It’s hard not to notice the recurring front end issues lately… the staking APRs have been showing 0% again for a few days now, and I see the community asking questions and grumbling…because this isn’t the first time. These kinds of bugs and UI inconsistencies have really shaken community confidence in the Moonwell protocol and $WELL — mine included.

We all remember the “bug” that allowed a few wallets to claim rewards meant for the entire staking community. While it was said that “no user funds were lost” and that stakers still received what they should have in the end, I’m not entirely convinced. This was bad for confidence. If the APR is showing zero, and nobody on the team is making any statement of acknowledgment or explanation about it, that’s bad for confidence.

Anyway… the deeper concern isn’t just the UI or bugs — it’s what’s happening behind the scenes.

Every major question, whether technical, governance, or strategic, ultimately gets deferred to Luke (aka Lunar Labs). The admin team and community managers, even those on governance calls, often can’t answer basic questions about how the protocol works, or what’s going on. Their default response is always, “I have to ask Luke.” then of course there’s no follow-ups, nobody gets back to anybody…

The dev team is spread out … in Brazil and elsewhere , but all work directly under Luke. Let’s be honest — Luke has control over basically every major and minor aspect of Moonwell’s development and direction, funding, and how the community is rewarded. There’s really only one core contributor driving this project, while everyone else largely follows and obeys orders. That’s not meant as an insult; it’s just the reality of how things are currently structured. Some might like to pretend there’s a layer of decentralization and the proposals come from “independent contributors”…okay sure, I’ll play along.

Luke is brilliant and clearly dedicated, and I have a lot of respect for what he’s built. But as it stands now, if anything were to happen to Luke Youngblood — if he got sick, burned out, or simply lost interest, Moonwell, as it stands, would struggle to function. I would say it would be game over in short order actually. All ideas, proposals, and meaningful actions seem to come directly from one person. That’s not sustainable for a protocol that’s supposed to outlive any individual.

I’m sharing this not as FUD, but as an honest concern from someone who’s been here, observed, and cares about Moonwell’s long-term future. Also someone who is holding a meaningful bag of WELL,( that was once a lot more meaningful)

I don’t have a solution, nor do I expect anything to change in the short run. But if I’m honest, it’s concerning when days go by, people are voicing frustrations and there’s radio silence from Luke or ‘the team”

I don’t blame him… if he’s anything like me, he might still be feeling the sting from the Oct 10 flash crash. I got liquidated on hyperliquid that day too, and it wasn’t fun. I can imagine how much worse that felt for someone carrying the weight of an entire protocol, and who I’m sure is also a degen like some of us.

But I’ll digress.

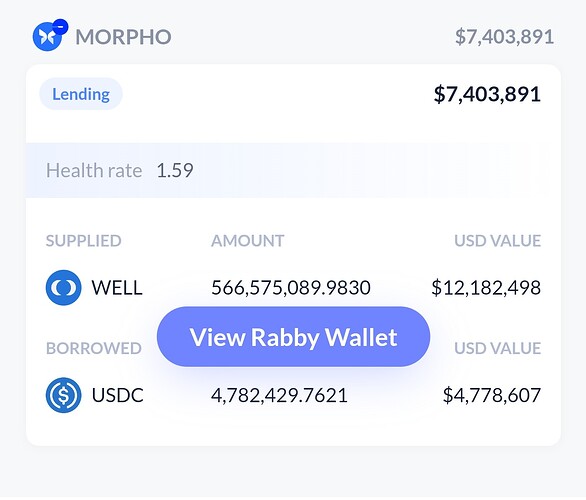

On a related note, I did check moonwell funding wallet (private more for vault backed by well tokens) from which it deposited 566m WELL and borrowed $4.78m.

Right now, the main credit facility, and how the dev runway gets funded. Supplying WELL and borrowing USDC has a health rate around 1.59 . The health Factor did drop to about 1.4 Friday when the market was bleeding, and well was down 20% to ≈0.019

Liquidation would start if WELL dropped roughly 35–40% from here (around the $0.013–$0.014 range). That assumes no new loans, but in reality the borrowed amount grows over time as interest accrues, even if no new borrowing happens. And it’s likely more borrowing will occur from that vault. In other words, the buffer is smaller than it appears. If price pressure pushes WELL lower, that position could trigger a cascade of forced liquidations, putting unbelievable sell pressure on the token. It would create its own spiraling liquidation effect. Don’t get me wrong, right now I would much rather fund the protocol and Dev from borrowing then from continuing to dump the token on the market. But it’s a risk I think about.

Here’s a link to the wallet.

Moments like this highlight why we need a structure where the community, contributors, and developers can operate independently — where knowledge, execution, and leadership aren’t bottlenecked through one person.

Curious to hear what others think. Am I the only one seeing it this way, or do others share these concerns?