[Anthias Labs] - Minimum Reserves Recommendations (7/23/2025)

Introduction

The following report contains recommendations for setting minimum reserves in Moonwell’s Core markets on Base and OP Mainnet for July.

Methodology

Our goal is to establish minimum reserves proportional to the maximum borrow capacity of a market (borrow cap). This metric reflects the maximum potential debt within a given market. For each collateral asset, we assign a recommended reserve coverage ratio (RRCR) based on its overall risk profile. This ratio, expressed as a percentage, represents the minimum reserves relative to the maximum borrow capacity in a market.

To assess the state of reserves given current reserve levels and borrow cap we have reserve coverage ratio (RCR). This represents reserve coverage if borrows were at capacity.

To asses the state of reserves given current reserve levels and current borrows we have current reserve coverage ration (CRCR). It represents reserve coverage given current the current amount borrowed.

As the amount borrowed within a particular market grows over time, and reserves are accrued, we wish to see Current Reserve Coverage Ratio greater than or equal to Recommended Reserve Coverage Ratio. This tells us if we have an adequate amount of reserves in a particular market, given the current amount borrowed.

For each collateral asset we suggest a Recommended Reserve Coverage Ratio (RRCR), which gives a standardized method for calculating minimum reserves:

This enables us to address the distinct risk profiles of each collateral asset while ensuring a standardized approach to reserve management across all markets. To assign the appropriate RRCR for each asset, we perform a risk assessment evaluating multiple factors, including historical price volatility, secondary market liquidity, correlation with underlying assets (where relevant), asset maturity, and exposure to unique tail risks.

Based on this assessment we categorize assets into risk tiers (e.g., low, medium, high), with each tier corresponding to a range of RCRs. For example:

- Low-risk (e.g., highly liquid stables): 0.2%-0.4%

- Medium-risk (e.g., established cryptoassets): 0.4%-1%

- High-risk (e.g., LRTs or volatile gov tokens): 1%-2%

Base

| Asset | Borrow Cap (tokens) | Total Borrows | Total Reserves | RRCR | RCR | CRCR |

|---|---|---|---|---|---|---|

| WETH | 64,000.00 | 20,801.36 | 324.35 | 0.50% | 0.51% | 1.56% |

| USDC | 184,000,000.00 | 82,619,192.98 | 346,802.43 | 0.30% | 0.19% | 0.42% |

| cbBTC | 640.00 | 153.66 | 1.65 | 0.40% | 0.26% | 1.07% |

| AERO | 25,000,000.00 | 10,417,930.71 | 109,871.74 | 1.20% | 0.44% | 1.05% |

| cbETH | 6,400.00 | 65.00 | 9.61 | 0.60% | 0.15% | 14.78% |

| wstETH | 4,800.00 | 89.02 | 6.76 | 0.60% | 0.14% | 7.60% |

| EURC | 21,000,000.00 | 4,044,887.08 | 17,551.14 | 0.40% | 0.08% | 0.43% |

| WELL | 75,000,000.00 | 30,512,934.09 | 1,287,217.85 | 1.80% | 1.72% | 4.22% |

| VIRTUAL | 2,300,000.00 | 337,082.48 | 6,102.10 | 1.20% | 0.27% | 1.81% |

| MORPHO | 1,000,000.00 | 510,432.37 | 2,093.84 | 1.80% | 0.21% | 0.41% |

| weETH | 700.00 | 31.16 | 6.66 | 1.00% | 0.95% | 21.38% |

| LBTC | 38.00 | 13.94 | 0.16 | 0.60% | 0.43% | 1.16% |

| tBTC | 36.00 | 3.74 | 0.02 | 0.60% | 0.05% | 0.48% |

| rETH | 900.00 | 15.68 | 2.53 | 0.60% | 0.28% | 16.12% |

| wrsETH | 430.00 | 2.21 | 0.78 | 1.00% | 0.18% | 35.34% |

| cbXRP | 500,000.00 | 151,154.39 | 218.32 | 0.60% | 0.04% | 0.14% |

| USDS | 690,000.00 | 10,477.34 | 14.94 | 0.40% | 0.00% | 0.14% |

| DAI | 300,000.00 | 19,228.52 | 517.66 | 0.40% | 0.17% | 2.69% |

| Asset | Price (7/22/25) | Recommended Min. Reserves (Tokens) | Recommended Min. Reserves (USD) |

|---|---|---|---|

| WETH | $3,766.20 | 320 | $1,205,184.00 |

| USDC | $1.00 | 552000 | $552,000.00 |

| cbBTC | $117,520.88 | 2.56 | $300,853.45 |

| AERO | $0.97 | 300000 | $291,900.00 |

| cbETH | $4,156.31 | 38.4 | $159,602.34 |

| wstETH | $4,537.69 | 28.8 | $130,685.44 |

| EURC | $1.17 | 84000 | $98,364.00 |

| WELL | $0.04 | 1350000 | $56,700.00 |

| VIRTUAL | $1.92 | 27600 | $52,964.40 |

| MORPHO | $2.04 | 18000 | $36,648.00 |

| weETH | $4,029.51 | 7 | $28,206.57 |

| LBTC | $117,520.88 | 0.228 | $26,794.76 |

| tBTC | $116,935.51 | 0.216 | $25,258.07 |

| rETH | $4,290.04 | 5.4 | $23,166.23 |

| wrsETH | $3,940.74 | 4.3 | $16,945.19 |

| cbXRP | $3.56 | 3000 | $10,668.00 |

| USDS | $1.00 | 2760 | $2,760.00 |

| DAI | $1.00 | 1200 | $1,200.00 |

| Total: $3,019,900.45 |

Comparing the recommended reserve coverage ration (RRCR) to the current reserve coverage ratio (CRCR), the assets falling short of full coverage are:

- AERO: RRCR = 1.2%, CRCR = 1.05%

- MORPHO: RRCR = 1.8%, CRCR = 0.41%

- tBTC: RRCR = 0.6%. CRCR = 0.48%

- cbXRP: RRCR = 0.6%, CRCR = 0.14%

- USDS: RRCR = 0.4%, CRCR = 0.14%

With MORPHO and cbXRP, this is to be expected as the markets are relatively new and haven’t had sufficient time to accrue reserves. USDS comparatively is a small market with very few borrows, therefore the lack of reserve coverage is rather insignificant. AERO and tBTC are not far off from their marks either. Overall these numbers should not be a cause for immediate concern, as the discrepancies are either minor or attributable to market maturity.

Optimism

| Asset | Borrow Cap | Total Borrows | Total Reserves | RRCR | RCR | CRCR |

|---|---|---|---|---|---|---|

| WETH | 30000 | 7840.4733 | 28.6931 | 0.60% | 0.10% | 0.37% |

| USDC | 34000000 | 9721515.706 | 53031.98 | 0.40% | 0.16% | 0.55% |

| USDT | 18400000 | 255201.9597 | 7989.1796 | 0.40% | 0.04% | 3.13% |

| wstETH | 1500 | 71.1064 | 0.9608 | 0.80% | 0.06% | 1.35% |

| USDT0 | 8000000 | 1802079.848 | 1959.6488 | 0.50% | 0.02% | 0.11% |

| DAI | 4500000 | 383044.1801 | 911.1639 | 0.50% | 0.02% | 0.24% |

| VELO | 20000000 | 2684084.762 | 9561.9675 | 1.50% | 0.05% | 0.36% |

| rETH | 340 | 13.3932 | 0.1204 | 0.80% | 0.04% | 0.90% |

| weETH | 220 | 21.0773 | 0.1302 | 1.20% | 0.06% | 0.62% |

| wrsETH | 160 | 3.9321 | 0.0605 | 1.20% | 0.04% | 1.54% |

| OP | 650000 | 127207.9103 | 409.1301 | 1.50% | 0.06% | 0.32% |

| cbETH | 0 | 0.0002 | 0 | 0.80% | N/A | 0.00% |

| Asset | Price (7/22/25) | Recommended Min. Reserves (Tokens) | Recommended Min. Reserves (USD) |

|---|---|---|---|

| WETH | $3,764.13 | 180 | $677,543.40 |

| USDC | $1.00 | 136000 | $136,000.00 |

| USDT | $1.00 | 73600 | $73,600.00 |

| wstETH | $4,534.55 | 12 | $54,414.65 |

| USDT0 | $1.00 | 40000 | $40,000.00 |

| DAI | $1.00 | 22500 | $22,500.00 |

| VELO | $0.06 | 300000 | $18,600.00 |

| rETH | $4,287.87 | 2.72 | $11,663.00 |

| weETH | $4,027.44 | 2.64 | $10,632.44 |

| wrsETH | $3,938.58 | 1.92 | $7,562.06 |

| OP | $0.81 | 9750 | $7,858.50 |

| cbETH | $4,154.19 | 0 | $0.00 |

| Total: $1,060,374.05 |

Comparing the recommended reserve coverage ration (RRCR) to the current reserve coverage ratio (CRCR), the assets falling short of full coverage are:

- WETH: RRCR = 0.6%, CRCR = 0.37%

- USDT0: RRCR = 0.5%, CRCR = 0.11%

- DAI: RRCR = 0.5%, CRCR= 0.24%

- VELO: RRCR = 1.5%, CRCR = 0.36%

- weETH: RRCR = 1.2%, CRCR = 0.62%

- OP: RRCR = 1.5%, CRCR = 0.32%

- cbETH: 0.8%, CRCR = 0%

The only market that stands out here is WETH, its by far the largest market on Moonwell on OP Mainnet, but lacks the reserve coverage that we would like to see. The other markets either had sufficient coverage that was just recently auctioned off in May or June, are new and haven’t had time to accrue reserves (USDT0), or are minuscule in borrows (cbETH).

Reserve Accrual

The following data is from a 26-day period from 6/12/25 to 7/8/25, it represents the last full period between reserve auctions. We will use this data to approximate annual reserve accrual rates for each market, and provide an estimate on how long it will take reserves to fill to their recommended levels.

Not included: Reserves from OEV

Example, AERO:

Base

From 6/12/25 to 7/8/25 we measured:

- Total Reserve Change (USD): $86,698.75

- From Liquidations (USD): $33,378.12

- From Borrower Interest (USD): $53,320.63

| Market | Price (7/8/25) | Total Change (Tokens) | Total Change (USD) | From Liquidations (Tokens) | From Liquidations (USD) | From Borrower Interest (Tokens) | From Borrower Interest (USD) |

|---|---|---|---|---|---|---|---|

| USDC | $1.00 | 43918.7989 | $43,918.80 | 15517.396 | $15,517.40 | 28401.4029 | $28,401.40 |

| AERO | $0.72 | 26982.541 | $19,292.52 | 9425.7856 | $6,739.44 | 17556.7554 | $12,553.08 |

| cbBTC | $109,066.94 | 0.0794 | $8,659.91 | 0.0724 | $7,899.74 | 0.007 | $760.17 |

| WETH | $2,615.77 | 2.8419 | $7,433.76 | 0.3962 | $1,036.35 | 2.4457 | $6,397.40 |

| VIRTUAL | $1.47 | 1861.9273 | $2,742.62 | 158.7309 | $233.81 | 1703.1964 | $2,508.81 |

| WELL | $0.03 | 41133.6317 | $1,151.74 | 14818.2323 | $414.91 | 26315.3994 | $736.83 |

| weETH | $2,802.29 | 0.3875 | $1,085.89 | 0.3867 | $1,083.63 | 0.0008 | $2.26 |

| MORPHO | $1.40 | 545.5761 | $764.35 | 1.4471 | $2.03 | 544.129 | $762.32 |

| EURC | $1.17 | 586.1096 | $685.75 | 0 | $0.00 | 586.1096 | $685.75 |

| wstETH | $3,157.74 | 0.1055 | $333.14 | 0.1004 | $316.94 | 0.0051 | $16.20 |

| cbXRP | $2.32 | 125.1357 | $289.81 | 15.4513 | $35.79 | 109.6844 | $254.03 |

| LBTC | $109,066.94 | 0.001 | $109.07 | 0 | $5.06 | 0.001 | $104.01 |

| cbETH | $2,884.98 | 0.0341 | $98.38 | 0.0322 | $93.03 | 0.0019 | $5.35 |

| DAI | $1.00 | 94.7895 | $94.79 | 0 | $0.00 | 94.7895 | $94.79 |

| tBTC | $108,506.61 | 0.0003 | $32.55 | 0 | $0.00 | 0.0003 | $32.55 |

| USDS | $1.00 | 3.5276 | $3.53 | 0 | $0.00 | 3.5276 | $3.53 |

| rETH | $2,981.49 | 0.0005 | $1.49 | 0 | $0.00 | 0.0005 | $1.49 |

| wrsETH | $2,742.22 | 0 | $0.00 | 0 | $0.00 | 0 | $0.00 |

Optimism

- Total Reserve Change (USD): $10,420.98

- From Liquidations (USD): $4,503.66

- From Borrower Interest (USD): $5,917.31

| Market | Price (7/8/25) | Total Change (Tokens) | Total Change (USD) | From Liquidations (Tokens) | From Liquidations (USD) | From Borrower Interest (Tokens) | From Borrower Interest (USD) |

|---|---|---|---|---|---|---|---|

| wstETH | $3,158.46 | 1.3242 | $4,182.43 | 1.3228 | $4,177.94 | 0.0014 | $4.49 |

| WETH | $2,616.02 | 1.0681 | $2,794.17 | 0.0539 | $140.96 | 1.0142 | $2,653.21 |

| USDC | $1.00 | 2289.5643 | $2,289.56 | 0.3295 | $0.33 | 2289.2348 | $2,289.23 |

| USDT0 | $1.00 | 594.2297 | $594.23 | 63.1856 | $63.19 | 531.0441 | $531.04 |

| USDT | $1.00 | 200.9985 | $201.00 | 0 | $0.00 | 200.9985 | $201.00 |

| DAI | $1.00 | 136.4789 | $136.48 | 0 | $0.00 | 136.4789 | $136.48 |

| OP | $0.55 | 214.766 | $118.34 | 155.7975 | $85.84 | 58.9685 | $32.49 |

| VELO | $0.05 | 2051.0582 | $94.35 | 769.6044 | $35.40 | 1281.4538 | $58.95 |

| weETH | $2,802.56 | 0.0017 | $4.76 | 0 | $0.00 | 0.0017 | $4.76 |

| wrsETH | $2,742.48 | 0.0013 | $3.57 | 0 | $0.00 | 0.0013 | $3.57 |

| rETH | $2,981.78 | 0.0007 | $2.09 | 0 | $0.00 | 0.0007 | $2.09 |

| WBTC | $108,917.60 | 0 | $0.00 | 0 | $0.00 | 0 | $0.00 |

| cbETH | $2,885.37 | 0 | $0.00 | 0 | $0.00 | 0 | $0.00 |

Time-to-Fill (TTF)

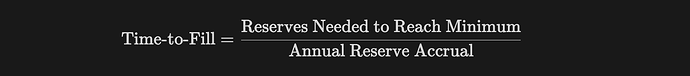

We calculate the time to fill, or the estimated number of years required for reserves to reach minimum levels, as:

Base

| Asset | Reserves Needed to Reach Minimum | Reserve Accrual (annualized) | Time-to-Fill (years) |

|---|---|---|---|

| WETH | 0 | 39.8959 | 0 |

| USDC | 205,197.57 | 616,552.3692 | 0.33 |

| cbBTC | 0.91 | 1.1147 | 0.82 |

| AERO | 190,128.26 | 378,793.3640 | 0.50 |

| cbETH | 28.79 | 0.4787 | 60.15 |

| wstETH | 22.04 | 1.4811 | 14.88 |

| EURC | 66,448.86 | 8,228.0771 | 8.08 |

| WELL | 62,782.15 | 577,452.9066 | 0.11 |

| VIRTUAL | 21,497.90 | 26,138.5948 | 0.82 |

| MORPHO | 15,906.16 | 7,659.0491 | 2.08 |

| weETH | 0.34 | 5.4399 | 0.06 |

| LBTC | 0.07 | 0.0140 | 4.71 |

| tBTC | 0.20 | 0.0042 | 47.06 |

| rETH | 2.87 | 0.0070 | 409.03 |

| wrsETH | 3.52 | 0 | inf |

| cbXRP | 2,781.68 | 1,756.7127 | 1.58 |

| USDS | 2,745.06 | 49.5221 | 55.43 |

| DAI | 682.34 | 1,330.6988 | 0.51 |

Optimism

| Asset | Reserves Needed to Reach Minimum | Reserve Accrual (annualized) | Time-to-Fill (years) |

|---|---|---|---|

| WETH | 151.31 | 14.9945 | 10.09 |

| USDC | 82,968.02 | 32,141.9604 | 2.58 |

| USDT | 65,610.82 | 2,821.7097 | 23.25 |

| wstETH | 11.04 | 18.5897 | 0.59 |

| USDT0 | 38,040.35 | 8,342.0708 | 4.56 |

| DAI | 21,588.84 | 1,915.9538 | 11.27 |

| VELO | 290,438.03 | 28,793.7017 | 10.09 |

| rETH | 2.60 | 0.0098 | 264.54 |

| weETH | 2.51 | 0.0239 | 105.16 |

| wrsETH | 1.86 | 0.0183 | 101.89 |

| OP | 9,340.87 | 3,014.9842 | 3.10 |

| cbETH | 0 | 0 | 0 |

Note that the projected time to reach full reserves for certain markets is unrealistically long. This primarily results from basing minimum reserve targets on borrow caps. Markets with low borrow cap utilization may appear to have insufficient reserve accrual based on this metric; however, the ratio of current reserves to current borrow amounts (CRCR) typically indicates healthy reserve levels in these cases. One limitation of this metric is that it assumes a constant rate of reserve accrual. In practice, reserve accumulation can vary significantly from month to month, influenced by fluctuating borrowing volumes and liquidation events. As a market expands, its reserve accrual rate typically accelerates accordingly.

Concerns Regarding Minimum Reserves Based on Borrow Caps

“Basing minimum reserves on under-utilized borrow caps may result in some markets being unable to auction off reserves within a reasonable timeframe, potentially limiting their contribution to the safety staking module.”

While reserve auctions play a critical role in funding the safety staking module, tying minimum reserves to borrow caps addresses a significant issue. Consider a scenario where a market’s borrow cap is at 5% utilization, with a strategy of auctioning off reserves monthly if CRCR exceeds RRCR, reducing the excess to align CRCR with RRCR. At any moment, supply and borrow volumes could rapidly reach full capacity, but reserves accumulate over a longer period. In such cases, inadequate reserve coverage could increase risk and exposure. Thus, the minimum reserve strategy must account for these edge cases to ensure sufficient protection.

In practice, smaller underutilized markets contribute minimally to reserve auctions, with the majority of contributions originating from large markets on Base, such as USDC, WETH, or AERO, where reserves accumulate quickly and minimum requirements are typically met. This approach allows smaller markets to continue accumulating reserves to support future growth while larger markets fund reserve auctions, strengthening the safety module.

Conclusion

The above minimum reserve recommendations, along with the Safety Module, give the protocol ample insurance to cover potential shortfalls. Anthias Labs is committed to refining this minimum reserves framework, monitoring reserve levels closely, and providing monthly updates and urgent recommendations as needed.