[Anthias Labs] - Risk Parameter Recommendations (8/5/2025)

Anthias Labs proposes the following parameter changes for the month of August. For more information on current parameters, please refer to our monitoring dashboard here.

Base

Summary

Risk Parameters

| Parameters | Current Value | Recommended Value |

|---|---|---|

| cbXRP Reserve Factor | 30% | 20% |

| cbXRP Supply Cap | 2M | 3M |

| cbXRP Borrow Cap | 500K | 1.6M |

Cap changes will be implemented via Cap Guardian

IR Parameters

| USDC IR Parameters | Current Value | Recommended Value |

|---|---|---|

| Base | 0 | 0 |

| Kink | 0.9 | 0.9 |

| Multiplier | 0.049 | 0.56 |

| Jump Multiplier | 9 | 9 |

| cbXRP IR Parameters | Current Value | Recommended Value |

|---|---|---|

| Base | 0 | 0 |

| Kink | 0.45 | 0.6 |

| Multiplier | 0.23 | 0.134 |

| Jump Multiplier | 5 | 5 |

USDC

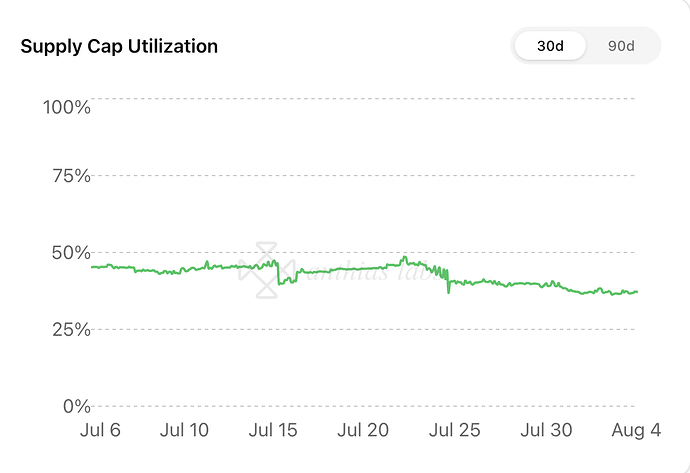

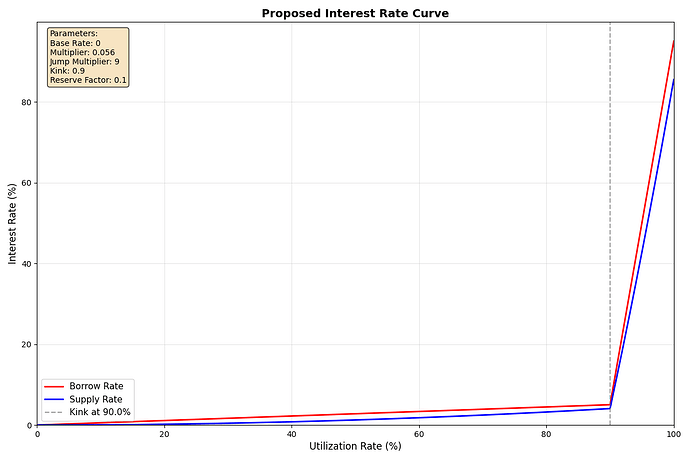

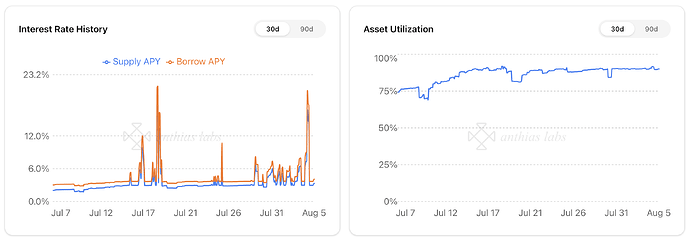

Over the past month, interest rates have been spiking amid a bull market, where borrowing has become increasingly attractive. At the same time, supply has been decreasing as users likely shift their assets to alternative venues offering higher supply rates. Borrowing levels remain nearly constant at the kink point, indicating no shortage of borrowers under the current parameters and suggesting that the true equilibrium rate may exceed what the existing interest rate model can support. As suppliers exit, utilization (previously at kink) rises above the kink where the jump multiplier takes effect causing interest rates to spike. Some borrowers, elastic to these spikes, promptly repay loans to avoid paying high interest rates which brings utilization back below kink. By raising rates at the kink, we aim to attract suppliers by offering more competitive rates while simultaneously stabilizing rates for borrowers. Ideally, utilization should hover slightly below the kink so there’s enough of a buffer where suppliers can smoothly exit without causing rate spikes.

Current APYs

With reserve factor of 10%

| Utilization | Borrow APY | Supply APY |

|---|---|---|

| 0% | 0% | 0% |

| 90% (kink) | 4.41% | 3.57% |

| 100% | 94.41% | 85.97% |

Projected APYs

With reserve factor of 10%

| Utilization | Borrow APY | Supply APY |

|---|---|---|

| 0% | 0% | 0% |

| 90% (kink) | 5.04% | 4.08% |

| 100% | 95.04% | 85.54% |

cbXRP

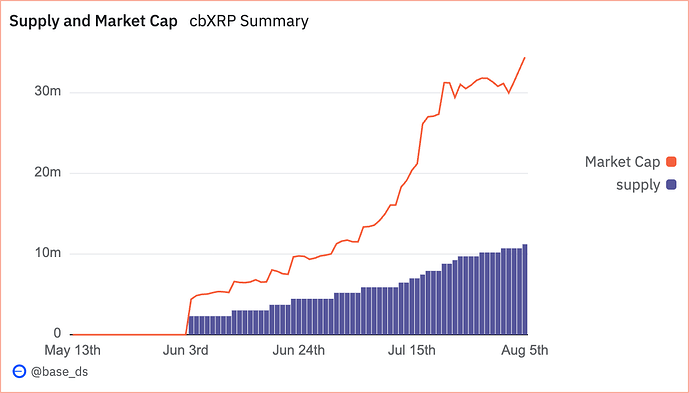

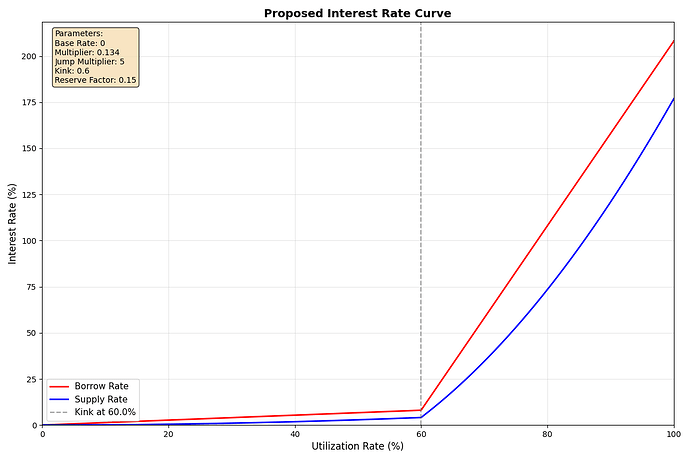

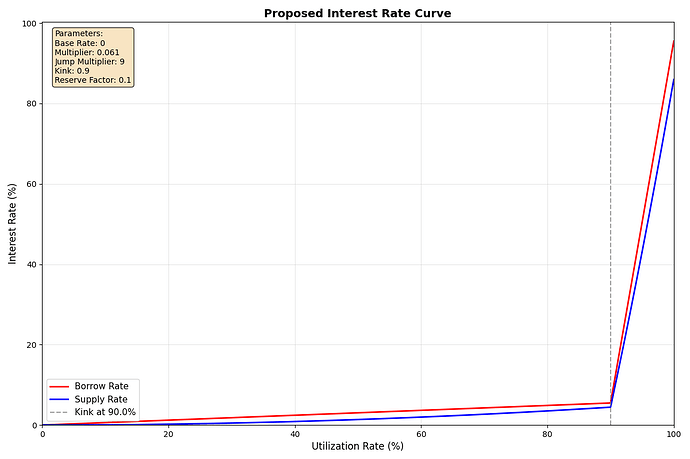

cbXRP’s interest rate parameters were set conservatively at launch to encompass a broad range and allow the market to naturally discover an equilibrium. Now, over a month later, borrow interest rates have stabilized between 3% and 7%. With this tighter range now established, we propose amending the curve to allow more efficient utilization of supply. Additionally, the reserve factor was initially set high; we propose reducing it from 30% to 20% to better incentivize suppliers while continuing to allocate a substantial portion of borrower interest toward strengthening reserves.

cbXRP’s adoption on Base thus far has been largely successful. As of August 5th there’s over 11M cbXRP on base with over 14K unique holders. DEX liquidity is also strong, in July we saw 8 days where DEX volume surpassed $2M. Currently, ~600K cbXRP can be sold to USDC on DEXs while slippage stays below the liquidation incentive.

Current APYs

With reserve factor of 30%

| Utilization | Borrow APY | Supply APY |

|---|---|---|

| 0% | 0% | 0% |

| 45% (kink) | 10.35% | 3.26% |

| 100% | 285.35% | 199.74% |

Projected APYs

With reserve factor of 20%

| Utilization | Borrow APY | Supply APY |

|---|---|---|

| 0% | 0% | 0% |

| 60% (kink) | 8.04% | 3.86% |

| 100% | 208.04% | 166.43% |

OP Mainnet

Summary

IR Parameters

| USDT0 IR Parameters | Current Value | Recommended Value |

|---|---|---|

| Base | 0 | 0 |

| Kink | 0.9 | 0.9 |

| Multiplier | 0.041 | 0.049 |

| Jump Multiplier | 9 | 9 |

| DAI IR Parameters | Current Value | Recommended Value |

|---|---|---|

| Base | 0 | 0 |

| Kink | 0.9 | 0.9 |

| Multiplier | 0.054 | 0.061 |

| Jump Multiplier | 9 | 9 |

USDT0

Over the past 30 days, the USDT0 market has experienced multiple instances where utilization surged past the kink, resulting in significant interest rate spikes. To address this volatility and stabilize rates, we propose increasing the multiplier to elevate the borrow rate at the kink.

Current APYs

With reserve factor of 10%

| Utilization | Borrow APY | Supply APY |

|---|---|---|

| 0% | 0% | 0% |

| 90% (kink) | 3.69% | 2.99% |

| 100% | 93.69% | 84.32% |

Projected APYs

With reserve factor of 10%

| Utilization | Borrow APY | Supply APY |

|---|---|---|

| 0% | 0% | 0% |

| 90% (kink) | 4.41% | 3.57% |

| 100% | 94.41% | 85.97% |

DAI

Similarly, even after the recent small bump to DAI’s multiplier we continue to see spiking interest rates. For this reason, we propose raising the multiplier further to increase the borrow rate at the kink. This adjustment aims to allow for smoother borrow rate discovery beneath 5.5%.

Current APYs

With reserve factor of 10%

| Utilization | Borrow APY | Supply APY |

|---|---|---|

| 0% | 0% | 0% |

| 90% (kink) | 4.86% | 3.94% |

| 100% | 94.86% | 85.37% |

Projected APYs

With reserve factor of 10%

| Utilization | Borrow APY | Supply APY |

|---|---|---|

| 0% | 0% | 0% |

| 90% (kink) | 5.49% | 4.45% |

| 100% | 95.49% | 85.94% |

Additional Links

Anthias Labs has not been compensated by any third party for any statements made. All opinions and suggestions provided are based solely on our independent analysis and are not influenced by external entities.