[Anthias Labs] - Risk Parameter Recommendations (9/3/2025)

Anthias Labs proposes the following parameter changes for the month of September. For more information on current parameters, please refer to our monitoring dashboard here.

Base

Summary

Risk Parameters

| Parameters | Current Value | Recommended Value |

|---|---|---|

| weETH Supply Cap | 4000 | 5400 |

| cbXRP Supply Cap | 3M | 5M |

| WELL Supply Cap | 220M | 250M |

| WELL Borrow Cap | 75M | 100M |

Cap changes will be implemented via Cap Guardian

IR Parameters

| USDC IR Parameters | Current Value | Recommended Value |

|---|---|---|

| Base | 0 | 0 |

| Kink | 0.9 | 0.9 |

| Multiplier | 0.056 | 0.061 |

| Jump Multiplier | 9 | 9 |

weETH

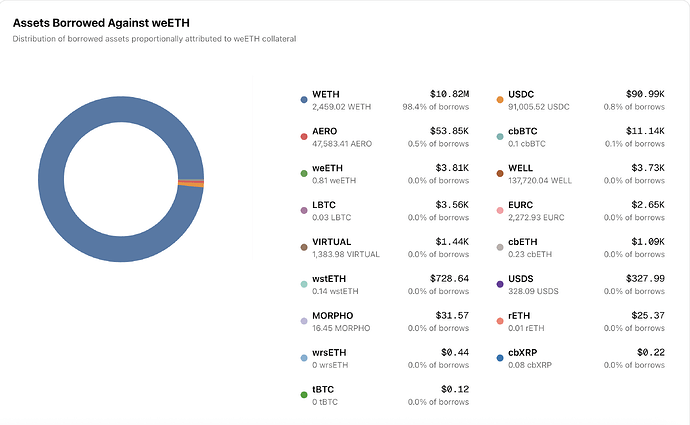

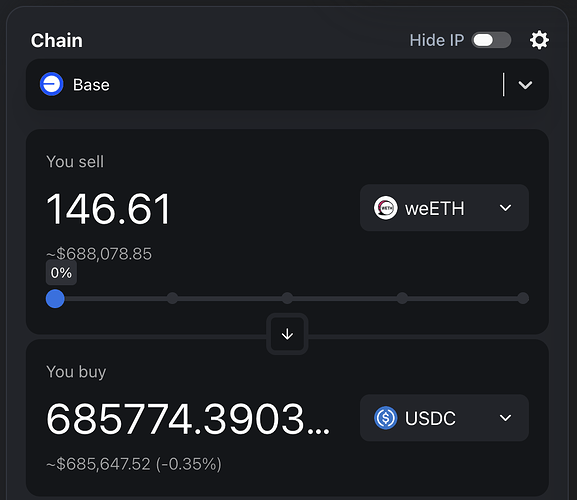

Over the past month weETH supply has been steadily increasing and approaching the supply cap. According to our risk framework, which is based on liquidation probability score(over a 30 day time interval) the estimated Collateral at Risk is about 146.61 weETH ($675k at the rate of $4600). This value is relatively small compared to the market size of weETH as the primary use case of weETH is to loop it with WETH (as can be seen from the attached distribution). If we compare this CaR value to the secondary market liquidity we can observe that the incurred slippage while liquidating complete amount in a single transaction is minimal(<0.5%).

Considering all the given info and the current market dynamics, we propose increasing the supply cap of weETH by 35% to 5400 weETH (from 4000 weETH).

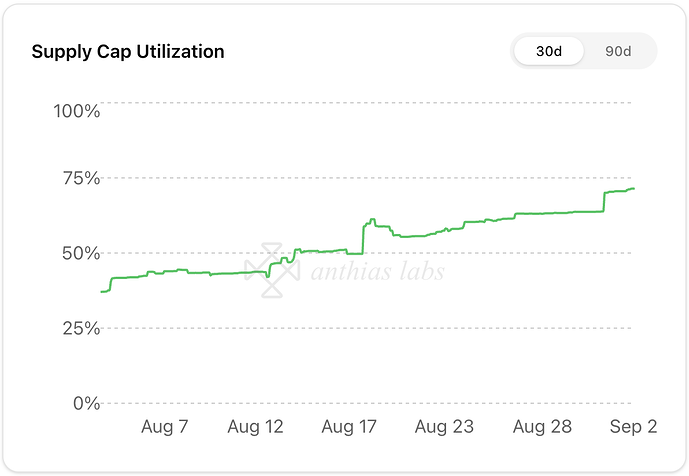

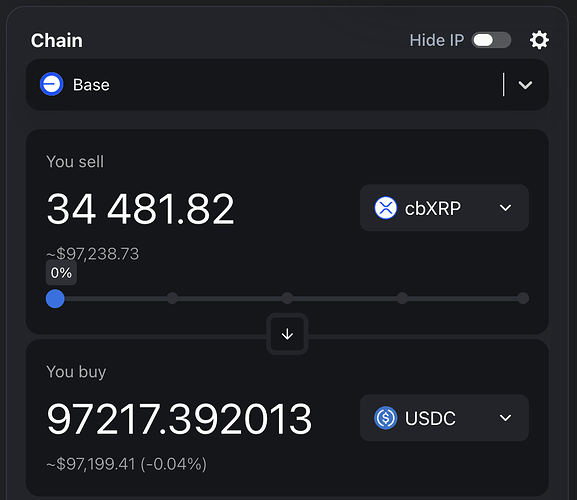

cbXRP

cbXRP is once again approaching its supply cap, since it’s launch in June the cbXRP market as had its supply increase steadily. Currently, supply cap utilization sits at 71%. We propose increasing supply cap from 3M to 5M cbXRP to support further market growth. Collateral-at-risk sits at around 35K cbXRP (~$95k), swapping the full amount to stables incurs negligible slippage. About 600k cbXRP can be swapped to USDC while slippage stays below 5%.

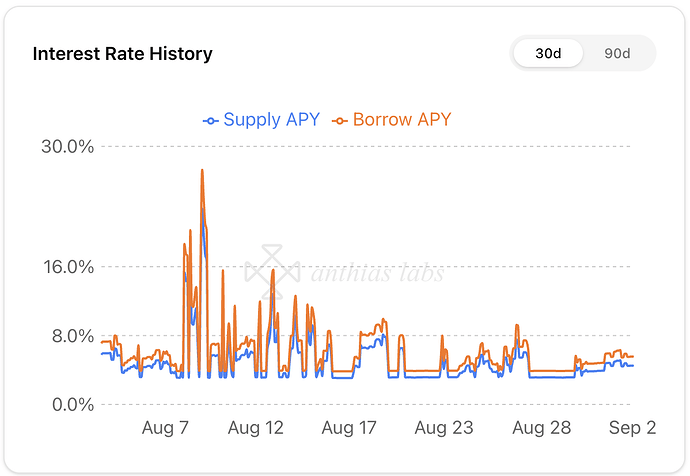

USDC

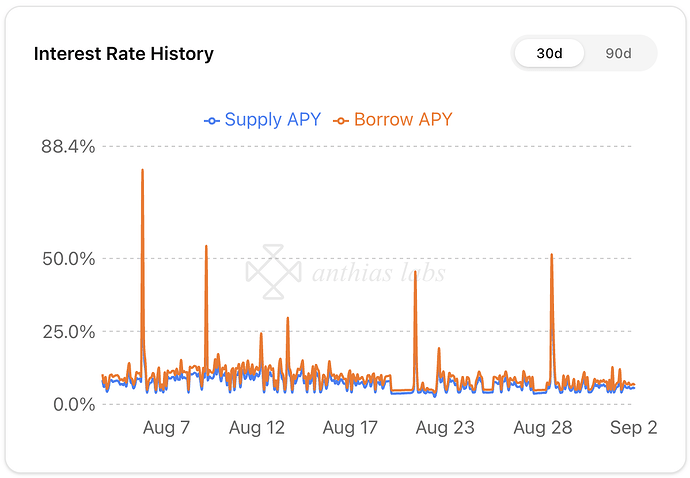

Just like last month, demand for USDC has been high consistently which led to frequent interest rate spikes despite the IRM parameter changes we proposed last month. At the same time, supply has been decreasing as users likely shift their assets to alternative venues offering higher supply rates. Borrowing remains nearly constant near kink, indicating no shortage of borrowers under the current parameters and suggesting that the true equilibrium rate may exceed what the existing interest rate model can support.

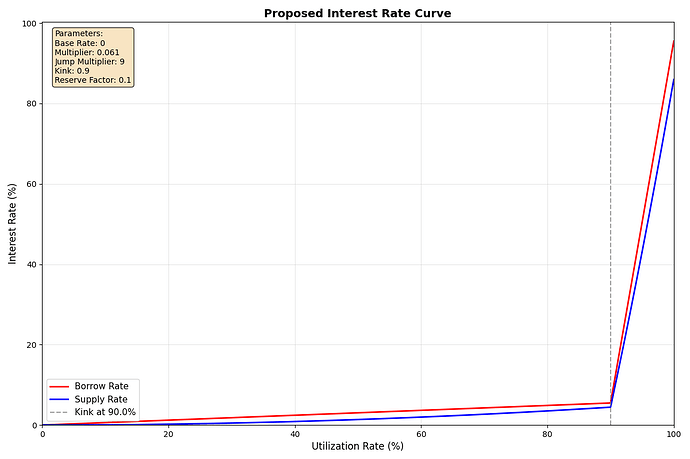

We propose to increase the multiplier value from 0.056 to 0.061 with no additional changes. By raising rates at the kink, we aim to attract suppliers by offering more competitive rates while simultaneously stabilizing rates for borrowers. Ideally, utilization should hover slightly below the kink so there’s enough of a buffer where suppliers can smoothly exit without causing rate spikes.

Current APYs

With reserve factor of 10%

| Utilization | Borrow APY | Supply APY |

|---|---|---|

| 0% | 0% | 0% |

| 90% (kink) | 5.04% | 4.08% |

| 100% | 95.04% | 85.54% |

Projected APYs

With reserve factor of 10%

| Utilization | Borrow APY | Supply APY |

|---|---|---|

| 0% | 0% | 0% |

| 90% (kink) | 5.49% | 4.45% |

| 100% | 95.49% | 85.94% |

WELL

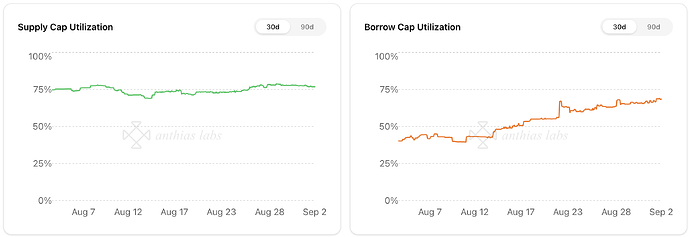

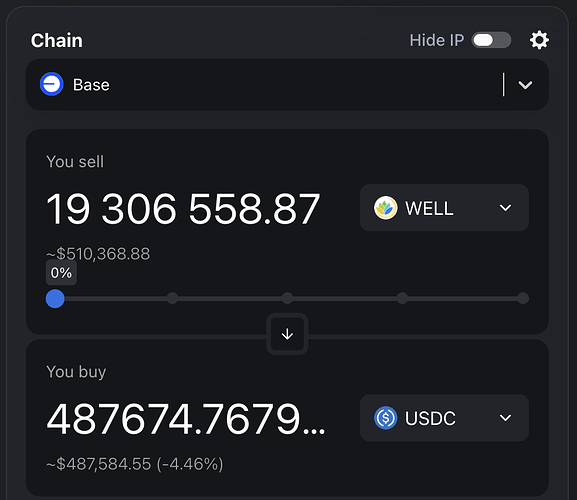

WELL has shown steady growth in borrows over the past month, with the borrow cap utilization going from about 40% to being just under 70% currently. The supply cap has also hovered consistently around 75%. Currently the collateral at risk stands at 19.3M WELL(~$500k), we compare this to the secondary liquidity and observe that it can be easily liquidated profitably in a single transaction. Hence in accordance to the above analysis, we propose an increment in the caps with supply cap going to 250M from 220M and borrow cap going to 100M from 75M.

OP Mainnet

Summary

Risk Parameters

| Parameters | Current Value | Recommended Value |

|---|---|---|

| VELO Supply Cap | 68M | 80M |

Cap changes will be implemented via Cap Guardian

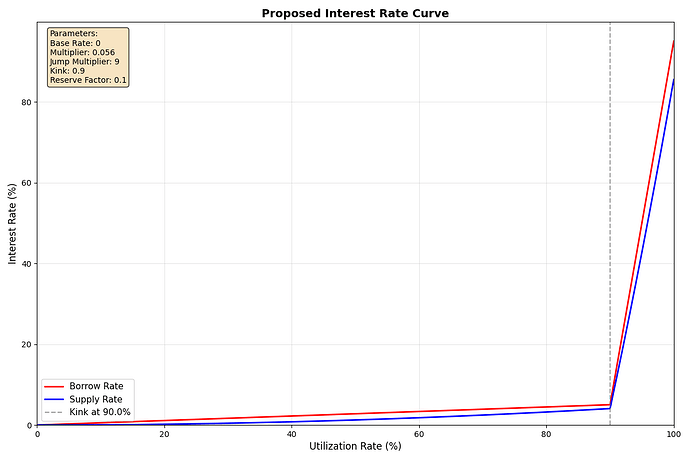

IR Parameters

| USDT IR Parameters | Current Value | Recommended Value |

|---|---|---|

| Base | 0 | 0 |

| Kink | 0.9 | 0.9 |

| Multiplier | 0.049 | 0.056 |

| Jump Multiplier | 9 | 9 |

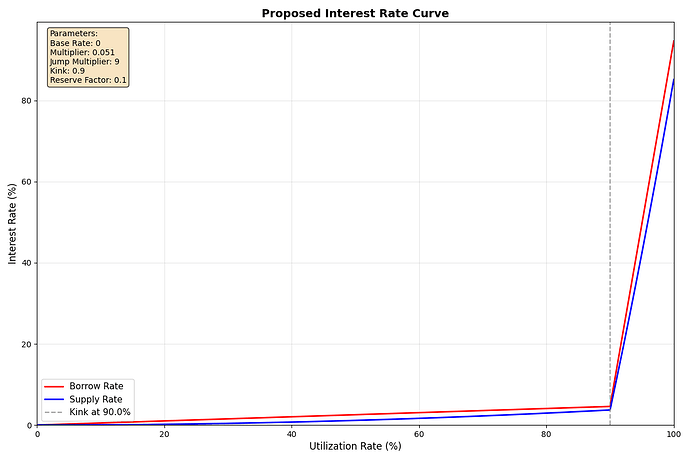

| USDC IR Parameters | Current Value | Recommended Value |

|---|---|---|

| Base | 0 | 0 |

| Kink | 0.9 | 0.9 |

| Multiplier | 0.0435 | 0.051 |

| Jump Multiplier | 9 | 9 |

VELO

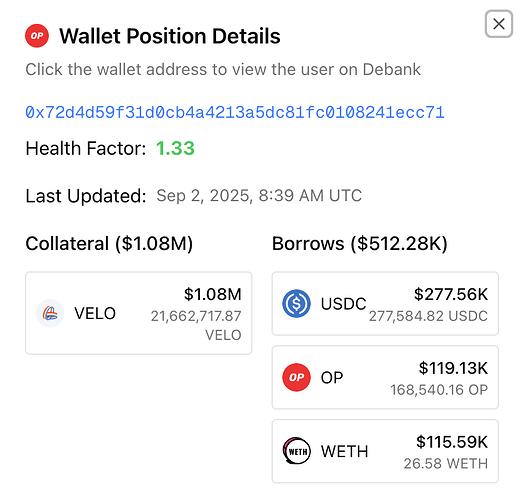

Over the past month, supply cap utilization for VELO has climbed to 82%, prompting a raise. We propose increase supply cap from 68M to 80M to allow further growth in the market. The 30d CaR is ~7.6M VELO (~$380K), swapping the full amount for USDC in a single transaction yields slippage of 8.8%. Most CaR can be attributed a single position supplying over 21M VELO and borrowing over $500k of USDC, OP, and WETH. This concentration does not pose significant risk to the protocol as multiple transactions would be able to liquidate this position if needed.

USDT

Interest rates for USDT have been spiking over the past month as utilization surges past kink causing the jump multiplier to kick in. We propose increasing the multiplier from 0.049 to 0.056. This change will raise the interest rates for borrowers and suppliers at the kink, which aims to stabilize borrower rates and attract more supply.

Current APYs

With reserve factor of 10%

| Utilization | Borrow APY | Supply APY |

|---|---|---|

| 0% | 0% | 0% |

| 90% (kink) | 4.41% | 3.57% |

| 100% | 94.41% | 84.97% |

Projected APYs

With reserve factor of 10%

| Utilization | Borrow APY | Supply APY |

|---|---|---|

| 0% | 0% | 0% |

| 90% (kink) | 5.04% | 4.08% |

| 100% | 95.04% | 85.54% |

USDC

Similarly to USDT, we propose increasing the multiplier from 0.0435 to 0.051 to raise borrower interest rates at the kink. This change aims to stabilize rates for borrowers while increasing the incentive for suppliers.

Current APYs

With reserve factor of 10%

| Utilization | Borrow APY | Supply APY |

|---|---|---|

| 0% | 0% | 0% |

| 90% (kink) | 3.92% | 3.17% |

| 100% | 93.91% | 84.52% |

Projected APYs

With reserve factor of 10%

| Utilization | Borrow APY | Supply APY |

|---|---|---|

| 0% | 0% | 0% |

| 90% (kink) | 4.59% | 3.72% |

| 100% | 94.59% | 85.13% |

Additional Links

Anthias Labs has not been compensated by any third party for any statements made. All opinions and suggestions provided are based solely on our independent analysis and are not influenced by external entities.