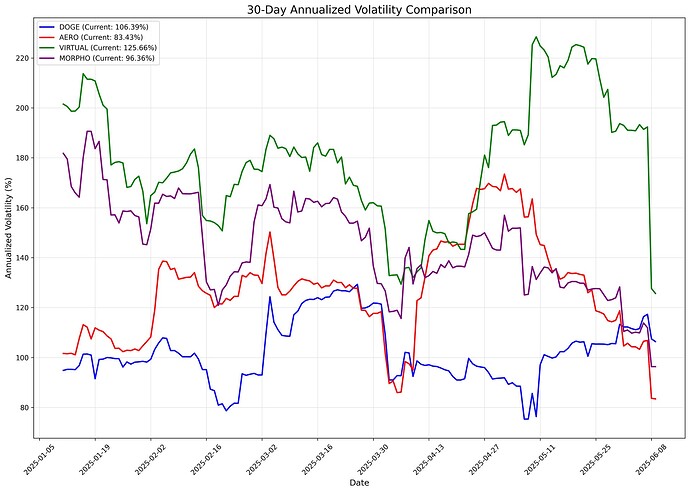

Market Risk Assessment

Market Metrics (Source)

- Market Cap: $1.82M

- Minimum/Maximum Market Cap (Last 6 months): $0 (December 5th 2024) / $1.82M (June 5th 2025)

- Circulating Supply: 10.4M cbDOGE

- Maximum Supply: 10.4M cbDOGE

- 24 Hour Trading Volume: It has only been out for a day, it is currently $566,000 worth of trading volume through Aerodrome

Liquidity on Centralized Exchanges

This does not apply to this token as it stands to be an Base deployment of DOGE.

Herfindahl Index: 0.86 (on Base)

The Herfindahl Index quantifies token concentration among holders. A value of 0.86 reflects significant concentration among wallets for the cbDOGE token, indicating that governance risks stemming from concentrated holdings are high. It should be noted however that Coinbase is a reputable company, and that cbDOGE borrows from Coinbase’s reserve supply on and so this may not be a completely accurate representation and there are some safeguards.

Decentralization

- Top 10 Holders (Majority is concentrated in a Coinbase wallet followed by an Aerodrome LP)

- Token Contract: 0xcbD06E5A2B0C65597161de254AA074E489dEb510

Ownership and Administration:

cbDOGE operates as an onchain Base native deployment of DOGE, backed by the reserves of Coinbase. The token is only on Base as of now, and all administrative roles and access are through Coinbase.

Governance Structure:

- Coinbase Wrapped Assets are held in custody by Coinbase, and thus are subject to rules of Coinbase’s Custody depending on the jurisdiction: see here for asset-specific details.

Blacklist Functionality:

- The cbDOGE contract has a blacklisting function, barring an account from transferring, minting, or burning cbDOGE. There is also an “unBlacklist” function for removing blacklisting and a blacklist public getter to check the status of the blacklist.

Smart Contract Risks

Codebase and Onchain Activity

- The smart contract for cbDOGE can be found here.

- cbDOGE has only 174 holders as of right now.

Security Posture

- cbDOGE is deployed under the same wrapped framework that was audited by OpenZeppelin. See here for auditing details.

Upgradeability

- It is upgradeable under an Admin role found in the contract. cbDOGE can be upgraded at any time by the proxy admin (likely a Coinbase multisig).

Oracle Assessment

- Chainlink oracle price feed address: 0x8422f3d3CAFf15Ca682939310d6A5e619AE08e57

- Is the asset a wrapped, staked, or synthetic version of a different underlying asset?* If yes, and the Chainlink price feed provides price data for the underlying asset rather than the wrapped, staked, or synthetic version, please provide the following information: How is the asset wrapped, staked, or otherwise created?

- cbDOGE price tracks DOGE by leveraging Coinbase reserves. The supply on Base is capped by Coinbase Custody. This can be found here on its Coinbase Proof of Reserves page.

Swap Size Requirement

cbDOGE does not currently fulfill the swap size requirements of the MALF; however, it is very early in the listing process AND cbDOGE has only been out for one day.

Liquidity Threshold

Currently, the liquidity does not meet the $2M threshold Moonwell has under MALF; however, seeing as though liquidity on Aerodrome has already hit 8% of that goal in a day, it is not far fetched to see it hitting this threshold sooner rather than later.

Commercial Viability

We can use the utilization rate patterns from Gauntlet’s dashboard of comparable long‑tail assets; two scenarios can show cbDOGE’s revenue outlook. Scenario 1 (TBTC‑like) assumes $3 M supplied liquidity, 37 % utilisation and an 8 % borrow APR, numbers that resemble TBTC’s current profile, and would generate roughly $89 k in annual interest, sending ≈ $1.1 k per month to Moonwell reserves and clearing the $1 k commercial‑viability bar. Scenario 2 (WELL‑like) takes a stricter view: $2 M supplied, 20 % utilisation and a 6 % APR produce about $24 k in yearly interest and ≈ $300 per month in reserves, below the target yet attainable with modest growth.

Proposal Author Information

- Name: Coolhorsegirl & 0xMims

- Twitter: Coolhorsegirl & 0xMims

- Relationship with token: 0xMims is a Moonwell governance lead and CHG is a Moonwell delegate.

Conclusion

For all other information, such as risk assessments or lacking information found within this document for commercial viability, we ask @Gauntlet and @AnthiasLabs to make the proper risk assessments and commercial viability assessment needed to continue.

The listing of cbDOGE as a core asset on Moonwell unlocks significant potential for protocol growth, liquidity expansion, and user adoption. As a stable and compliance-ready asset, a cbDOGE listing would increase lending functionality while aligning with Moonwell’s mission of simple, secure, and accessible DeFi.

While this listing is risky, it is definitely warranted to bring this to discussion immediately to stay ahead in the game. We invite the community to engage in discussion and help shape this listing proposal to best serve the protocol’s long-term vision.