[Anthias Labs] - Initial Parameter Recommendations for cbDOGE

Introduction

Anthias Labs supports onboarding cbDOGE as collateral in Moonwell’s Core markets on Base. Below we share the results of our analysis, and subsequent parameter recommendations.

About cbDOGE

Coinbase Wrapped Dogecoin (cbDOGE) is an ERC-20 token issued by Coinbase, representing Dogecoin (DOGE) on blockchains like Base and Ethereum. Backed 1:1 by DOGE held in Coinbase’s custody, cbDOGE enables Dogecoin holders to participate in DeFi ecosystems, bridging the popular memecoin to new use cases.

Dogecoin (DOGE) is the original meme coin, and second-biggest proof-of-work cryptocurrency by market cap behind Bitcoin. It was launched in 2013 as a joke, poking fun at the large number of crypto project entering the market following the rapid ascent of Bitcoin, and playing off of the popular “doge” internet meme. Dogecoin is a fork of Litecoin, which itself was forked from Bitcoin.

Initially obscure, Dogecoin gained prominence when Elon Musk endorsed it in 2019, calling it his “favorite cryptocurrency” on Twitter. With subsequent tweets, including a pivotal 2021 post, he sparked a meteoric rise that propelled Dogecoin into the mainstream. Today Dogecoin sits as the 8th largest cryptocurrency by market cap.

The process of minting and burning cbDOGE involves a set of audited smart contracts also used for cbETH and cbBTC.

- Minting: A user initiates a withdrawal of DOGE held in their Coinbase account to an address/wallet on Base. An equivalent amount of cbDOGE is minted and sent to the specified address, with the original DOGE being locked in a secure reserve.

- Redeeming: A user sends cbDOGE to their Coinbase account, upon deposit the wrapped tokens are burned and the corresponding DOGE is moved from the reserve and credited to the users account.

This process guarantees a strict 1:1 peg with DOGE, ensuring that every cbDOGE token is fully backed by an equivalent reserve of DOGE. Additionally, this mechanism essentially enhances liquidity for cbDOGE on Base by providing access to external liquidity sources, with Coinbase serving as a bridge. For Moonwell, this means parameters like supply caps, borrow caps, and collateral factor can factor in this ability to redeem directly as there is decreased risk of bad debt due to unprofitable liquidations. Liquidators with a Coinbase account can easily access external liquidity sources, mitigating the impact of slippage on DEXs, and preserving profitability. By contrast, non-wrapped assets face stricter limitations, as they are solely reliant on DEX liquidity.

Risk Parameter Recommendations

| Parameter | Value |

|---|---|

| Collateral Factor | 65% |

| Supply Cap | 10M cbDOGE |

| Borrow Cap | 4.5M cbDOGE |

| Protocol Seize Share | 30% |

IR Parameter Recommendations

| Parameter | Value |

|---|---|

| Base Rate | 0 |

| Kink | 0.45 |

| Multiplier | 0.23 |

| Jump Multiplier | 5 |

| Reserve Factor | 0.3 |

DEX Pools

On chain market cap: $ 1.94 M

| Exchange | Pair | Volume (24 hr) | TVL | Link |

|---|---|---|---|---|

| Aerodrome SlipStream | cbBTC / cbDOGE | $2.9M | ~$450K | cbDOGE/cbBTC - Coinbase Wrapped DOGE Price on Aerodrome SlipStream with 0.25% Fee | GeckoTerminal |

| Aerodrome SlipStream | WETH / cbDOGE | $145K | ~$450K | cbDOGE/WETH - Coinbase Wrapped DOGE Price on Aerodrome SlipStream with 1% Fee | GeckoTerminal |

Price Volatility

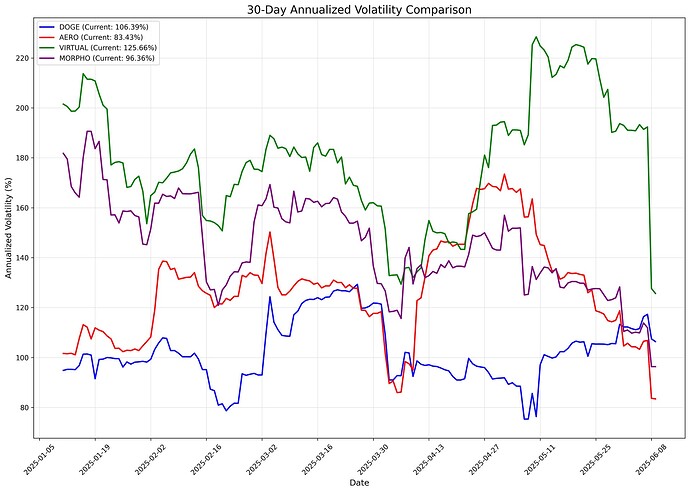

- Current cbDOGE 30d annualized volatility: 106.39%

- Comparing DOGE’s volatility profile to other assets on Moonwell, it’s more volatile than assets such as BTC and ETH, and less volatile than assets like AERO, VIRTUAL, and MORPHO.

- A large portion of DOGE’s supply is heavily concentrated among retail traders. The largest wallet, a Robinhood cold wallet, holds 19.28% of the total coins (source).

On Chain Supply

- ~10M cbDOGE (source)

- Most cbDOGE is held by Coinbase (~65%)

- Of the top 10 holders on Base, 8 are contracts (LPs).

Slippage

Selling 2.1M cbDOGE currently incurs <7% slippage (liquidator bonus). This represents ~40% of liquidatable collateral at max supply and borrow caps of 10M and 4.5M respectively. As cbDOGE has only been out for a week, we expect on-chain liquidity to continue to increase. Additionally, cbDOGE is fungible 1:1 with DOGE through Coinbase, granting access to deep liquidity from other centralized venues.

Supply and Borrow Caps

We recommend setting the supply cap for cbDOGE to 10 million tokens and the borrow cap to 4.5 million tokens. The supply cap is designed to approximate the total supply of cbDOGE on the base network, providing a safe ceiling without stifling growth. These caps are intended to create a secure lending environment where, in a worst-case scenario involving significant collateral liquidation, the platform can rely solely on DEX liquidity to manage liquidations. This approach minimizes risks tied bridging cbDOGE through Coinbase to access liquidity from external sources, which liquidators should easily be able to do, but might not be immediately prepared for. Initially, these caps are set conservatively to evaluate lending demand and monitor market conditions, allowing for future adjustments as needed.

Colateral Factor

We recommend setting cbDOGE’s initial collateral factor to 65%, aligning it with volatile assets such as AERO, VIRTUAL, and MORPHO. Although cbDOGE’s risk profile may permit a higher factor, we suggest a gradual increase from this starting point during the asset’s onboarding phase.

IR Parameters

Borrowing DOGE is currently facilitated through CEXs, which typically offer APYs ranging from 4% to 14%. As lending DOGE is new to DeFi, we propose initial interest rate parameters designed to span a wide range of APYs. This flexibility aims to help determine the market-optimal rate based on demand and utilization.

The table below details the proposed borrow and supply annual percentage rates (APRs) at different utilization levels:

| Utilization | Borrow APY | Supply APY |

|---|---|---|

| 0 | 0 | 0 |

| 45% | 10.35% | 3.26% |

| 100% | 285.35% | 199.74% |

Conclusion

As cbDOGE is a novel asset, we will continue to monitor DEX liquidity, and expansion on Base. We will propose updated parameters as new information develops. As always, we are open to community feedback and happy to answer any lingering questions.