[Gauntlet] - Base/Optimism/Moonbeam/Moonriver Monthly Recommendations - 2025-06-12

Base

Simple Summary

Risk Parameters

A proposal to adjust the following risk parameters:

| Risk Parameter | Current Value | Recommended Value |

|---|---|---|

| cbBTC Reserve Factor | 5% | 10% |

| LBTC Reserve Factor | 5% | 10% |

| tBTC Reserve Factor | 5% | 10% |

IR Parameters

A proposal to adjust IR curve for WETH, cbBTC, LBTC, tBTC and AERO:

| WETH IR Parameters | Current | Recommended |

|---|---|---|

| Base | 0 | 0 |

| Kink | 0.9 | 0.9 |

| Multiplier | 0.019 | 0.014 |

| Jump Multiplier | 8 | 8 |

| cbBTC IR Parameters | Current | Recommended |

|---|---|---|

| Base | 0 | 0 |

| Kink | 0.7 | 0.7 |

| Multiplier | 0.07 | 0.0615 |

| Jump Multiplier | 2 | 2 |

| LBTC IR Parameters | Current | Recommended |

|---|---|---|

| Base | 0 | 0 |

| Kink | 0.7 | 0.7 |

| Multiplier | 0.07 | 0.0615 |

| Jump Multiplier | 2 | 2 |

| tBTC IR Parameters | Current | Recommended |

|---|---|---|

| Base | 0 | 0 |

| Kink | 0.7 | 0.7 |

| Multiplier | 0.07 | 0.0615 |

| Jump Multiplier | 2 | 2 |

| AERO IR Parameters | Current | Recommended |

|---|---|---|

| Base | 0 | 0 |

| Kink | 0.45 | 0.6 |

| Multiplier | 0.23 | 0.23 |

| Jump Multiplier | 5 | 5 |

Rationale

Interest Rate (IR) Parameters

USDC

Source: Dune Dashboard

Given the stable SSR and the recent stabilization in DSR, Gauntlet recommends maintaining current stablecoin borrowing APRs. This recommendation also accounts for utilization levels nearing the kink and the risk profiles of top USDC borrowers.

WETH

WETH utilization has remained consistently below the kink threshold, signaling sustained underutilization. Gauntlet recommends a ~50bps reduction in kink rate to encourage increased borrowing activity.

Recommended IR Curve for WETH

Projected APRs for WETH

| Utilization | Borrow APR | Supply APR |

|---|---|---|

| 0 | 0% | 0% |

| kink | 1.26% | 1.02% |

| 100 | 81.26% | 73.13% |

Current APRs for WETH

| Utilization | Borrow APR | Supply APR |

|---|---|---|

| 0 | 0% | 0% |

| kink | 1.71% | 1.39% |

| 100 | 81.71% | 73.54% |

cbBTC, tBTC, LBTC

Gauntlet recommends lowering the kink rate for BTC wrapper assets by ~60bps in light of their consistently low utilization levels. Despite the presence of supply, these assets are not being actively borrowed, which limits the effectiveness of the current rate structure.

The subdued utilization of BTC wrapper assets is partly due to their typical use case (they are primarily supplied as collateral to enable borrowing of blue-chip tokens like USDC, WETH, or higher-demand assets such as VIRTUAL). Consequently, direct borrow demand for BTC wrappers remains structurally limited, a pattern consistently observed across various lending platforms.

Top cbBTC Supplier Positions

Recommended IR Curve for cbBTC, tBTC, LBTC

Projected APRs for cbBTC, tBTC, LBTC

| Utilization | Borrow APR | Supply APR |

|---|---|---|

| 0 | 0% | 0% |

| kink | 4.30% | 2.86% |

| 100 | 64.30% | 61.09% |

Current APRs for cbBTC, tBTC, LBTC

| Utilization | Borrow APR | Supply APR |

|---|---|---|

| 0 | 0% | 0% |

| kink | 4.90% | 3.26% |

| 100 | 64.90% | 61.65% |

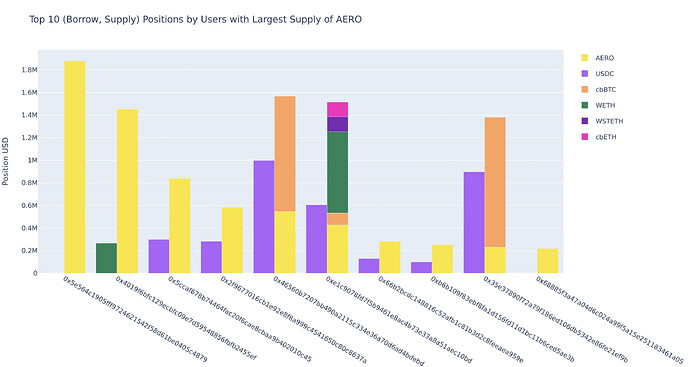

AERO

We recommend raising the kink point in the AERO interest rate (IR) model from 45% to 60%. This adjustment aims to enhance capital efficiency, particularly under current conditions where utilization is consistently approaching the existing kink threshold. Given the liquidity profile of the market, especially among top suppliers who can exit their positions with minimal slippage, a higher kink point allows the protocol to accommodate additional borrowing demand before steep rate escalations are triggered. This change helps maintain competitive borrowing costs while more effectively deploying idle capital within safe utilization bounds.

Projected APRs for AERO

| Utilization | Borrow APR | Supply APR |

|---|---|---|

| 0 | 0% | 0% |

| 60 | 13.80% | 5.80% |

| 100 | 288.80% | 202.16% |

Current APRs for AERO

| Utilization | Borrow APR | Supply APR |

|---|---|---|

| 0 | 0% | 0% |

| 45 | 10.35% | 3.26% |

| 100 | 285.35% | 199.74% |

Current and Projected IR Curve

Reserve Factor

cbBTC, LBTC, tBTC

In April, we reduced the reserve factor to enhance the attractiveness of these markets for suppliers by boosting their net yields, which successfully led to a notable increase in supply and improved liquidity.

Given this growth, we now recommend raising the reserve factor for BTC wrapper assets from 5% to 10% to better align with broader market standards. A 10% reserve factor remains competitive.

Projected APRs for cbBTC, LBTC, tBTC

| Utilization | Borrow APR | Supply APR |

|---|---|---|

| 0 | 0% | 0% |

| kink | 4.90% | 3.08% |

| 100 | 64.90% | 58.40% |

Current APRs for cbBTC, LBTC, tBTC

| Utilization | Borrow APR | Supply APR |

|---|---|---|

| 0 | 0% | 0% |

| kink | 4.90% | 3.26% |

| 100 | 64.90% | 61.65 |

Optimism

Simple Summary

Risk Parameters

A proposal to adjust the following risk parameters:

| Risk Parameter | Current Value | Recommended Value |

|---|---|---|

| USDT0 Supply Cap | 45M | 10M |

| USDT0 Borrow Cap | 13.5M | 8M |

| weETH Supply Cap | 860 | 1,200 |

| weETH Borrow Cap | 110 | 220 |

*Cap Recommendations will be implemented via Guardian

IR Parameters

A proposal to adjust IR parameters for USDC, USDT0 and WETH:

| USDC IR Parameters | Current | Recommended |

|---|---|---|

| Base | 0 | 0 |

| Kink | 0.9 | 0.9 |

| Multiplier | 0.049 | 0.0435 |

| Jump Multiplier | 9 | 9 |

| USDT0 IR Parameters | Current | Recommended |

|---|---|---|

| Base | 0 | 0 |

| Kink | 0.9 | 0.9 |

| Multiplier | 0.0515 | 0.041 |

| Jump Multiplier | 9 | 9 |

| WETH IR Parameters | Current | Recommended |

|---|---|---|

| Base | 0 | 0 |

| Kink | 0.9 | 0.9 |

| Multiplier | 0.019 | 0.014 |

| Jump Multiplier | 8 | 8 |

Rationale

Interest Rate (IR) Parameters

USDC

Given the recent low utilization of USDC, we recommend reducing slope1 by 55 basis points.

The recent drop in USDC utilization (between May 16 and May 24) was mainly driven by a surge in supply, intended to support USDT0 borrowing, while USDC borrow demand remained muted and lagging.

Recommended USDC IR Curve

Projected APRs for USDC

| Utilization | Borrow APR | Supply APR |

|---|---|---|

| 0 | 0% | 0% |

| kink | 3.91% | 3.17% |

| 100 | 93.91% | 84.52% |

Current APRs for USDC

| Utilization | Borrow APR | Supply APR |

|---|---|---|

| 0 | 0% | 0% |

| kink | 4.41% | 3.57% |

| 100 | 94.41% | 84.97% |

Given the distinct utilization pattern of USDT, we recommend leaving its interest rate settings unchanged. Notably, USDT is primarily borrowed against WETH and LSTs, in contrast to the supply and borrow dynamics observed with USDC.

USDT0

With utilization hovering around 50%, USDT0 remains well below its kink rate. This is largely due to its use as collateral for borrowing WETH and other riskier assets, in contrast to USDC’s frequent role in leveraged looping strategies. To encourage greater borrowing activity, we recommend mirroring the USDC rate structure, while incorporating an additional 0.25 decrease in slope1.

Recommended USDT0 IR Curve

Projected APRs for USDT0

| Utilization | Borrow APR | Supply APR |

|---|---|---|

| 0 | 0% | 0% |

| kink | 3.69% | 2.99% |

| 100 | 93.69% | 84.32% |

Current APRs for USDT0

| Utilization | Borrow APR | Supply APR |

|---|---|---|

| 0 | 0% | 0% |

| kink | 4.63% | 3.75% |

| 100 | 94.63% | 85.17% |

WETH

For the same reasons cited in the Base market, we recommend a 55bps reduction in kink rate.

Recommended IR Curve for WETH

Projected APRs for WETH

| Utilization | Borrow APR | Supply APR |

|---|---|---|

| 0 | 0% | 0% |

| kink | 1.26% | 1.02% |

| 100 | 81.26% | 73.13% |

Current APRs for WETH

| Utilization | Borrow APR | Supply APR |

|---|---|---|

| 0 | 0% | 0% |

| kink | 1.71% | 1.39% |

| 100 | 81.71% | 73.54% |

Cap Recommendations

Gauntlet will use Cap Guardian to adjust the Supply and Borrow Cap for the below assets:

| Asset | Chain | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| USDT0 | Optimism | 45,000,000 | 10,000,000 | 13,500,000 | 8,0000,000 |

| weETH | Optimism | 860 | 1,200 | 110 | 220 |

USDT0

Following the recent pullback in USDT0 supply and borrowing, we recommend reducing the cap to limit risk exposure while still providing ample headroom to support potential growth.

Gauntlet continuously monitors cap utilization and provides timely recommendations. You can find our latest cap recommendations here.

weETH

We recently advised maintaining the current caps for weETH, based on user risk profiles and LaR on Optimism. However, given the evolving risk landscape on Optimism, we now recommend raising the caps for weETH to enable further market growth.

LaR on Optimism

Moonbeam

Simple Summary

Risk Parameters

A proposal to adjust the following risk parameters:

| Risk Parameter | Current Value | Recommended Value |

|---|---|---|

| FRAX Collateral Factor | 31% | 21% |

| USDC.wh Collateral Factor | 14% | 9% |

| WETH.wh Collateral Factor | 25% | 24% |

| WGLMR Collateral Factor | 47% | 37% |

| xcUSDC Collateral Factor | 45% | 25% |

| xcUSDT Collateral Factor | 55% | 25% |

Rationale

Collateral Factor

We continue recommending a reduction in Collateral Factors across assets as follows.

- Decrease FRAX Collateral Factor from 31% to 21%

- Decrease USDC.wh Collateral Factor from 14% to 9%

- Decrease WETH.wh Collateral Factor from 25% to 24%

- Decrease WGLMR Collateral Factor from 47% to 37%

- Decrease xcUSDC Collateral Factor from 45% to 25%

- Decrease xcUSDT Collateral Factor from 55% to 25%

The proposed reduction in CFs will trigger liquidations of positions totaling ~$7K in borrows. The positions poised to be liquidated are listed below.

| User Address | Total Supply Balance (USD) | Total Borrow Balance (USD) | Initial Borrow Usage | New Borrow Usage | Initial Health Factor | New Health Factor |

|---|---|---|---|---|---|---|

| 0xec121ab51bcd56d1f88ba045db9bbf4b4de9509f | 4220.76 | 1374.96 | 0.7132 | 1.1264 | 1.402 | 0.888 |

| 0x93b5f3681c605f99aecaeea14cdd754e73941730 | 2562.02 | 1072.12 | 0.762 | 1.6655 | 1.312 | 0.6 |

| 0xc6302894cd030601d5e1f65c8f504c83d5361279 | 4623.17 | 1030.08 | 0.7187 | 1.061 | 1.391 | 0.943 |

| 0x6c7cdd4afdd2ec7eaa56ad196839974f6717e3b6 | 10252.5 | 755.669 | 0.8831 | 1.043 | 1.132 | 0.959 |

| 0x2f062d9aa98209d2c79a744b0d4ef203d363b7d6 | 1377.99 | 360.21 | 0.4753 | 1.0456 | 2.104 | 0.956 |

| 0x11d0c910bae3030e3d18dbfe9f25010a1d3b4de2 | 1070.18 | 352.334 | 0.5986 | 1.3169 | 1.671 | 0.759 |

| 0x26cb1dbad7349b57af814a22718d04d0fcdfbeb1 | 638.335 | 222.391 | 0.8461 | 1.1658 | 1.182 | 0.858 |

| 0x638b40a8e64cda8a41957ea4eeea213d2b0da55a | 638.051 | 194.355 | 0.5548 | 1.2112 | 1.802 | 0.826 |

| 0xb0a80c11765af2692be0646ecd3ac859abbc65e6 | 388.554 | 150.836 | 0.826 | 1.0492 | 1.211 | 0.953 |

| 0x6bc3e7b5010f588cfe347473c610b9a5d363e140 | 365.558 | 138.792 | 0.8078 | 1.0261 | 1.238 | 0.975 |

| 0x2fcb0fb214478fab0737265bcbf209b138109fc4 | 328.889 | 135.793 | 0.8785 | 1.1159 | 1.138 | 0.896 |

| 0xc436b4df402910c315a32fbe2b97b95cb27df2ee | 319.822 | 120.069 | 0.7988 | 1.0147 | 1.252 | 0.986 |

| 0x82ad076fe3637e851741a4ec48e3f0a427d8672f | 307.243 | 116.434 | 0.8063 | 1.0242 | 1.24 | 0.976 |

| 0xd45b0949822eb1dfbd27b683425e98d91a306231 | 278.724 | 103.437 | 0.7896 | 1.003 | 1.266 | 0.997 |

| 0xedd6be48b0fa7bc1dd43f6fed8cdfe666bfbc0cf | 259.629 | 101.336 | 0.8304 | 1.0549 | 1.204 | 0.948 |

| 0x631550179111278b29bd67a88584e6d44acf440f | 241.112 | 90.5554 | 0.7991 | 1.0151 | 1.251 | 0.985 |

| 0x1b0450699c22333372ed4e4c80b536d8b148a3e1 | 230.728 | 82.2175 | 0.9242 | 1.0431 | 1.082 | 0.959 |

| 0x54ed1b8c4e4a2871bfbe0d5f2777468da69f77a2 | 215.841 | 69.0951 | 0.6946 | 1.0157 | 1.44 | 0.985 |

| 0xe72994419480d9a0b3ab38e53ef7d7c28c48193d | 158.026 | 68.7964 | 0.9263 | 1.1766 | 1.08 | 0.85 |

| 0x20de118961bd6bef82018834710a28466b445cad | 141.364 | 60.5066 | 0.9107 | 1.1568 | 1.098 | 0.864 |

| 0x200e073f2bb2e6c420dd986f52234815599b58dd | 232.96 | 56.1424 | 0.7 | 1.0856 | 1.429 | 0.921 |

| 0x6ebcd1bffb2d6be2efc3c33f09250a95745b7bb1 | 102.685 | 43.5987 | 0.9034 | 1.1475 | 1.107 | 0.871 |

| 0xd1bf5f87c7f04f93e46521988940b5aea30eb7aa | 79.4135 | 35.8472 | 0.8207 | 1.8056 | 1.218 | 0.554 |

| 0x10115ea72868edacc4fda8f398043ca593f5b830 | 83.0588 | 20.3936 | 0.792 | 1.1692 | 1.263 | 0.855 |

| 0xe3053cde2124eaa6103ddde8e5c6bd36c66f716e | 56.569 | 17.4561 | 0.9954 | 1.4694 | 1.005 | 0.681 |

| 0x990792f2e3e06fe423cd7209993a176f92ff5681 | 41.1554 | 15.7465 | 0.8141 | 1.0341 | 1.228 | 0.967 |

| 0xc7c88e8a4936c11b4e049138df4ea0c56fa8590c | 31.3085 | 13.8112 | 0.9386 | 1.1922 | 1.065 | 0.839 |

| 0xd4af30b39680b642bbf276a2242d064046e723ea | 35.3872 | 13.3547 | 0.803 | 1.02 | 1.245 | 0.98 |

| 0xababe7c986a57792ffe17656db76c99413a385b5 | 32.361 | 12.2243 | 0.8037 | 1.0209 | 1.244 | 0.98 |

| 0x64823c68fb0eeb195e03b58fe412822df0d237ae | 43.4362 | 11.491 | 0.8449 | 1.1168 | 1.184 | 0.895 |

| 0x0e61a5d840b883d234940c738cf49a2aebfaf1c8 | 101.434 | 11.46 | 0.807 | 1.2553 | 1.239 | 0.797 |

| 0x27169678e54678ad12f5b6d1cd81df01d9a516ed | 25.8367 | 10.1474 | 0.8356 | 1.0615 | 1.197 | 0.942 |

| 0xbaa0b77700482d2c0c19f804e563c0b62c9934d3 | 24.8763 | 9.58255 | 0.8196 | 1.0411 | 1.22 | 0.961 |

| 0x6c961fff8a1f49e0a01a36eee5169ced8a6163c5 | 19.244 | 8.55651 | 0.946 | 1.2017 | 1.057 | 0.832 |

| 0x5c4a094e59a6387088d3c5f79aaa5ed5ada0bc91 | 19.907 | 8.5101 | 0.9096 | 1.1554 | 1.099 | 0.866 |

| 0x26342d43cdd34a3af30da40502fef18f2bbf3dcf | 54.3504 | 6.13867 | 0.8068 | 1.255 | 1.239 | 0.797 |

| 0xb28662425e6a01e68e6d8ef6635c1b90311a9401 | 44.7347 | 5.46876 | 0.8732 | 1.3583 | 1.145 | 0.736 |

Moonriver

Gauntlet does not recommend any risk parameters for the Moonriver market at this time.

Risk Dashboard

The community should use Gauntlet’s Moonwell Base Risk Dashboard to better understand the updated parameter suggestions and general market risk in Moonwell BASE.

Methodology

This set of parameter updates seeks to maintain the overall risk tolerance of the protocol while making risk trade-offs between specific assets.

Gauntlet’s parameter recommendations are driven by an optimization function that balances 3 core metrics: insolvencies, liquidations, and borrow usage. Parameter recommendations seek to optimize for this objective function. Our agent-based simulations use a wide array of varied input data that changes on a daily basis (including but not limited to asset volatility, asset correlation, asset collateral usage, DEX / CEX liquidity, trading volume, expected market impact of trades, and liquidator behavior). Gauntlet’s simulations tease out complex relationships between these inputs that cannot be simply expressed as heuristics. As such, the input metrics we show below can help understand why some of the param recs have been made but should not be taken as the only reason for recommendation. To learn more about our methodologies, please see the Helpful Links section at the bottom.

Quick Links

Please click below to learn about our methodologies:

Gauntlet Parameter Recommendation Methodology

Gauntlet Model Methodology

By approving this proposal, you agree that any services provided by Gauntlet shall be governed by the terms of service available at gauntlet.network/tos.