[Anthias Labs] Minimum Reserve Recommendations (9/18/25) (Base)

Summary

| Asset | Recommended Reserves (Tokens) | Recommended Reserves ($) |

|---|---|---|

| AERO | 130000 | $174,720.00 |

| cbBTC | 2 | $232,941.46 |

| cbETH | 9 | $45,465.01 |

| cbXRP | 6000 | $18,516.00 |

| DAI | 900 | $900.00 |

| EURC | 67000 | $79,328.00 |

| LBTC | 0.2 | $23,316.35 |

| MORPHO | 6000 | $12,366.00 |

| rETH | 2 | $10,471.01 |

| tBTC | 0.2 | $23,255.61 |

| USDC | 600000 | $600,000.00 |

| USDS | 2500 | $2,500.00 |

| VIRTUAL | 10000 | $13,600.00 |

| weETH | 6 | $29,618.59 |

| WELL | 1200000 | $30,000.00 |

| WETH | 320 | $1,469,027.20 |

| wrsETH | 1 | $4,834.48 |

| wstETH | 6.6 | $36,733.97 |

| Total: $2,807,593.69 |

Methodology

Minimum reserves are calculated using an approach that accounts for probable liquidation volumes through Collateral at Risk (CAR) analysis, while considering both the secondary market liquidity of collateral assets and the debt borrowed against them. This methodology ensures reserves are proportional to the actual liquidation risk in the protocol.

For each asset in the protocol, we establish a 5% slippage threshold: the maximum dollar amount that can be swapped for stables before incurring 5% price impact. This represents the practical liquidity limit for liquidations.

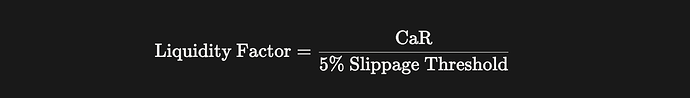

The liquidity factor for each asset is derived by comparing the Collateral-at-Risk (CaR) to the 5% slippage threshold:

| Asset | Liquidity Factor | Risk Level |

|---|---|---|

| WELL | 1.166 | High - limited liquidity vs CAR |

| weETH | 0.262 | Moderate - reasonable liquidity |

| WETH | 0.026 | Low - deep liquidity |

For each collateral asset, we multiply all debt borrowed against it by that collateral’s liquidity factor:

For each collateral_asset:

For each debt_asset borrowed against collateral_asset:

weighted_debt[debt_asset] += collateral_liquidity_factor × debt_amount

This produces a risk-adjusted view of debt where:

- Debt backed by less-liquid collateral relative to CaR (high factor) requires larger reserves

- Debt backed by highly liquid collateral relative to CaR (low factor) requires smaller reserves

The minimum reserves for each asset are then set proportionally to its risk-weighted debt.

Collateral-at-Risk Snapshot

The table below provides a snapshot of Collateral-at-Risk (CaR) on 9/16/25 using the methodology described here.

| Token | 30d CaR USD | CaR Tokens | Positions |

|---|---|---|---|

| AERO | $1,554,238 | 1220350.69 | 1,232 |

| WETH | $1,517,801 | 335.21 | 1,300 |

| USDC | $1,295,493 | 1295752.67 | 1,539 |

| weETH | $472,204 | 97.09 | 74 |

| WELL | $466,736 | 17892934.88 | 309 |

| cbBTC | $444,347 | 3.84 | 768 |

| wstETH | $228,561 | 41.65 | 306 |

| cbETH | $140,030 | 28.11 | 333 |

| MORPHO | $133,460 | 68328.68 | 217 |

| cbXRP | $99,337 | 33156.53 | 134 |

| VIRTUAL | $70,859 | 57708.47 | 400 |

| LBTC | $42,168 | 0.36 | 83 |

| rETH | $14,305 | 2.76 | 124 |

| wrsETH | $14,032 | 2.94 | 38 |

| EURC | $5,299 | 4502.92 | 226 |

| tBTC | $4,555 | 0.04 | 75 |

| USDS | $46 | 46.06 | 55 |

| DAI | $21 | 21.29 | 43 |

Monthly Accrual

Reserve accrual from August 17th to September 14th, 2025.

| Asset | Token Change | From Liquidations | Liquidation % | From Interest | Interest % | USD Change |

|---|---|---|---|---|---|---|

| AERO | 28589.9 | 9221.99 | 32.30% | 19367.9 | 67.70% | $34,164.93 |

| cbBTC | 0.0139 | 0.00530781 | 38.20% | 0.00859219 | 61.80% | $1,605.52 |

| cbETH | 0.005 | 0.00348439 | 69.70% | 0.00151561 | 30.30% | $25.38 |

| cbXRP | 292.229 | 187.72 | 64.20% | 104.509 | 35.80% | $892.18 |

| DAI | 225.674 | 0.0549821 | 0.00% | 225.619 | 100.00% | $225.67 |

| EURC | 618.19 | 73.4054 | 11.90% | 544.785 | 88.10% | $727.61 |

| LBTC | 0.0007 | 0.0000138469 | 2.00% | 0.000686153 | 98.00% | $80.92 |

| MORPHO | 268.526 | 8.16433 | 3.00% | 260.362 | 97.00% | $538.66 |

| rETH | 0.0007 | 0 | 0.00% | 0.0007 | 100.00% | $3.69 |

| tBTC | 0.0001 | 0.00000679027 | 6.80% | 0.0000932097 | 93.20% | $11.51 |

| USDC | 89103.9 | 50907.6 | 57.10% | 38196.2 | 42.90% | $89,103.90 |

| USDS | 15.9999 | 0 | 0.00% | 15.9999 | 100.00% | $16.00 |

| VIRTUAL | 1076.38 | 42.5872 | 4.00% | 1033.79 | 96.00% | $1,367.00 |

| weETH | 4.5604 | 4.14519 | 90.90% | 0.415212 | 9.10% | $22,600.70 |

| WELL | 108394 | 35949 | 33.20% | 72444.8 | 66.80% | $2,926.64 |

| WETH | 2.1497 | 0.134828 | 6.30% | 2.01487 | 93.70% | $9,918.33 |

| wrsETH | 0.0001 | 0 | 0.00% | 0.0001 | 100.00% | $0.49 |

| wstETH | 0.0049 | 0.00176408 | 36.00% | 0.00313592 | 64.00% | $27.39 |

| Total: $164,237.39 |

Reserve Auctions

| Asset | Current Reserves ($) | Current Reserves (Token) | Recommended Reserves (Tokens) | Reserves to be Auctioned Off (Tokens) | Reserves to be Auctioned Off (USD) |

|---|---|---|---|---|---|

| AERO | $179,327.46 | 140759.3886 | 130000 | 11859.3746 | $15,939.00 |

| cbBTC | $257,188.90 | 2.2202 | 2 | 0.2205 | $25,681.80 |

| cbETH | $44,868.55 | 9.0003 | 9 | 0.0004 | $2.02 |

| cbXRP | $6,504.39 | 2171.0235 | 6000 | 0 | $0.00 |

| DAI | $1,083.02 | 1083.0194 | 900 | 338.4477 | $338.45 |

| EURC | $22,346.72 | 18986.1662 | 67000 | 0 | $0.00 |

| LBTC | $18,989.83 | 0.1638 | 0.2 | 0 | $0.00 |

| MORPHO | $5,368.76 | 2748.9821 | 6000 | 0 | $0.00 |

| rETH | $13,102.52 | 2.5304 | 2 | 0.5305 | $2,777.44 |

| tBTC | $2,118.50 | 0.0184 | 0.2 | 0 | $0.00 |

| USDC | $438,380.07 | 438380.0725 | 600000 | 0 | $0.00 |

| USDS | $69.54 | 69.5351 | 2500 | 0 | $0.00 |

| VIRTUAL | $7,525.21 | 6128.0247 | 10000 | 0 | $0.00 |

| weETH | $48,247.55 | 9.914 | 6 | 3.914 | $19,321.19 |

| WELL | $38,061.06 | 1463887.041 | 1200000 | 268451.8152 | $6,711.30 |

| WETH | $1,503,127.76 | 331.7719 | 320 | 0* | 0* |

| wrsETH | $3,735.71 | 0.7834 | 1 | 0 | $0.00 |

| wstETH | $36,250.81 | 6.6014 | 6.6 | 0.0017 | $9.46 |

| Total: $70,780.65 |

*= an issue with WETH Unwrapper contrcat currently prohibits WETH reserves from being auctioned off.

The next Automated Liquidity Incentive Proposal, scheduled for October 5th, 2025, will auction reserves that are expected to significantly exceed the current $70K estimate as they continue to accrue.

Projected APY for Staked WELL

There is $25M in WELL currently staked, if $70K in WELL is distributed to stakers from reserve auctions this would result in a boosted APY of $70,000/25,000,000 * 12 = 3.36%$. As the actual amount of WELL acquired in auctions is projected to be around $100K, this would result in a boosted APY of 4.5%. Assuming a 4.5% base staking rate, the total APY next month is estimated at approximately 9% (4.5% + 4.5%).