Summary

Recently, the Base Safety Module experienced a minor bug triggered by the execution of MIP-X28. While no staked funds were ever at risk, the bug allowed a small number of users to claim the full reward budget from MIP-X28, resulting in an estimated loss of 8.4M WELL. Moonwell contributors propose making affected users whole for the rewards they were legitimately owed before the bug was triggered. A number of users who received excess rewards have already offered to return them to the DAO, which is appreciated and will help reduce the loss.

We propose distributing WELL to Safety Module participants on Base based on their accrued rewards up to the block immediately before the execution of MIP-X28. Moonwell contributors are evaluating whether Sablier or Angle Protocol offers the best method for distribution. Contributors will aim to ensure that any claim fees (Sablier charges ~$1-2 in ETH per claim) are covered by the Moonwell DAO so that participants receive their full owed amount of rewards, except for those accounts that claimed an abnormally high amount and didn’t return the excess tokens. A full snapshot, verification data, and the list of addresses that claimed excessive rewards (and the amounts they are encouraged to return) will be published before funding and setting up the claim process.

Background

The bug was an edge-case in the Base Safety Module reward configuration. It was triggered when:

-

An address transferred stkWELL to the stkWELL contract, creating a non-zero balance in the contract, and then

-

An admin function was called on Base and updated the reward configuration, which caused reward accruals to inflate. Other chains (OP Mainnet, Moonbeam, Moonriver) are unaffected. Updates to reward configurations will now use an admin path that avoids the faulty code.

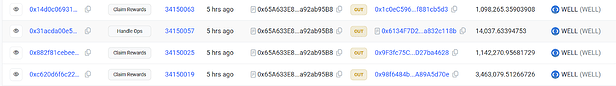

The erroneous claims occurred after MIP-X28 updated the reward speed of the Safety Module on Base. Total excess claims were approximately 8.4M in WELL. The inflated claims can be viewed here.

While this loss is not material compared to the total WELL token supply, users should not bear the cost of implementation edge cases. This proposal is the first step in restoring rewards for the period before MIP-X28 was executed. A separate proposal will address the post-execution period with a time-weighted distribution.

Scope of Proposal

-

Make Base Safety Module participants whole for legitimate rewards accrued before the bug was triggered.

-

Seek DAO approval for a WELL grant from the Moonwell Foundation to fund these distributions.

-

Stream rewards to affected users via Sablier or Angle Protocol, with claim costs covered by the DAO.

-

Continue working with Halborn to ensure this issue cannot reoccur.

Timeline

-

Review: Halborn will review and approve the reward distribution method

-

Onchain vote: Once the distribution method and funding details are finalized we will proceed to an onchain vote.