Base

Recommendations

Following up on the minimum reserves required for each asset in the Moonwell Base markets before auctioning excess reserves for WELL, Gauntlet has updated the minimum reserve thresholds below. These adjustments increase the scaling factor to 4 times the recent VaR high across all assets.

Further adjustments to the minimum reserves will follow based on market conditions and historical VaR.

| Token | Minimum Reserves (USD) | Minimum Reserves (Token) |

|---|---|---|

| EURC | 80315 | 69325 |

| USDC | 643521 | 643592 |

| cbBTC | 487642 | 4.62 |

| tBTC | 29173 | 0.28 |

| USDS | 2320 | 2320 |

| WETH | 692265 | 285 |

| LBTC | 30884 | 0.29 |

| wstETH | 120726 | 41.38 |

| cbETH | 122687 | 45.97 |

| wrsETH | 6808 | 2.69 |

| weETH | 29287 | 11.30 |

| WELL | 11091 | 399603 |

| VIRTUAL | 24132 | 14145 |

| cbXRP | 6351 | 2938 |

| rETH | 20121 | 7.30 |

| AERO | 186509 | 220042 |

| MORPHO | 15507 | 11378 |

| DAI | 901 | 901 |

Supporting Data

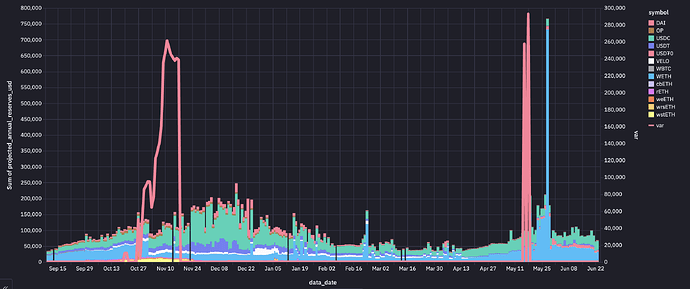

Current reserves sit well above the latest $31k VaR peak, however, the projected annual reserve growth has been trending lower, therefore, we recommend applying a 4x VaR multiplier. Under this threshold, the WETH market shows ≈ $92,250 in surplus reserves that could be auctioned for WELL.

Optimism

Recommendations

Gauntlet recommends the following minimum reserve thresholds for assets on Optimism. These thresholds apply a scaling factor of 3 to the maximum historical VaR. Minimum reserves will be updated over time based on evolving market conditions and historical VaR trends.

| Token | Minimum Reserves (USD) | Minimum Reserves (Token) |

|---|---|---|

| wstETH | 68322 | 23.41 |

| cbETH | 127 | 0.05 |

| rETH | 9677 | 3.51 |

| WETH | 373216 | 154 |

| DAI | 23909 | 23907 |

| USDT0 | 49448 | 49435 |

| USDC | 190782 | 190791 |

| USDT | 119066 | 119035 |

| wrsETH | 4457 | 1.76 |

| weETH | 14380 | 5.55 |

| VELO | 12597 | 273821 |

| OP | 12712 | 23191 |

Supporting Data

Given the most recent VaR spike and the relative reserves accumulated being far below the threshold, we do not recommend any reserves to be auctioned for WELL.

Methodology

This set of parameter updates seeks to maintain the overall risk tolerance of the protocol while making risk trade-offs between specific assets.

Gauntlet’s parameter recommendations are driven by an optimization function that balances 3 core metrics: insolvencies, liquidations, and borrow usage. Parameter recommendations seek to optimize for this objective function. Our agent-based simulations use a wide array of varied input data that changes on a daily basis (including but not limited to asset volatility, asset correlation, asset collateral usage, DEX / CEX liquidity, trading volume, expected market impact of trades, and liquidator behavior). Gauntlet’s simulations tease out complex relationships between these inputs that cannot be simply expressed as heuristics. As such, the input metrics we show below can help understand why some of the param recs have been made but should not be taken as the only reason for recommendation. To learn more about our methodologies, please see the Helpful Links section at the bottom.

Quick Links

Please click below to learn about our methodologies:

Improved VaR Methodology

Gauntlet Parameter Recommendation Methodology

Gauntlet Model Methodology

By approving this proposal, you agree that any services provided by Gauntlet shall be governed by the terms of service available at gauntlet.network/tos.