Weekly Update (9/26/25 - 10/2/25)

Anthias Labs would like to provide an update on market performance over the past week for Core markets on Base, OP mainnet, Moonbeam, and Moonriver. Data from 9/26/25 to 10/2/25. More information can be found on our monitoring dashboard.

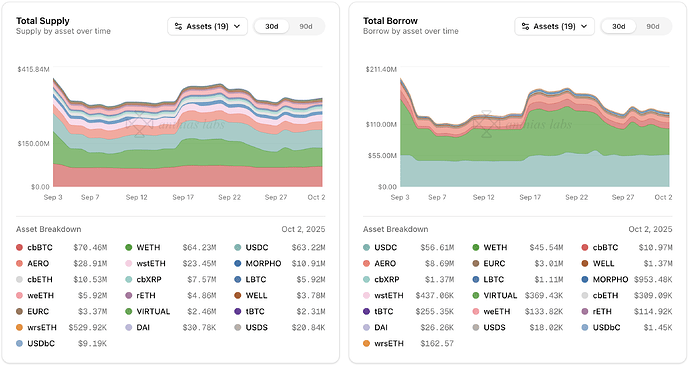

Base

| Asset | Current Borrow Cap | Current Supply Cap | Average Borrow Cap Usage (Past Week) | Average Supply Cap Usage (Past Week) | Average Utilization |

|---|---|---|---|---|---|

| USDC | 184.00M | 200.00M | 30.15% | 30.89% | 89.80% |

| USDS | 690.00K | 750.00K | 2.61% | 2.69% | 89.39% |

| EURC | 21.00M | 21.90M | 12.15% | 13.37% | 87.24% |

| DAI | 300.00K | 400.00K | 8.75% | 7.66% | 85.69% |

| WETH | 64.00K | 96.00K | 19.89% | 15.65% | 84.60% |

| AERO | 25.00M | 70.00M | 34.68% | 39.70% | 31.29% |

| WELL | 100.00M | 250.00M | 43.51% | 60.38% | 28.75% |

| VIRTUAL | 2.30M | 4.50M | 15.82% | 42.00% | 20.10% |

| tBTC | 36.00 | 90.00 | 5.98% | 13.47% | 17.78% |

| LBTC | 38.00 | 95.00 | 22.07% | 51.86% | 17.01% |

| cbXRP | 1.60M | 5.00M | 25.52% | 49.15% | 16.60% |

| USDbC | 1.00 | 1.00 | 145.48K% | 919.79K% | 15.82% |

| cbBTC | 640.00 | 1.50K | 13.63% | 40.29% | 14.44% |

| MORPHO | 1.00M | 6.00M | 51.93% | 100.04% | 8.65% |

| cbETH | 6.40K | 16.00K | 1.00% | 13.64% | 2.93% |

| rETH | 900.00 | 2.60K | 2.54% | 37.21% | 2.36% |

| wstETH | 4.80K | 14.40K | 1.85% | 30.08% | 2.05% |

| weETH | 700.00 | 5.40K | 4.15% | 53.21% | 1.12% |

| wrsETH | 430.00 | 1.00K | 0.01% | 11.44% | 0.03% |

Week-over-Week Changes

| Asset | Total Borrow | Total Supply | Utilization |

|---|---|---|---|

| USDC | +3% from 54.94M USDC to 56.79M USDC | +5% from 60.58M USDC to 63.48M USDC | -1% from 90.68% to 89.46% |

| USDS | -1% from 18.16K USDS to 18.06K USDS | -3% from 21.50K USDS to 20.84K USDS | +3% from 84.46% to 86.68% |

| EURC | +2% from 2.49M EURC to 2.54M EURC | +3% from 2.79M EURC to 2.86M EURC | -0% from 89.19% to 88.82% |

| DAI | +1% from 26.04K DAI to 26.26K DAI | +1% from 30.62K DAI to 30.78K DAI | +0% from 85.04% to 85.31% |

| WETH | -31% from 15.26K WETH to 10.55K WETH | -14% from 17.22K WETH to 14.84K WETH | -20% from 88.63% to 71.09% |

| AERO | -14% from 8.94M AERO to 7.66M AERO | +1% from 29.11M AERO to 29.53M AERO | -16% from 30.73% to 25.96% |

| WELL | +48% from 39.48M WELL to 58.56M WELL | +10% from 147.88M WELL to 162.80M WELL | +35% from 26.70% to 35.97% |

| VIRTUAL | -28% from 356.11K VIRTUAL to 256.00K VIRTUAL | +44% from 1.49M VIRTUAL to 2.15M VIRTUAL | -50% from 23.91% to 11.90% |

| tBTC | -0% from 2.15 tBTC to 2.15 tBTC | -5% from 12.74 tBTC to 12.08 tBTC | +5% from 16.90% to 17.82% |

| LBTC | +19% from 7.87 LBTC to 9.34 LBTC | -0% from 49.38 LBTC to 49.14 LBTC | +19% from 15.94% to 19.00% |

| cbXRP | +29% from 358.68K cbXRP to 461.22K cbXRP | +10% from 2.31M cbXRP to 2.54M cbXRP | +17% from 15.53% to 18.14% |

| USDbC | -0% from 1.46K USDbC to 1.45K USDbC | -0% from 9.21K USDbC to 9.19K USDbC | +0% from 15.81% to 15.83% |

| cbBTC | +3% from 83.59 cbBTC to 85.79 cbBTC | -3% from 611.13 cbBTC to 592.09 cbBTC | +6% from 13.68% to 14.49% |

| MORPHO | -0% from 542.84K MORPHO to 542.28K MORPHO | -0% from 6.00M MORPHO to 6.00M MORPHO | -0% from 9.04% to 9.03% |

| cbETH | +0% from 63.90 cbETH to 63.92 cbETH | -1% from 2.20K cbETH to 2.18K cbETH | +1% from 2.91% to 2.93% |

| rETH | +0% from 22.86 rETH to 22.87 rETH | -1% from 977.10 rETH to 967.07 rETH | +1% from 2.34% to 2.36% |

| wstETH | -7% from 87.87 wstETH to 81.66 wstETH | +1% from 4.34K wstETH to 4.40K wstETH | -8% from 2.02% to 1.86% |

| weETH | -3% from 29.03 weETH to 28.29 weETH | -61% from 3.18K weETH to 1.25K weETH | +148% from 0.91% to 2.26% |

| wrsETH | +1% from 0.03 wrsETH to 0.04 wrsETH | -0% from 114.44 wrsETH to 114.41 wrsETH | +1% from 0.03% to 0.03% |

Notable Trends

- weETH supply -61% (3.18K → 1.25K weETH)

- WELL borrows +48% (39.48M → 58.56M WELL)

- VIRTUAL supply +44% (1.49M → 2.15M VIRTUAL)

- WETH borrows -31% (15.26K → 10.55K WETH)

- cbXRP borrows +29% (358.68K → 461.22K cbXRP)

- VIRTUAL borrows -28% (356.11K → 256K VIRTUAL)

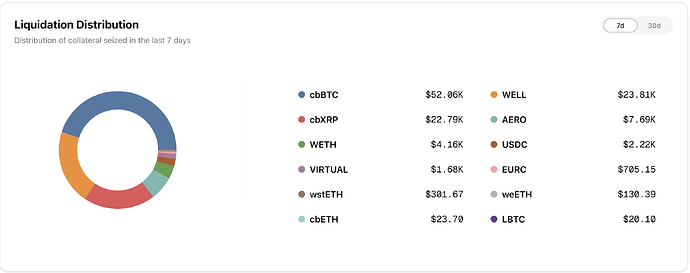

Liquidations

- Total liquidations: 68

- Total Collateral Seized (USD): $81,144.43

- Total Debt Repaid (USD): $73,767.67

- Total Liquidation Bonus (USD): $7,376.77

- Total Liquidator Bonus (USD): $5,163.74

- Total Protocol Bonus (USD): $2,213.03

| Asset | Total Seized (Tokens) | Total Seized (USD) | Debt Repaid (USD) | Liquidation Bonus (USD) | Liquidator Bonus (USD) | Protocol Bonus (USD) | Liquidation Count |

|---|---|---|---|---|---|---|---|

| cbBTC | 0.456109 | $51,994.88 | $47,268.08 | $4,726.81 | $3,308.77 | $1,418.04 | 4 |

| cbXRP | 7,706.632310 | $22,791.80 | $20,719.82 | $2,071.98 | $1,450.39 | $621.59 | 3 |

| USDC | 1,994.422440 | $1,993.74 | $1,812.49 | $181.25 | $126.87 | $54.37 | 9 |

| VIRTUAL | 1,707.200800 | $1,677.79 | $1,525.26 | $152.53 | $106.77 | $45.76 | 2 |

| AERO | 1,042.862100 | $1,085.27 | $986.61 | $98.66 | $69.06 | $29.60 | 6 |

| EURC | 600.204000 | $705.15 | $641.05 | $64.10 | $44.87 | $19.23 | 1 |

| WETH | 0.129311 | $550.32 | $500.29 | $50.03 | $35.02 | $15.01 | 37 |

| wstETH | 0.057163 | $301.67 | $274.25 | $27.42 | $19.20 | $8.23 | 4 |

| cbETH | 0.005187 | $23.70 | $21.54 | $2.15 | $1.51 | $0.65 | 1 |

| LBTC | 0.000169 | $20.10 | $18.27 | $1.83 | $1.28 | $0.55 | 1 |

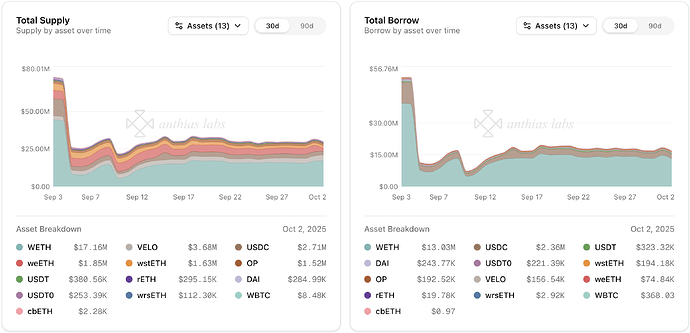

Optimism

| Asset | Current Borrow Cap | Current Supply Cap | Average Borrow Cap Usage (Past Week) | Average Supply Cap Usage (Past Week) | Average Utilization |

|---|---|---|---|---|---|

| USDC | 34.00M | 36.40M | 7.26% | 7.67% | 88.45% |

| USDT0 | 8.00M | 10.00M | 2.94% | 2.66% | 88.45% |

| WETH | 30.00K | 32.00K | 11.13% | 12.06% | 86.49% |

| USDT | 18.40M | 22.60M | 1.72% | 1.64% | 83.79% |

| DAI | 4.50M | 4.80M | 3.37% | 4.19% | 74.44% |

| OP | 650.00K | 5.60M | 42.76% | 37.41% | 13.27% |

| wstETH | 1.50K | 5.00K | 2.26% | 6.23% | 10.89% |

| rETH | 340.00 | 750.00 | 1.29% | 7.83% | 7.48% |

| VELO | 20.00M | 80.00M | 16.20% | 89.33% | 4.58% |

| WBTC | 0.00 | 0.00 | 0.00% | 0.00% | 4.34% |

| wrsETH | 160.00 | 400.00 | 0.40% | 6.04% | 2.62% |

| weETH | 220.00 | 1.20K | 6.93% | 71.96% | 1.86% |

| cbETH | 0.00 | 10.00 | 0.00% | 5.01% | 0.03% |

Week-over-Week Changes

| Asset | Total Borrow | Total Supply | Utilization |

|---|---|---|---|

| USDC | -9% from 2.59M USDC to 2.36M USDC | -7% from 2.90M USDC to 2.70M USDC | -2% from 89.33% to 87.16% |

| USDT0 | -7% from 238.43K USDT0 to 220.99K USDT0 | -3% from 260.81K USDT0 to 253.30K USDT0 | -5% from 91.42% to 87.24% |

| WETH | -16% from 3.52K WETH to 2.97K WETH | -1% from 3.97K WETH to 3.92K WETH | -15% from 88.73% to 75.65% |

| USDT | -26% from 511.63K USDT to 380.39K USDT | -23% from 570.50K USDT to 437.95K USDT | -3% from 89.68% to 86.86% |

| DAI | +134% from 104.31K DAI to 243.77K DAI | +85% from 154.11K DAI to 284.99K DAI | +26% from 67.68% to 85.54% |

| OP | -7% from 283.27K OP to 264.09K OP | -0% from 2.10M OP to 2.09M OP | -7% from 13.50% to 12.61% |

| wstETH | +15% from 32.77 wstETH to 37.54 wstETH | -8% from 331.89 wstETH to 306.99 wstETH | +24% from 9.87% to 12.23% |

| rETH | -11% from 4.44 rETH to 3.94 rETH | +0% from 58.66 rETH to 58.74 rETH | -11% from 7.57% to 6.70% |

| VELO | +18% from 3.31M VELO to 3.91M VELO | +28% from 59.83M VELO to 76.57M VELO | -8% from 5.53% to 5.11% |

| WBTC | 0% from 0.00 WBTC to 0.00 WBTC | 0% from 0.07 WBTC to 0.07 WBTC | 0% from 4.34% to 4.34% |

| wrsETH | -0% from 0.63 wrsETH to 0.63 wrsETH | +9% from 22.24 wrsETH to 24.24 wrsETH | -9% from 2.85% to 2.60% |

| weETH | +12% from 14.17 weETH to 15.82 weETH | -57% from 911.44 weETH to 391.35 weETH | +160% from 1.56% to 4.04% |

| cbETH | 0% from 0.00 cbETH to 0.00 cbETH | -6% from 0.50 cbETH to 0.47 cbETH | +7% from 0.03% to 0.03% |

Notable Trends

- DAI borrows +134% (104.31K → 243.77K DAI)

- DAI supply +85% (154.11K → 284.99K DAI)

- weETH supply -57% (911.44 → 391.35 weETH)

- VELO supply +28% (59.83M → 76.57M VELO)

- USDT borrows -26% (511.63K → 380.39K USDT)

Liquidations

- Total liquidations: 16

- Total Collateral Seized (USD): $3,302.65

- Total Debt Repaid (USD): $3,002.41

- Total Liquidation Bonus (USD): $300.24

- Total Liquidator Bonus (USD): $210.17

- Total Protocol Bonus (USD): $90.07

| Asset | Total Seized (Tokens) | Total Seized (USD) | Debt Repaid (USD) | Liquidation Bonus (USD) | Liquidator Bonus (USD) | Protocol Bonus (USD) | Liquidation Count |

|---|---|---|---|---|---|---|---|

| OP | 5,001.899800 | $3,302.65 | $3,002.41 | $300.24 | $210.17 | $90.07 | 16 |

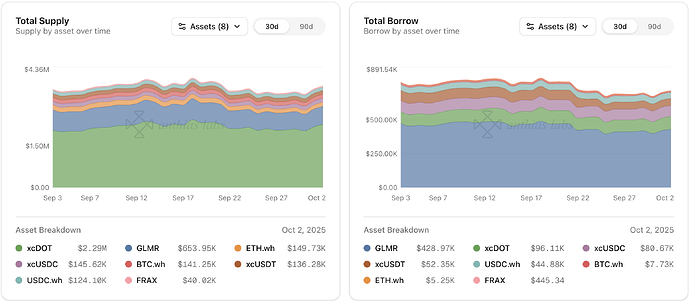

Moonbeam

| Asset | Current Borrow Cap | Average Borrow Cap Usage (Past Week) | Average Utilization |

|---|---|---|---|

| xcDOT | 0.10 | 22.52M% | 99.88% |

| GLMR | 0.10 | 7113.05M% | 65.65% |

| xcUSDC | 0.10 | 80.54M% | 57.49% |

| FRAX | 0.10 | 447.25K% | 44.99% |

| xcUSDT | 0.10 | 52.44M% | 38.41% |

| USDC.wh | 0.10 | 44.67M% | 36.11% |

| BTC.wh | 0.10 | 78.40% | 6.58% |

| ETH.wh | 0.10 | 1.20K% | 3.42% |

Week-over-Week Changes

| Asset | Total Borrow | Total Supply | Utilization |

|---|---|---|---|

| xcDOT | -0% from 22.54K xcDOT to 22.53K xcDOT | -0% from 535.95K xcDOT to 535.93K xcDOT | +0% from 100.00% to 100.00% |

| GLMR | +1% from 7.08M GLMR to 7.15M GLMR | -1% from 11.00M GLMR to 10.90M GLMR | +2% from 64.31% to 65.60% |

| xcUSDC | +0% from 80.36K xcUSDC to 80.67K xcUSDC | +2% from 142.71K xcUSDC to 145.62K xcUSDC | -2% from 56.31% to 55.40% |

| FRAX | -0% from 448.02 FRAX to 446.23 FRAX | -2% from 40.75K FRAX to 40.10K FRAX | +2% from 44.93% to 45.65% |

| xcUSDT | -1% from 52.51K xcUSDT to 52.24K xcUSDT | -0% from 136.60K xcUSDT to 136.15K xcUSDT | -0% from 38.45% to 38.37% |

| USDC.wh | +1% from 44.48K USDC.wh to 44.89K USDC.wh | +0% from 123.50K USDC.wh to 124.12K USDC.wh | +0% from 36.02% to 36.17% |

| BTC.wh | -35% from 0.10 BTC.wh to 0.07 BTC.wh | +0% from 1.19 BTC.wh to 1.19 BTC.wh | -35% from 8.43% to 5.47% |

| ETH.wh | -0% from 1.20 ETH.wh to 1.20 ETH.wh | -8% from 37.14 ETH.wh to 34.14 ETH.wh | +9% from 3.23% to 3.51% |

Liquidations

- Total liquidations: 105

- Total Collateral Seized (USD): $78.04

- Total Debt Repaid (USD): $70.94

- Total Liquidation Bonus (USD): $7.09

- Total Liquidator Bonus (USD): $4.97

- Total Protocol Bonus (USD): $2.13

| Asset | Total Seized (Tokens) | Total Seized (USD) | Debt Repaid (USD) | Liquidation Bonus (USD) | Liquidator Bonus (USD) | Protocol Bonus (USD) | Liquidation Count |

|---|---|---|---|---|---|---|---|

| GLMR | 1,318.681467 | $77.06 | $70.05 | $7.01 | $4.90 | $2.10 | 101 |

| xcUSDT | 0.742700 | $0.74 | $0.68 | $0.07 | $0.05 | $0.02 | 2 |

| FRAX | 0.238965 | $0.24 | $0.22 | $0.02 | $0.02 | $0.01 | 2 |

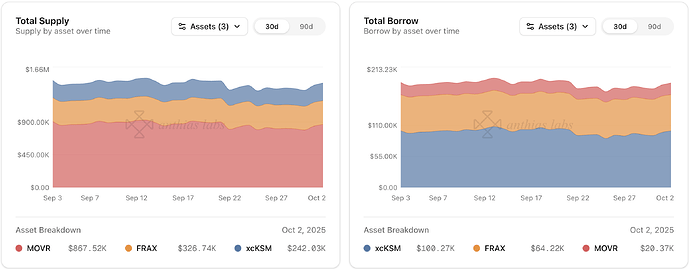

Moonriver

| Asset | Current Borrow Cap | Average Borrow Cap Usage (Past Week) | Average Utilization |

|---|---|---|---|

| xcKSM | 0.10 | 6.54M% | 41.38% |

| FRAX | 0.10 | 64.33M% | 19.65% |

| MOVR | 0.10 | 3.57M% | 2.36% |

Week-over-Week Changes

| Asset | Total Borrow | Total Supply | Utilization |

|---|---|---|---|

| xcKSM | +0% from 6.54K xcKSM to 6.54K xcKSM | -0% from 15.80K xcKSM to 15.80K xcKSM | +0% from 41.38% to 41.43% |

| FRAX | +0% from 64.30K FRAX to 64.35K FRAX | +0% from 327.36K FRAX to 327.40K FRAX | +0% from 19.64% to 19.65% |

| MOVR | +0% from 3.57K MOVR to 3.57K MOVR | +1% from 150.96K MOVR to 152.01K MOVR | -1% from 2.36% to 2.35% |

Liquidations

- Total liquidations: 1

- Total Collateral Seized (USD): $1.81

- Total Debt Repaid (USD): $1.64

- Total Liquidation Bonus (USD): $0.16

- Total Liquidator Bonus (USD): $0.11

- Total Protocol Bonus (USD): $0.05

| Asset | Total Seized (Tokens) | Total Seized (USD) | Debt Repaid (USD) | Liquidation Bonus (USD) | Liquidator Bonus (USD) | Protocol Bonus (USD) | Liquidation Count |

|---|---|---|---|---|---|---|---|

| FRAX | 1.809070 | $1.81 | $1.64 | $0.16 | $0.11 | $0.05 | 1 |