[Anthias Labs] - Risk Parameter Recommendations (7/9/2025)

Anthias Labs proposes the following parameter changes for the month of July for Core markets on Base, Optimism, Moonbeam, and Moonriver. We also would like to announce that our risk monitoring dashboard is now live, and can be viewed here.

Base

Summary

Risk Parameters

| Parameter |

Current Value |

Recommended Value |

| cbXRP Collateral Factor |

70% |

74% |

| MORPHO Supply Cap |

4,000,000 MORPHO |

6,000,000 MORPHO |

Rationale

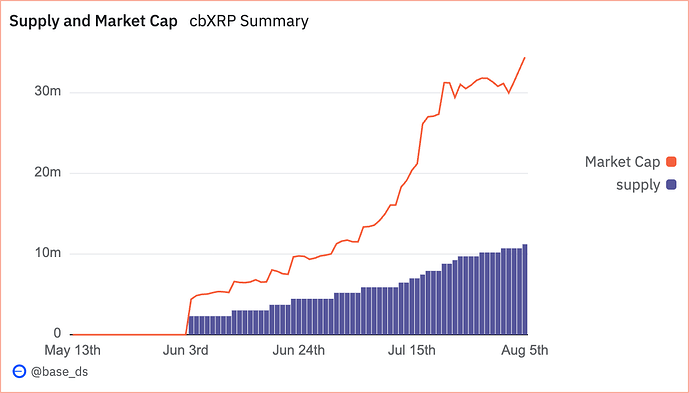

cbXRP

When determining the collateral factor, we evaluate two key factors: asset volatility and secondary market liquidity. The 30-day annualized volatility, calculated as the standard deviation of daily returns over the past 30 days and annualized, indicates the expected price fluctuation of an asset. Secondary market liquidity shows how much of an asset can be sold profitably given that price movement. These metrics together determine the collateral factor, which sets the buffer between when a position becomes eligible for liquidation and when it risks creating “bad debt,” where the collateral value falls below the loan value. More on our methodology can be found here.

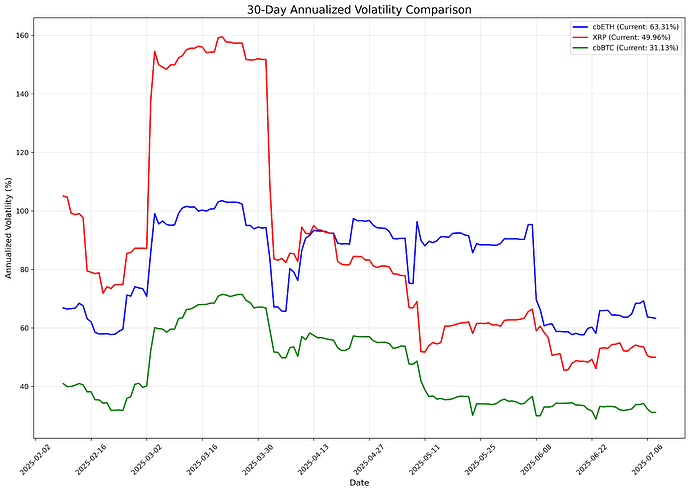

Below is the 30-day annualized volatility for cbETH, cbBTC, and XRP graphed over the last 180 days. For reference, cbBTC and cbETH have collateral factors of 85% and 81% respectively. As can be seen in the graph, XRP’s volatility spiked much higher than cbBTC and cbETH when it rose to elevated levels across the board in March 2025. Currently XRP’s 30d annualized volatility sits in between that of cbETH and cbBTC.

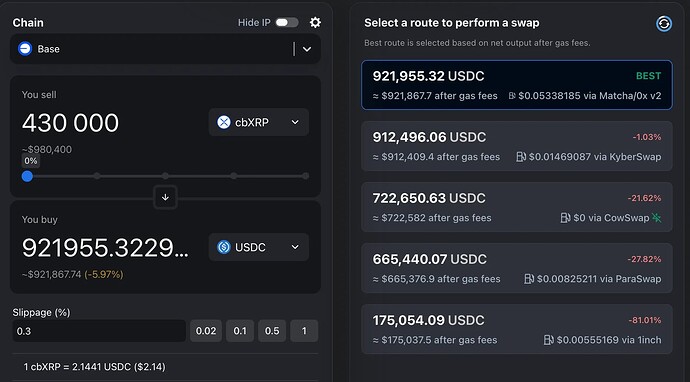

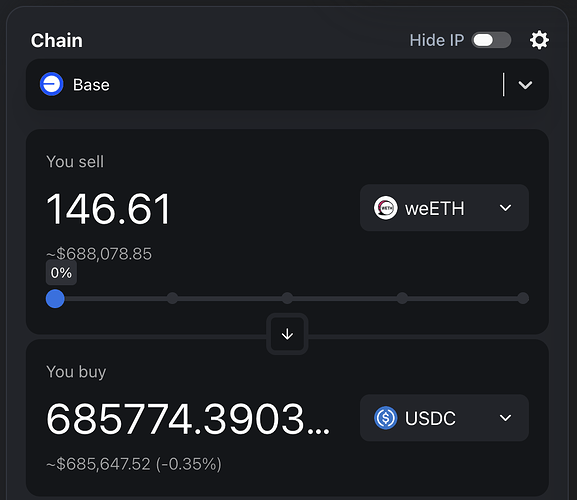

Measuring secondary market liquidity across DEXs on Base, we see that nearly $1M worth of cbXRP can be profitably sold for stables while slippage stays below the liquidation bonus (7%). This represents more than is currently supplied as collateral to the protocol (335,834 cbXRP), and nearly half of current supply caps. Additionally, liquidators can always access liquidity from other venues including CEXs due to cbXRP’s 1:1 redemption mechanism for XRP through Coinbase.

Based on current volatility and secondary market liquidity, we are confident that the protocol can safely increase cbXRP’s collateral factor from 70% to 74% with minimal additional risk of bad debt, unlocking increased capital efficiency for users. cbXRP’s collateral factor could potentially increase further, though our approach is to incrementally adjust the collateral factor as the asset matures on Base.

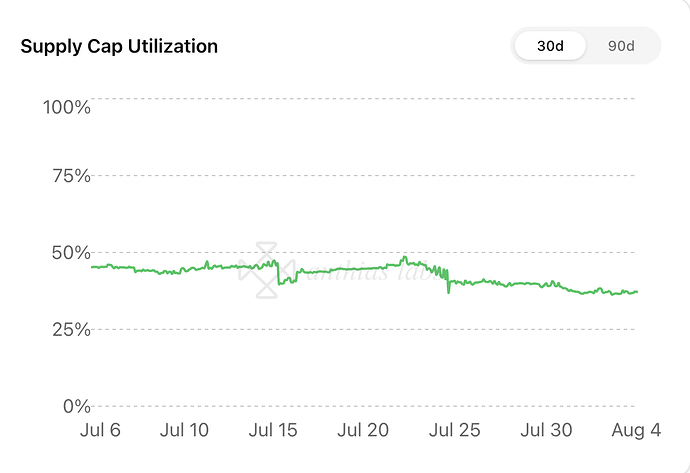

MORPHO

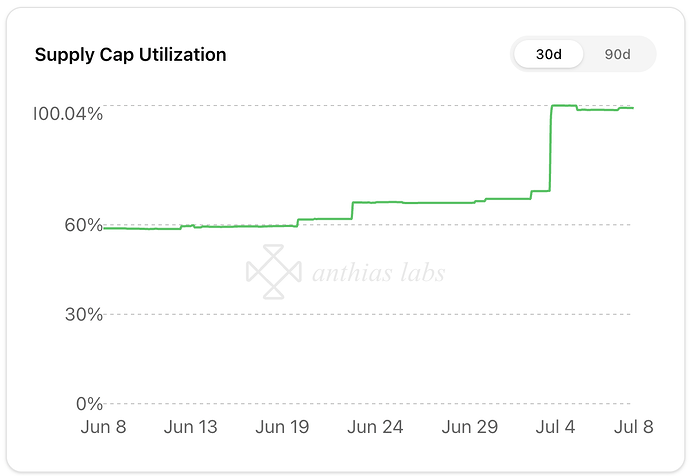

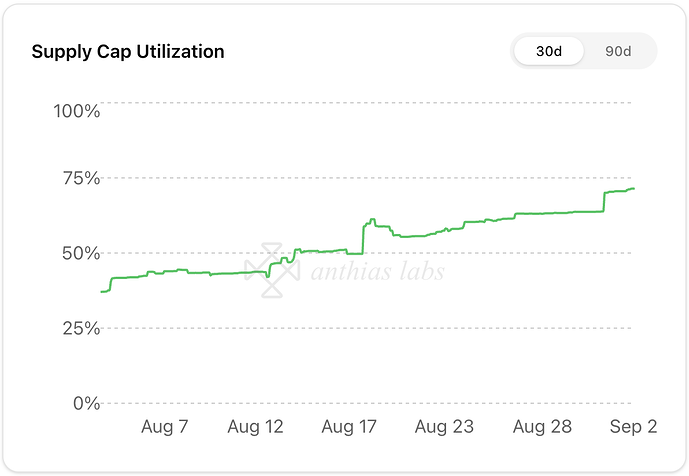

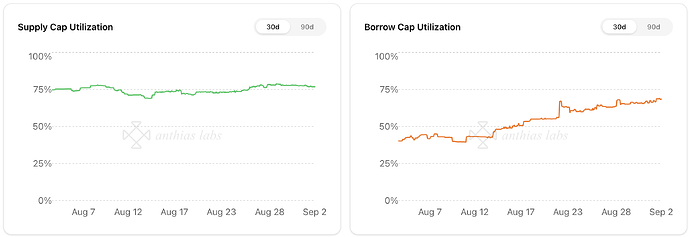

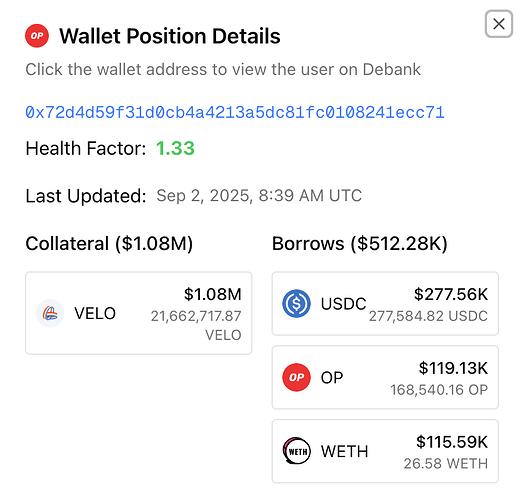

Morpho’s supply cap utilization has recently surged from ~70% to 100%, triggering a review for a potential increase. This review will consider the current profile of positions supplying Morpho, focusing on the types of assets borrowed (e.g., are they looped?) and the health of these positions. Additionally, we will assess secondary market liquidity to evaluate whether collateral at risk of liquidation could threaten bad debt for the protocol.

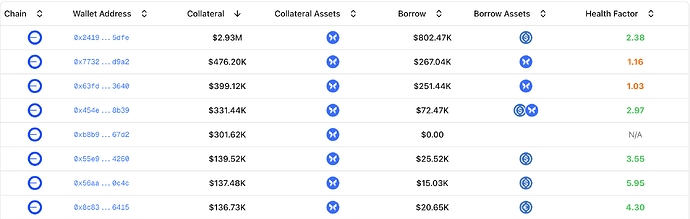

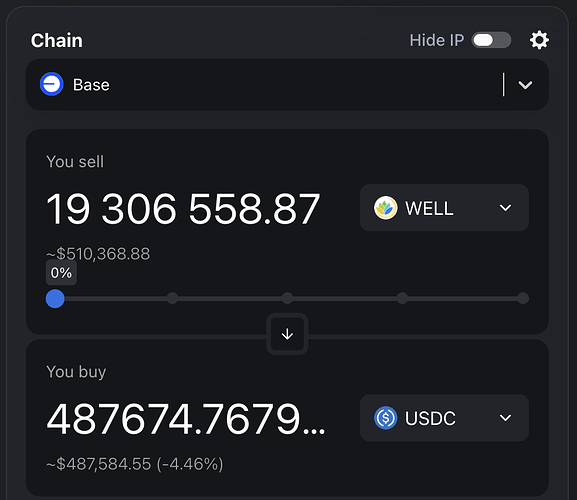

Looking at the top positions supplying Morpho to the protocol, we see that the majority comes from one position supplying $2.93M of MORPHO and borrowing ~$800K of USDC. This user alone accounts for nearly 54% of the supply cap. Other top positions are either looped or have high health factors and don’t pose significant risk of liquidation.

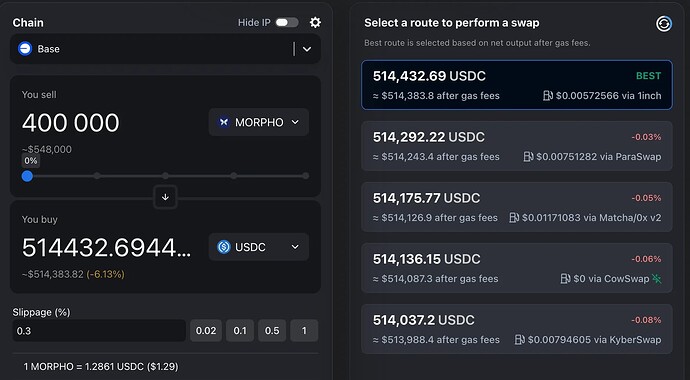

Looking at DEX liquidity, we notice that 400K MORPHO can be profitably sold to stables while staying below 7% slippage (liquidator bonus).

The primary trading pool for MORPHO is the WETH/MORPHO pair on Aerodrome, which sees substantial daily volume (~$1M). As a result, any swap causing significant slippage is likely to be quickly arbitraged, restoring pool balance. This enables partial liquidations to gradually reduce protocol debt, even for large positions eligible for liquidation. Combined with a conservative collateral factor of 65%, current liquidity levels and high trading volume in the main pool make it unlikely for such a large position to result in bad debt.

Optimism

Summary

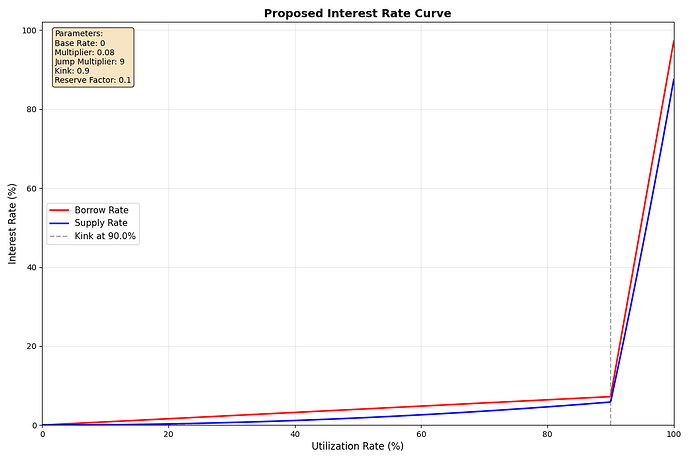

IR Parameters

| DAI IR Parameters |

Current Value |

Recommended Value |

| Base |

0 |

0 |

| Kink |

0.9 |

0.9 |

| Multiplier |

0.049 |

0.054 |

| Jump Multiplier |

9 |

9 |

Rationale

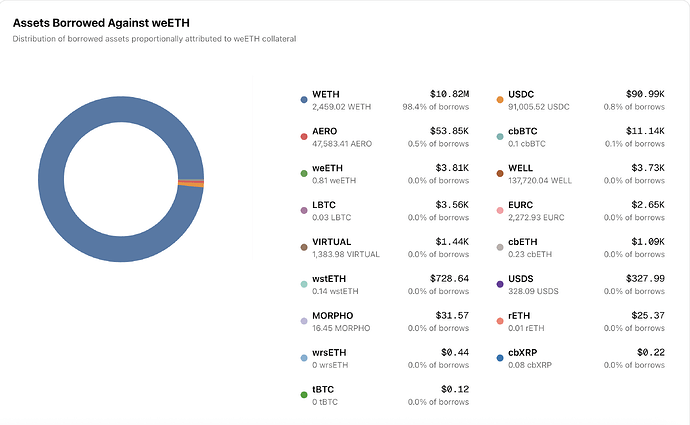

weETH

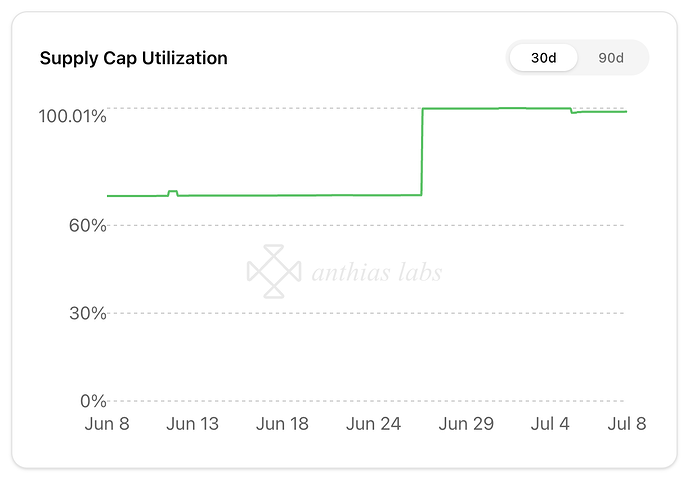

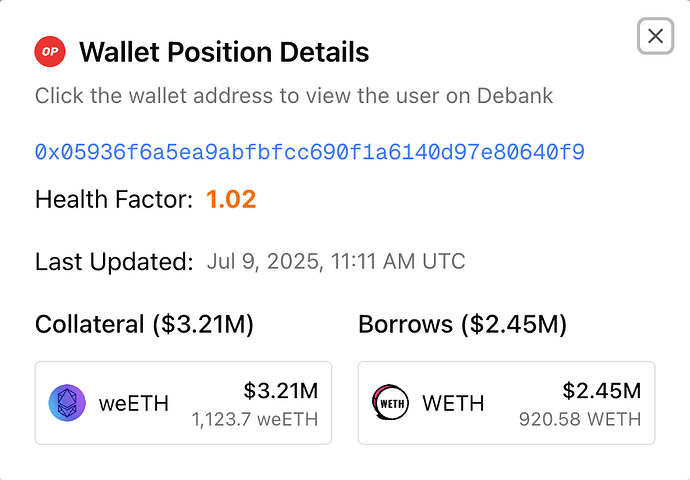

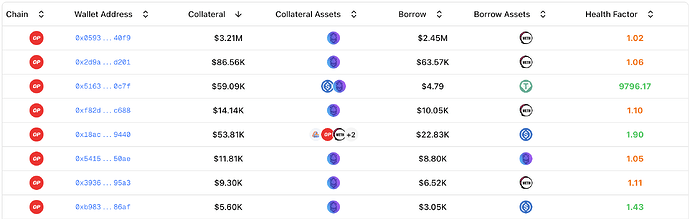

Supply cap utilization for weETH has reached 100%, prompting review for a raise. Similar to sections above we will look at the landscape of positions supplying weETH as well as DEX liquidity to determine if the supply cap for weETH can be safely raised.

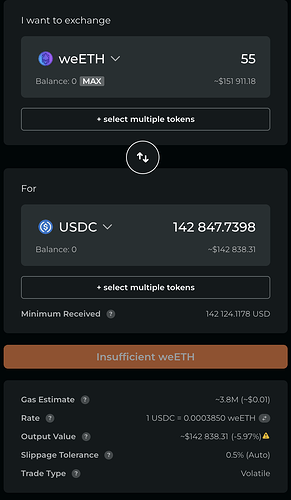

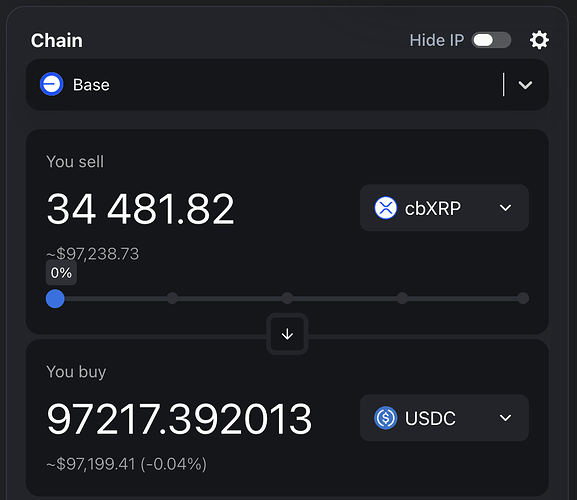

DEX liquidity for weETH on Optimism is limited, with only about 55 weETH (~$150K) able to be swapped to stablecoins while keeping slippage below the liquidator bonus. This suggests that high liquidation volumes could make it challenging for liquidators to profitably sell seized collateral directly on-chain. However, liquidators could potentially access larger liquidity pools by bridging to SwellChain, where weETH DEX liquidity is significantly higher. Such cross-chain liquidations are more complex than standard on-chain flash-loan liquidations and cannot be consistently relied upon. This may change with the introduction of superswaps on Velodrome, which could simplify the process.

The top position supplying weETH on Optimism accounts for nearly 94% of the current supply cap. This position is a recursive position not at risk of liquidation due to supplying and borrowing highly correlated assets.

The largest position supplying weETH far exceeds the other top 8 positions, though all exhibit similar looping patterns. The current state of weETH supply positions, mostly looped, indicates that a sudden weETH price drop is unlikely to cause liquidation volumes that would overwhelm DEX liquidity or make liquidations unprofitable. However, increasing supply caps now could enable users to take large positions (e.g., supplying weETH and borrowing stablecoins) that, if liquidated, might not be profitably resolved due to limited DEX liquidity. Therefore, we do not recommend raising weETH supply caps on Optimism at this time. We will continue to monitor DEX liquidity and the introduction of superswaps between Optimism and SwellChain on Velodrome, which could facilitate safely increasing caps in the future.

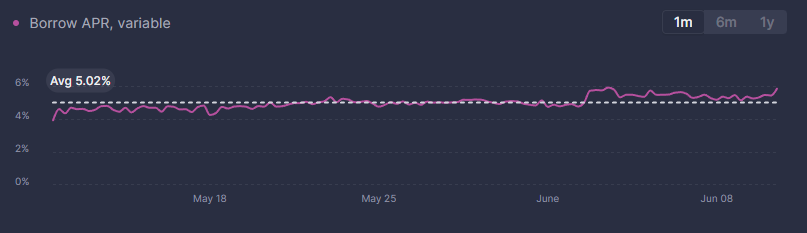

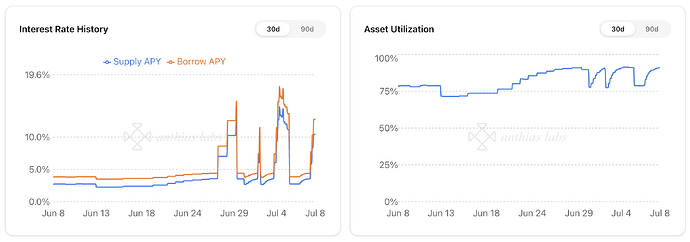

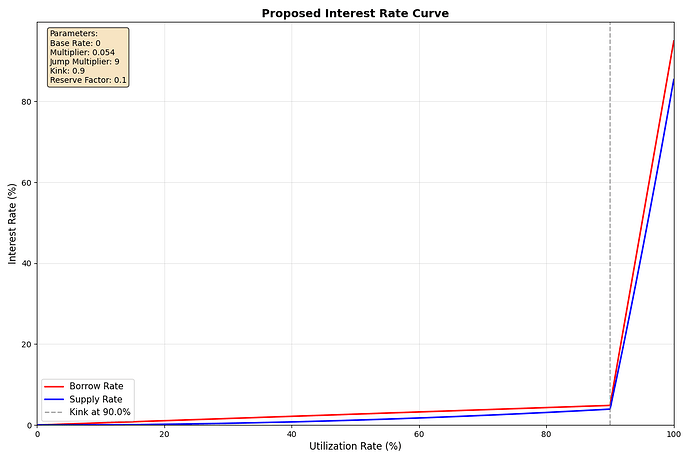

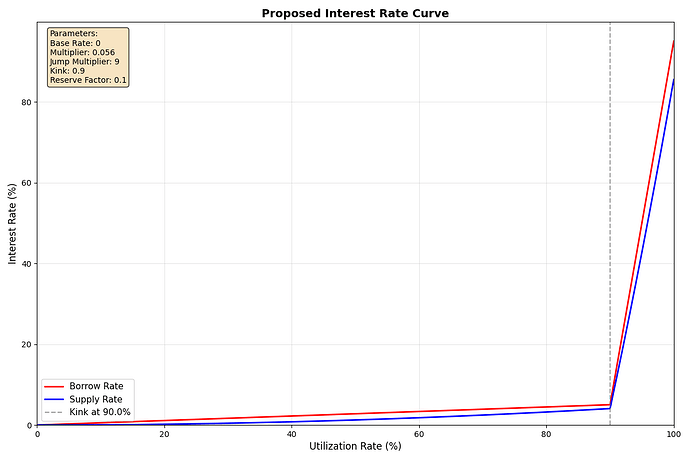

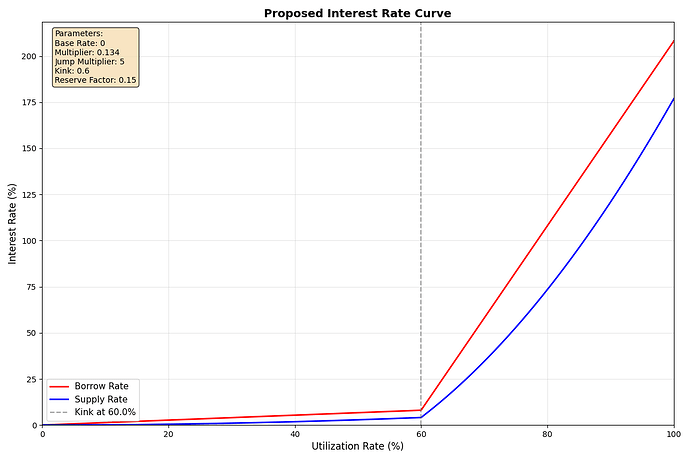

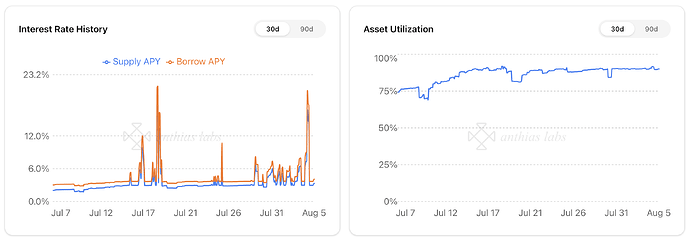

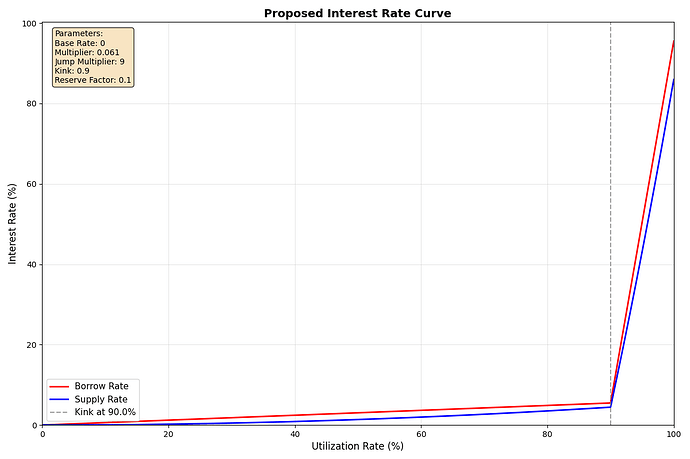

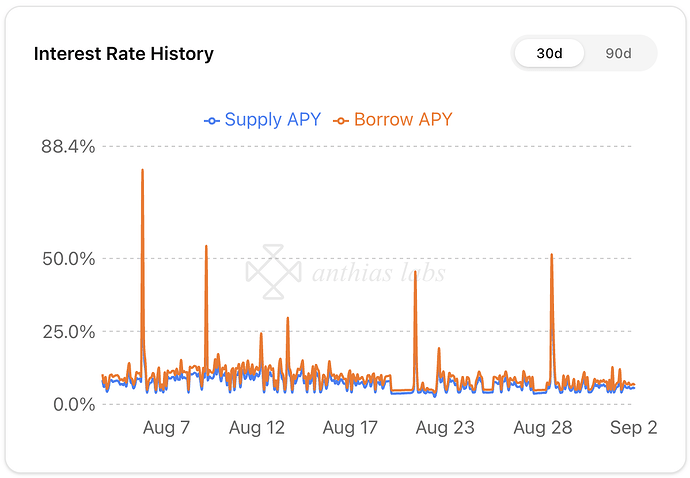

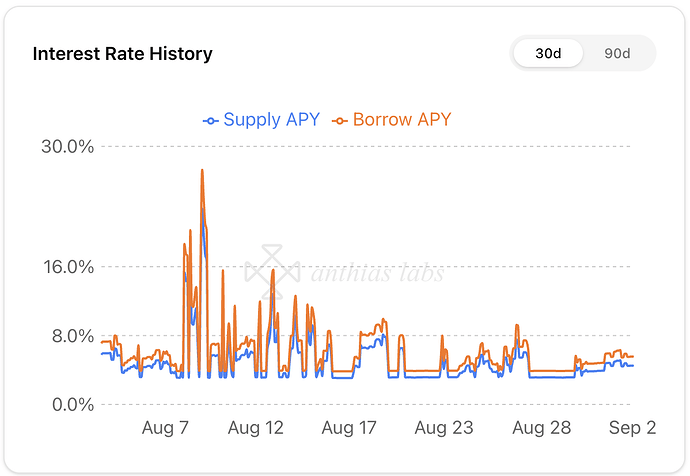

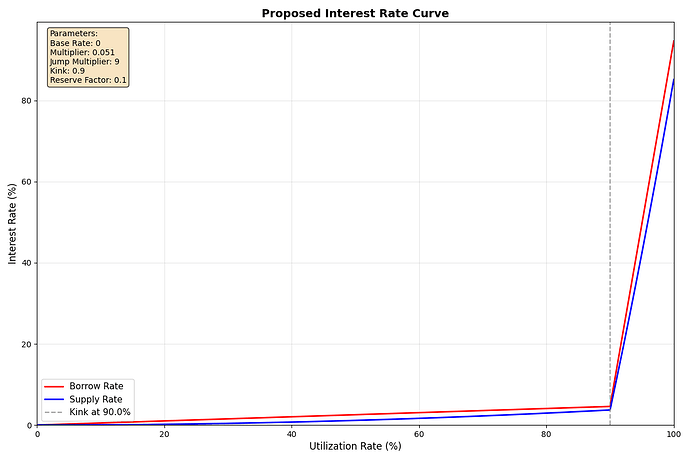

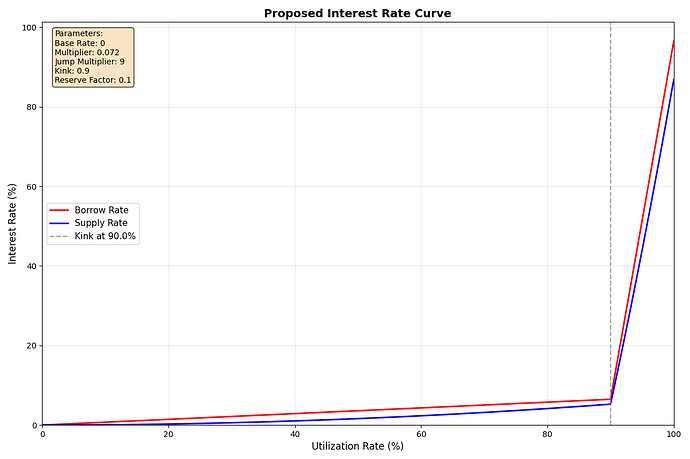

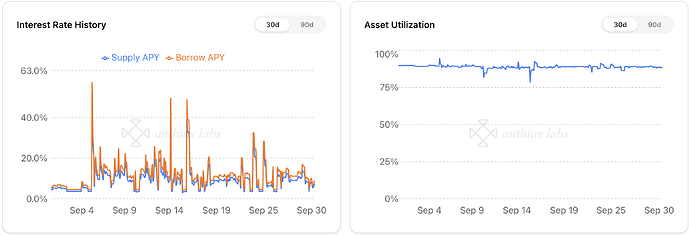

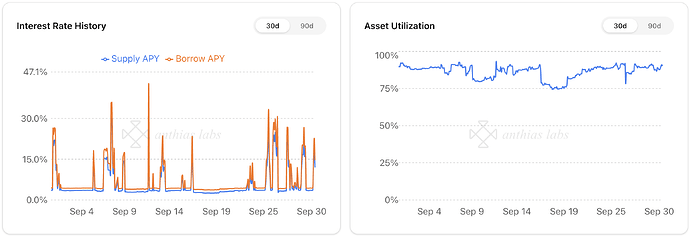

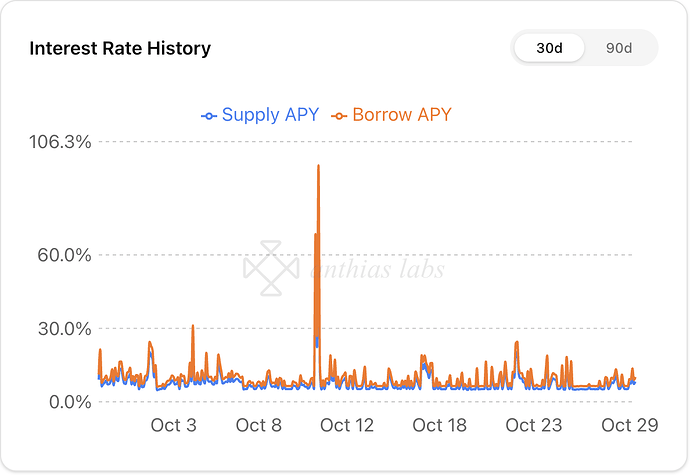

DAI

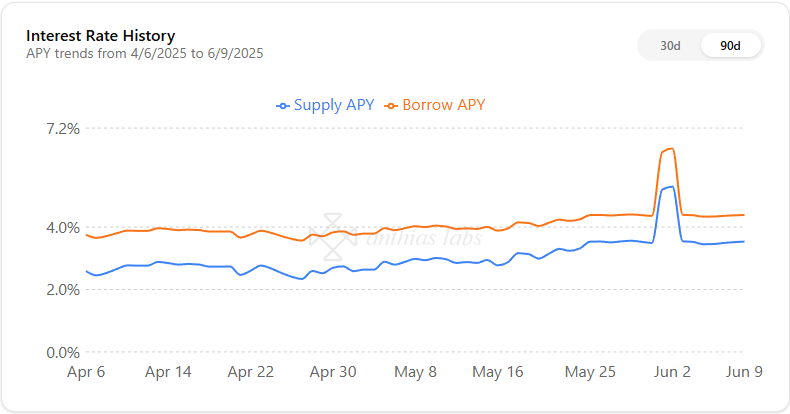

Over the past few weeks, we’ve noticed that DAI utilization has consistently exceeded the 90% kink threshold, triggering a sharp increase in interest rates due to the jump multiplier. These large fluctuations in interest rates are causing instability for borrowers, as borrowing costs become unpredictable and often unsustainable. To bring back stability to interest rates we recommend slightly increasing the multiplier from 0.049 to 0.054 (50bps increase).

Current APYs

| Utilization |

Borrow APY |

Supply APY |

| 0% |

0% |

0% |

| 90% (kink) |

4.41% |

3.57% |

| 100% |

94.41% |

84.97% |

Projected APYs

| Utilization |

Borrow APY |

Supply APY |

| 0% |

0% |

0% |

| 90% (kink) |

4.86% |

3.94% |

| 100% |

94.86% |

85.37% |

Moonbeam

We support Gauntlet’s risk-off approach for the Moonbeam Core markets, which involves incrementally lowering collateral factors across all assets. Following the significant reduction in collateral factors last month, we believe further risk-off measures are not immediately necessary. Over the coming weeks, we will assess the optimal strategy for continuing to wind down these markets.

Moonriver

No parameter recommendations for Moonriver at this time.

Additional Links

Monitoring Dashboard

Anthias Labs X Account