[Anthias Labs] - Risk Parameter Recommendations (10/29/2025)

Anthias Labs proposes the following parameter changes for the month of November. For more information on current parameters, please refer to our monitoring dashboard here.

Base

Summary

Risk Parameters

| Parameters | Current Value | Recommended Value |

|---|---|---|

| MAMO Borrow Cap | 12M | 3M |

| tBTC Collateral Factor | 85% | 84% |

| LBTC Collateral Factor | 85% | 84% |

IR Parameters

| USDC IR Parameters | Current Value | Recommended Value |

|---|---|---|

| Base | 0 | 0 |

| Kink | 0.9 | 0.9 |

| Multiplier | 0.072 | 0.08 |

| Jump Multiplier | 9 | 9 |

Rationale

MAMO

We propose decreasing the borrow cap from 12M to 3M, this will set the un-utilized ceiling lower while the market is still small, mitigating scenarios where users are able to over-borrow volatile assets during flash-crashes (such as what happened with VIRTUAL on 10/10).

tBTC & LBTC

As it currently stands, tBTC, LBTC and cbBTC all have the same collateral factor of 85%. While these assets have remained 1:1 with BTC, they do so through different mechanisms and are inherently exposed to different risks and have different levels of on-chain liquidity. To better reflect the risk profiles of these assets we wish to distinguish them by assigning lower collateral factors to LBTC and tBTC (which are less liquid than cbBTC). To avoid unnecessary liquidations of users with recursive positions, we will only decrease the collateral factors by 1% at a time, giving users the necessary time to react.

There are two users with recursive LBTC positions with health factors low enough to possibly be affected by a change in LBTC’s collateral factor

- 0xd567203a85d3667a4c2dad34b5d32485a49fcc7e

- 0xd46abef3264119a0f5a424521b521060a8701867

We will show that these user will not get liquidated by this change. As a reminder, health factor is calculated by supply * CF / borrow. Changing collateral factor from 0.85 to 0.85 results in the following health factors:

| User Address | Supplied | Borrowed | Health Factor (before change) | Health Factor (after change) |

|---|---|---|---|---|

| 0xd567203a85d3667a4c2dad34b5d32485a49fcc7e | 0.2242 LBTC | 0.1865 LBTC | 1.02 | 1.0096 |

| 0xd46abef3264119a0f5a424521b521060a8701867 | 0.2041 LBTC | 0.1683 LBTC | 1.03 | 1.0185 |

USDC

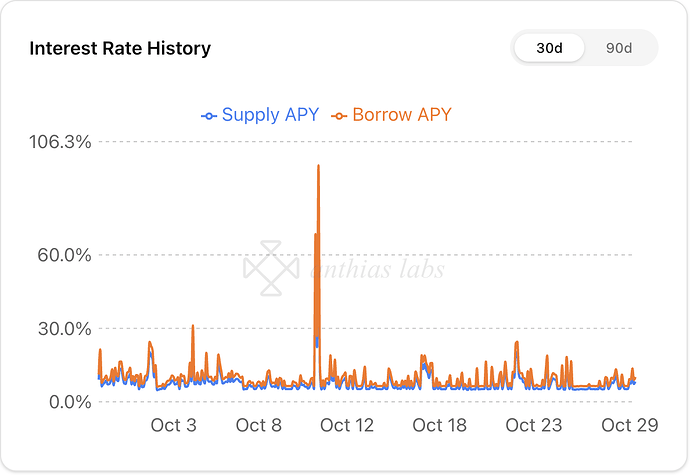

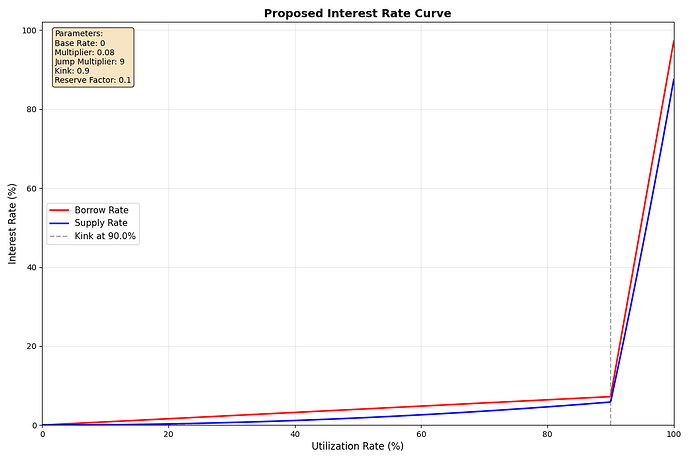

USDC interest rates have continued to spike the past month despite raising the multiplier, which suggests borrowers are still willing to pay interest rates that exist on the current curve above the kink. Over the past few months, interest rates for USDC have continued to climb across DeFi, reacting to this we will once again bump the multiplier higher from 0.072 to 0.08. This will increase the borrow rate at the kink from 6.48% to 7.2%, allowing smoother rate discovery below 7.2%.

Current APYs

With reserve factor of 10%

| Utilization | Borrow APY | Supply APY |

|---|---|---|

| 0% | 0% | 0% |

| 90% (kink) | 6.48% | 5.25% |

| 100% | 96.48% | 86.83% |

Projected APYs

With reserve factor of 10%

| Utilization | Borrow APY | Supply APY |

|---|---|---|

| 0% | 0% | 0% |

| 90% (kink) | 7.20% | 5.83% |

| 100% | 97.20% | 87.48% |

OP Mainnet

IR Parameters

| USDT0 IR Parameters | Current Value | Recommended Value |

|---|---|---|

| Base | 0 | 0 |

| Kink | 0.9 | 0.9 |

| Multiplier | 0.061 | 0.067 |

| Jump Multiplier | 9 | 9 |

| DAI IR Parameters | Current Value | Recommended Value |

|---|---|---|

| Base | 0 | 0 |

| Kink | 0.9 | 0.9 |

| Multiplier | 0.061 | 0.067 |

| Jump Multiplier | 9 | 9 |

Rationale

USDT0 and DAI

In order to standardize IR curves for stablecoins on OP Mainnet, we propose increasing the multiplier for USDT0 and DAI aligning it with USDC and USDT. This change will increase borrow rates at the kink from 5.49% to 6.03%, allowing for smoother rate discovery over an increased range.

Current APYs

With reserve factor of 10%

| Utilization | Borrow APY | Supply APY |

|---|---|---|

| 0% | 0% | 0% |

| 90% (kink) | 5.49% | 4.45% |

| 100% | 95.49% | 85.94% |

Projected APYs

With reserve factor of 10%

| Utilization | Borrow APY | Supply APY |

|---|---|---|

| 0% | 0% | 0% |

| 90% (kink) | 6.03% | 4.89% |

| 100% | 96.03% | 86.43% |

Moonbeam

No parameter changes to Moonbeam this month.

Moonriver

On November 10th 2025, Chainlink will deprecate the oracles used by Moonwell for MOVR, FRAX, and xcKSM (source). There are currently no other publicly available price feeds for these assets on Moonriver. Without an oracle, lending operations are impossible, leaving no choice but to fully deprecate these markets. Perhaps these price feeds can be serviced by API3, who currently provides price feeds on Moonbeam. An update will be given in the coming days if a deal can be made here.

Additional Links

Anthias Labs has not been compensated by any third party for any statements made. All opinions and suggestions provided are based solely on our independent analysis and are not influenced by external entities.