January 2025 Update

Key Insights

- Proposals for New Core Markets are Advancing. In January, the majority of the onchain submissions were related to progressing various Core Market proposals, continuing a trend from last month.

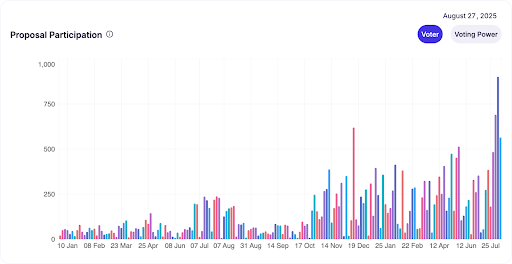

- Snapshot Voter Turnout Hit All-Time-Highs. While last month displayed new records in onchain voter turnout, January brought a new record for voting addresses participating in offchain signal proposals.

- Solidity Labs’ OEV Solution Has Begun its Onchain Rollout. After the community overwhelmingly voted to support Solidity Labs’ OEV solution through Snapshot, the team began rolling out the proposal’s onchain voting phase, beginning with the ETH Core Market on Optimism.

Primer

The monthly governance recap serves as a compendium of key governance updates for the preceding month. This update covers Moonwell governance activities for January 2025.

While no single onchain proposal managed to reach last month’s all-time high, January largely maintained previous months’ elevated average voter turnout. Most of the governance activity centered around activating new Moonwell Core Markets and the community signalled support for all of the proposals.

Key Metrics

- Eight onchain proposals

- Three Snapshot proposals

- 26 forum posts

The number of active voters for onchain proposals averaged 255, with a minimum of 147 and a maximum of 396.

This month, there were three Snapshot signal votes.

The USDS proposal this month has gone on to receive the highest number of votes for a Moonwell Snapshot proposal this year.

Success Insights:

- Onchain: The onchain proposals in January had a 100% success rate.

- Offchain: The Snapshot proposals in January had a 100% success rate.

Browse all of the proposals here.

Other Governance Metrics

| Metric |

Data |

| Voters |

5,173 (+11.49%) |

| Top-5 Wallets Voting Power |

52% (+2%) |

| Top-100 Wallets Voting Power |

84% (No change) |

| Top-200 Wallets Voting Power |

85% (-1%) |

| Delegate Quorum Gauge* |

3 (No change) |

| Nakamoto Coefficient** |

5 (No change) |

| Early Voters |

45% (No change) |

| Mid-Proposal Voters |

23% (No change) |

| Late Voters |

17% (No change) |

| End-of-Proposal Voters |

16% (No change) |

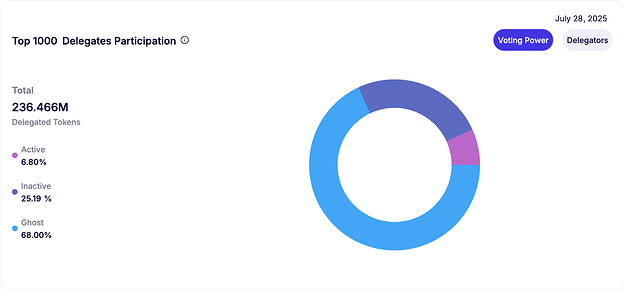

| Top-1000 Delegates Active |

16.81% (-1.92%) |

| Top-1000 Delegates Inactive*** |

21.52% (-0.35%) |

| Top-1000 Delegates Ghost**** |

61.68% (+2.28%) |

*Delegate Quorum Gauge: The number of delegates required to reach quorum.

**Nakamoto Coefficient: The number of delegates required to reach 50% of the total voting power.

***A delegate is considered inactive if they have not voted on any of the last 3 proposals but have voted on at least 1 proposal in the past.

****A delegate is considered a ghost if they have never voted on any proposal.

Top 1000 Delegates Participation

Compared to last month, we’ve seen a slight shift in the composition of delegate voting participation. The percentage of active delegates has decreased slightly from last month’s 18.73%. The proportion of delegates who are Inactive has remained relatively steady (December’s value was 21.87%), but the percentage of Ghost delegates has increased slightly (December’s value was 59.40%). A “Ghost” delegate is one who has never voted on any Moonwell proposal; an “Inactive” delegate is one who has voted at least once in the past, but not on any of the last three proposals. This shift continues a trend seen during the last few months and it likely can be attributed to the voting requirement established by MIP-X05. As first-time delegates (i.e. voters) get involved with Moonwell governance, it will take some time for them to shift into the “Active” delegate category.

Main Governance Initiatives in January

New Core Markets Are Being Added

Moonwell Super Delegate @0xMims kicked off the month with a Snapshot proposal to add a Core Market for USDS - Sky Protocol’s Sky Dollar - to Moonwell on Base. The signal vote was successful and Gauntlet then added their recommendations for the market. It progressed to an onchain vote on January 23rd. Around that same time, a forum post was created by Threshold Network that centered around adding a tBTC Core Market. The proposal progressed to a Snapshot vote, which was successful, before Gauntlet published their tBTC recommendations. Last month, 0xMims also spearheaded the effort to activate a WELL Core Market on Base by submitting a Snapshot proposal. This month, Gauntlet offered risk recommendations for the proposed Core Market before an onchain proposal was submitted. MIP-B37 was successful and the Core Market went live on January 13th.

Following last month’s successful Snapshot, Block Analitica offered their risk analysis for Lombard Finance’s proposed LBTC Core Market on Base, which was followed by Gauntlet’s market recommendations. LBTC, tBTC, and USDS all progressed to onchain votes on the same day and all proposals were successful. Core Markets for LBTC, tBTC, and USDS all went live on January 29th.

In mid-January, 0xMims proposed adding VIRTUAL, the governance and utility token of Virtuals Protocol, to Moonwell. It progressed to a Snapshot vote, which was successful; Gauntlet offered recommendations for the VIRTUAL Core Market before it moved to an onchain vote on January 29th.

Contributors are Implementing Technical Improvements

In December, Moonwell’s governance call was focused on “The Great OEV Debate.” Following a recap forum post created by @PGov, the community overwhelmingly chose to proceed with Solidity Labs’ proposal in a Snapshot signal vote. The team’s solution seeks to improve how liquidations occur on Moonwell, ensuring a more efficient capture of revenue from liquidation events. It entails introducing an “MEV tax”, charging liquidators for priority access to update price feeds and execute liquidations. After some development time, Solidity Labs began rolling out the OEV solution. On January 14th, MIP-O12 was submitted, which sought to test the technology solely on the ETH Core Market on Optimism. The proposal was successful.

Ideas for Increasing Governance Participation and Rewarding Voters

Towards the tail end of the month, contributor Luke Youngblood created a forum discussion that’s acting as a follow-up to October’s “Increasing Governance Participation” proposal. He first brought up the protocol’s status as a top revenue generator in DeFi before proposing that excess revenue should be used to reward Safety Module stakers. It would be auctioned off for WELL and used to bolster the Safety Module Ecosystem Reserve. The post is currently being discussed, and should the community choose to move forward, it will move to a Snapshot vote in early February and an onchain vote in mid-February.

Risk, Rewards Speeds, and Vaults

Gauntlet published a forum post to adjust market risk parameters for Moonwell’s Base, Optimism, and Moonbeam deployments. The onchain proposal was created on January 22nd to adjust parameters for the next month. Throughout the month, Gauntlet also published weekly updates to give an overview of asset utilization, liquidations, protocol growth, and more. Gauntlet used their role as Cap Guardian to adjust Borrow/Supply caps for assets including WELL on Base. January’s monthly reward speed proposal, MIP-X11, successfully passed an onchain vote on January 18th, aiming to rebalance liquidity incentives and maintain healthy levels of rewards on the four deployments. Block Analitica and B.Protocol posted their monthly recap for Moonwell’s Flagship Vaults in late January. The teams previously launched the Moonwell Frontier cbBTC vault and the community voted to extend the WELL token reward program for another six months. The recap also highlights the automated reallocations and parameter adjustments which were executed for growth and security reasons.

Additional Developments

- Growth on Optimism: In early January, Moonwell announced the generation of record fees on Optimism, hitting an all-time-high of $616.7K.

- Bitcoin-backed loans on Coinbase: In mid-January, Coinbase announced that Bitcoin-backed loans were live on the platform, powered by Morpho. The Moonwell Flagship USDC Vault on Base provides 80% of all USDC that can be borrowed against cbBTC on Coinbase.

- Physical Moonwell Cards: On January 22nd, physical Moonwell cards were launched. The Visa cards enable Moonwell users to shop, dine, and travel globally while keeping their assets onchain and it is accepted at 44+ million merchants worldwide.

- New Isolated Market: On January 23rd, a new Morpho Labs LBTC/cbBTC Isolate Market was integrated into the Moonwell app.

- New Code4rena Bug Bounty Program: Following November’s Snapshot proposal, the new $250K Bug Bounty Program from Code4rena was kicked off on January 24th.

Delegate Digest

Super Delegates

Super Delegates

| Delegate |

Delegation Pitch |

Delegation Page |

Delegated Amount |

Proposals Created |

Completed their role’s minimum requirements this month? |

| 0xMims |

Link |

Link |

7.5M WELL |

6 |

Yes |

| Coolhorsegirl |

Link |

Link |

1.6M WELL |

18 |

Yes |

Mid-Tier Delegates

Mid-Tier Delegates

| Delegate |

Delegation Pitch |

Delegation Page |

Delegated Amount |

Proposals Created |

Completed their role’s minimum requirements this month? |

| Kimchiblock |

Link |

Link |

305K WELL |

0 |

Yes |

| PGov |

Link |

Link |

201K WELL |

1 |

Yes |

Junior Delegates

Junior Delegates

| Delegate |

Delegation Pitch |

Delegation Page |

Delegated Amount |

Proposals Created |

Completed their role’s minimum requirements this month? |

You can read more about the requirements to join each delegate tier and each tier’s contribution minimums here.

Delegate Highlights

- 0xMims created a Snapshot that sought feedback on potentially adding a Core Market for Sky Protocol’s USDS to Moonwell on Base. Its corresponding onchain proposal, MIP-B38, was later submitted onchain and it was successful. His previous WELL Snapshot also progressed to an onchain vote this month. 0xMims additionally submitted the first iteration of a VIRTUAL Core Market proposal to Snapshot in mid-January. Its onchain counterpart is currently live.

Community Overview

Community Trends

Last month, we reported that a new record in onchain voter turnout was set. MIP-X08’s 620 participating wallets surpassed November’s previous all-time high by 159.79%. While onchain voter turnout this month didn’t quite reach last month’s highs, we’ve seen more of an even distribution among the proposals. The average number of onchain voters last month was 280; this month, that figure is slightly lower at 255. For reference, the average for November was 228 and October’s was 105, so this month falls well within the expected turnout range.

Snapshot indicates a different story. Typically, Snapshot turnout is significantly lower than onchain turnout. This month, the USDS Snapshot voting numbers significantly passed the average onchain voter numbers with a record-setting 310 offchain signal votes. The previous record was set in November, when the Code4rena Snapshot proposal gathered 254 votes, equating to a 22% increase. The community appeared to be highly activated by the idea of supporting Sky.money’s growth across Ethereum Layer 2s, attracting users from the Sky Protocol ecosystem and expanding Moonwell’s stablecoin offerings.

At 11, this month has had a greater number of proposals compared to last month’s seven (including offchain and onchain). This is a return to form; it’s comparable to November and October.

Moonwell’s primary social channels continue to grow at a healthy pace: the main X account, the governance X account, and Discord have continued to grow at a relatively linear rate. Both Telegram channels have shown slightly decreased membership this month.

Closing Summary

January 2025 can largely be summed up as a month of progressing several Core Market proposals, high Snapshot voter turnout, and relatively steady social growth metrics.

Be sure to attend the upcoming governance community call on Thursday, February 6th at 17:00 UTC in Discord. Add it to your calendar here.

Links