October 2025 Update

Key Insights

- New Core Markets. MAMO was proposed to be added to the Base Core Markets in October after being discussed on the previous governance call.

- Morpho Vaults and Incentive Campaign. Creation of the Moonwell Ecosystem Vault (meUSDC), a public credit facility with 0% performance fee, was re-submitted in October. Another proposal sought to create Merkle incentive campaigns for Moonwell’s MetaMorpho vaults (USDC, WETH, EURC, and cbBTC) and introduce a new incentive campaign for stkWELL holders to encourage participation in the safety module.

- Community Initiatives are Picking Up. Multiple governance dashboards (built by Wheelhaus Labs and Moonwell delegate Jor-El) were built specifically for Moonwell and published to the forums this month; Jor-El also published an accompanying report.

- Monthly Governance Call. October’s governance call was, in part, centered around the macro events that took place on October 10th and its effects on Moonwell.

Primer

The monthly governance recap serves as a compendium of key governance updates for the preceding month. This update covers Moonwell governance activities for October 2025.

The main governance initiatives this month largely surrounded new core market proposals and Morpho vault additions and incentive campaigns. The delegate roster also continues to expand as more candidates are moving toward becoming Super Delegates through Boardroom’s delegation initiative.

Key Metrics

- 6 onchain proposals

- 0 Snapshot proposals

- 19 forum posts

The number of active voters for onchain proposals averaged 382, with a minimum of 293 and a maximum of 479.

This month, there were no Snapshot signal votes.

| Proposal | Offchain votes |

|---|

At 310 voters, the USDS proposal in January received the highest number of votes for a Moonwell Snapshot proposal.

Success Insights:

- Onchain: The onchain proposals in October had a 100% success rate.

Browse all of the proposals here.

Other Governance Metrics

Proposal Participation

Source: https://moonwell.wheelhaus.xyz

With a monthly average of 382 onchain voters, proposal participation is average. Excluding August (which had a substantially higher average voter turnout of 719), the previous three months’ averages were 462 in September, 484 in July, and 335 in June.

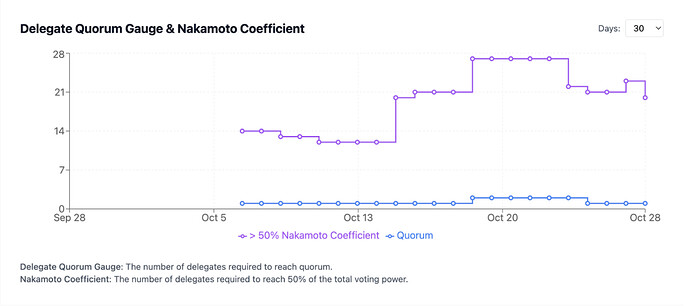

Delegate Quorum Gauge & Nakamoto Coefficient

Source: moonwell.wheelhaus.xyz

The Delegate Quorum Gauge represents the number of delegates required to reach the 100M WELL quorum for onchain proposals. While this metric appears to be low at only one delegate, it’s important to note that this dataset includes non-voting addresses that hold substantial WELL tokens. If we instead look only at wallets that have ever voted, then the Delegate Quorum Gauge would increase to 3. Higher Nakamoto Coefficients indicate a more decentralized system; it corresponds to a higher number of delegates required to make up 50% of the total voting power. As of the end of October, the Nakamoto Coefficient sits at 20 addresses.

Main Governance Initiatives in October

New Core Markets

On October 10th, a new onchain proposal was submitted, seeking to add MAMO to the Base Core Markets. In the previous governance call, Moonwell contributor 0xMims noted Mamo’s passing of a Halborn audit with no outstanding issues, meeting risk assessment parameters (liquidity, swap size testing, etc.), and its Chainlink price feed going live on October 9th. The proposal was successful, and the Core Market went live on October 16th.

Moonwell Morpho Vaults and Incentive Campaign

In September’s governance call, Moonwell contributor Luke Youngblood announced an upcoming proposal to introduce the Moonwell Ecosystem Vault (meUSDC), a public credit facility with 0% performance fee. This facility establishes infrastructure to enable the DAO to fund operations and expansion in a capital-efficient way that preserves long-term alignment. The proposal, seeking to accept ownership on behalf of the temporal governor and set Anthias Labs as the allocator, was originally submitted as an onchain vote at the end of September. It was re-submitted on October 10th. On October 17th, the meUSDC Vault officially went live on Base. MIP-B51 was later submitted to update the meUSDC Vault Timelock to a 72-hour delay, aligning with the latest risk recommendations set by Anthias Labs. On October 14th, MIP-B50 was submitted for onchain voting. Co-authored by Moonwell delegates Chidi, Joel, and Lunar Labs, this proposal sought to create Merkl incentive campaigns for Moonwell’s MetaMorpho vaults (USDC, WETH, EURC, and cbBTC) and introduce a new incentive campaign for stkWELL holders to encourage participation in the safety module.

Community Initiatives

On the first day of the month, community member Wheelhaus Labs published a forum post outlining a governance dashboard built for Moonwell. With it, users can find live voting stats, delegates lists and profiles, and different governance related stats and analytics. That same week, Moonwell delegate Jor-El posted a Moonwell Governance Dashboard built with Dune. The dashboard covers multi-chain governance data across Moonwell’s four deployments, and future planned updates include independent indexing and an ETL pipeline to keep data accurate and up-to-date. In mid-October, Jor-el also published the Moonwell Q3 2025 Report, an analysis of protocol growth, asset diversification, revenue dynamics, and governance statistics.

Risk and Reward Speeds

On the first day of the month, Anthias published a forum post to adjust risk parameters for Moonwell’s Base and Optimism Mainnet deployments. The onchain proposal was created on October 6th, which proceeded to pass its governance vote. Throughout the month, Anthias published weekly updates to report on week-over-week changes in borrows, supplies, utilization, liquidations, and more. October’s monthly automated liquidity incentive proposal, MIP-X32, successfully passed an onchain vote on October 8th, aiming to rebalance liquidity incentives on three Moonwell deployments. It additionally sought to auction off ~$72K of excess market reserves. Anthias also posted a report on the events of October 10th; the event and its effects were later discussed on October’s governance call.

Additional Developments

- Fee Revenue: In the previous month, Moonwell generated $928K in fees across Base and Optimism Mainnet

- Chainlink MAMO-USD Price Feed: On October 9th, the Chainlink MAMO-USD price feed went live on Base, providing trusted, real-time pricing for MAMO.

- WELL Rewards on Moonwell Vaults: Rewards for depositors on any Moonwell Vault on Base (USDC, ETH, cbBTC, EURC) went live on October 28th

Delegate Digest

Super Delegates

Super Delegates

| Delegate | Delegation Pitch | Delegation Page | Delegated Amount | Proposals Created | Completed their role’s minimum requirements this month? |

|---|---|---|---|---|---|

| Coolhorsegirl | Link | Link | 16K WELL | 20 | Yes |

| PGov | Link | Link | 1M WELL | 1 | Yes |

Mid-Tier Delegates

Mid-Tier Delegates

| Delegate | Delegation Pitch | Delegation Page | Delegated Amount | Proposals Created | Completed their role’s minimum requirements this month? |

|---|---|---|---|---|---|

| Jor-El | Link | Link | 200K WELL | 1 | Yes |

| Chidi | Link | Link | 200K WELL | 1 | Yes |

| Kimchiblock | Link | Link | 429K WELL | 0 | Yes |

| DAOplomats | Link | Link | 228 WELL | 0 | Yes |

| Maylosan | Link | Link | 46K WELL | 0 | Yes |

| FranklinDAO | Link | Link | 508 WELL | 0 | Yes |

Junior Delegates

Junior Delegates

| Delegate | Delegation Pitch | Delegation Page | Delegated Amount | Proposals Created | Completed their role’s minimum requirements this month? |

|---|

You can read more about the requirements to join each delegate tier and each tier’s contribution minimums here.

Delegate Highlights

- Jor-El and Chidi submitted an onchain proposal.

- PGov and Chidi continue to regularly update their delegate pitches with rationales for their voting behavior.

Community Overview

| Social Channel | Data |

|---|---|

| Main X account | 55.1K Followers (-0.18%) |

| Governance X account | 1338 Followers (+2.37%) |

| Discord | 11,215 Members (+1.61%) |

| Announcements Telegram | 678 Members (+0.00%) |

| Chat Telegram | 7,698 Members (-6.64%) |

Community Trends

October coincided with the greatest volume of proposals in over three months, tying June at five; September had four proposals, August had three, July had three. Interestingly, the number of average voters is also similar to June’s (335). There is an apparent negative correlation between the number of available voting opportunities and the average number of onchain voters.

Moonwell’s social channels continue to grow at predictable rates. This month, we saw the fastest relative growth in the Governance X account, moderate growth on the larger channels (Discord and Announcements telegram), and insignificant reduction in followers of the main X account.

Closing Summary

October 2025 saw a continued expansion of the Moonwell delegate base activity, predictable patterns in social media growth, and experienced a higher than average volume of proposals.

Look for the next Monthly Governance Call on X on the last Thursday of each month. The next call will be on November 27th at 17:00 UTC.