[Anthias Labs] - Risk Parameter Recommendations (10/1/2025)

Anthias Labs proposes the following parameter changes for the month of October. For more information on current parameters, please refer to our monitoring dashboard here.

Base

Summary

Risk Parameters

| Parameters | Current Value | Recommended Value |

|---|---|---|

| cbXRP Reserve Factor | 20% | 15% |

| EURC Reserve Factor | 5% | 10% |

IR Parameters

| USDC IR Parameters | Current Value | Recommended Value |

|---|---|---|

| Base | 0 | 0 |

| Kink | 0.9 | 0.9 |

| Multiplier | 0.061 | 0.072 |

| Jump Multiplier | 9 | 9 |

| EURC IR Parameters | Current Value | Recommended Value |

|---|---|---|

| Base | 0 | 0 |

| Kink | 0.9 | 0.9 |

| Multiplier | 0.061 | 0.072 |

| Jump Multiplier | 9 | 9 |

Rationale

cbXRP

When cbXRP debuted as a market on Moonwell, a high reserve factor was set to build reserves, which started at zero. The reserve factor determines the spread between interest paid by borrowers and earned by suppliers. Since cbXRP is primarily used as collateral with minimal borrowing, most reserves actually come from liquidations. In the chart below, steady slopes represent reserves accrued from borrower interest, while sudden spikes indicate reserves from liquidations. Lowering the reserve factor would provide suppliers with a slightly higher incentive while minimally affecting reserve accrual.

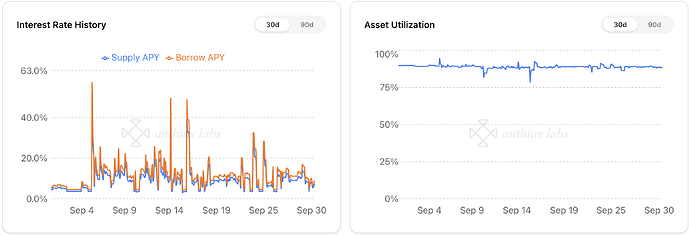

USDC

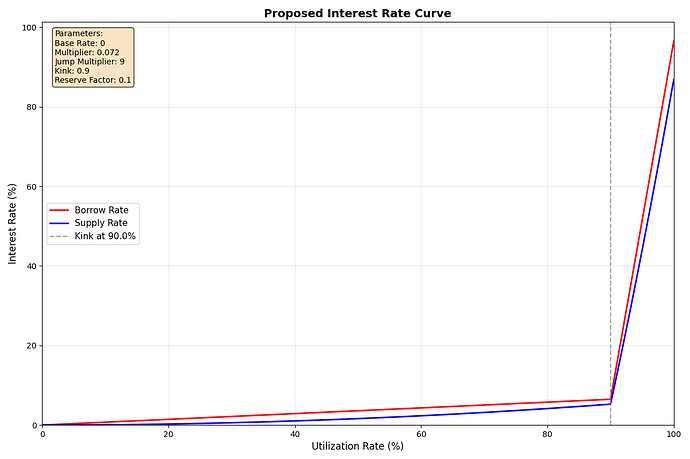

We propose increasing the interest rate multiplier for the USDC market from 0.061 to 0.072. Data shows that USDC utilization has consistently remained near or above 90% throughout September, with borrowers demonstrating a clear willingness to pay rates higher than the current kink rate of 5.49%. The sustained high utilization means there is little to no buffer for suppliers to exit without causing rates to increase. By increasing the multiplier to 0.072, this would raise the borrow rate at the kink to 6.48% APY (99 bps increase). This adjustment aims to allow smoother rate discovery below 6.48% borrow APY, stabilizing interest rates for borrowers.

Current APYs

With reserve factor of 10%

| Utilization | Borrow APY | Supply APY |

|---|---|---|

| 0% | 0% | 0% |

| 90% (kink) | 5.49% | 4.45% |

| 100% | 95.49% | 85.94% |

Projected APYs

With reserve factor of 10%

| Utilization | Borrow APY | Supply APY |

|---|---|---|

| 0% | 0% | 0% |

| 90% (kink) | 6.48% | 5.25% |

| 100% | 96.48% | 86.83% |

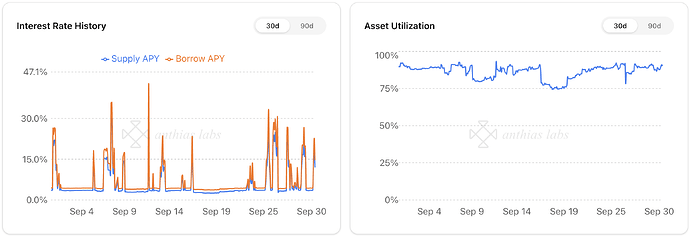

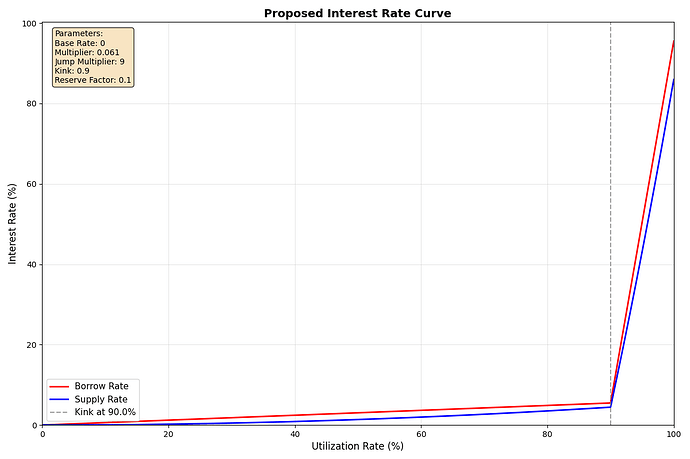

EURC

We propose the same adjustment for the EURC market, increasing the interest rate multiplier from 0.061 to 0.072. Similar to USDC, EURC has experienced periods of elevated utilization where borrowers have shown willingness to pay rates above the current kink rate of 5.49%. Raising the multiplier to 0.072 would increase the borrow rate at the kink to 6.48% APY (99 bps increase).

Additionally, we propose increasing EURC’s reserve factor from 5% to 10%. This change aims to increase the speed at which reserves are accrued. Currently, EURC reserves sit around 20K EURC, 64K short of the reserve target of 84K EURC. A reserve factor of 10% is in line with other stables like USDC.

Current APYs

With reserve factor of 5%

| Utilization | Borrow APY | Supply APY |

|---|---|---|

| 0% | 0% | 0% |

| 90% (kink) | 5.49% | 4.69% |

| 100% | 95.49% | 90.71% |

Projected APYs

With reserve factor of 10%

| Utilization | Borrow APY | Supply APY |

|---|---|---|

| 0% | 0% | 0% |

| 90% (kink) | 6.48% | 5.25% |

| 100% | 96.48% | 86.83% |

OP Mainnet

Summary

IR Parameters

| USDC IR Parameters | Current Value | Recommended Value |

|---|---|---|

| Base | 0 | 0 |

| Kink | 0.9 | 0.9 |

| Multiplier | 0.051 | 0.067 |

| Jump Multiplier | 9 | 9 |

| USDT IR Parameters | Current Value | Recommended Value |

|---|---|---|

| Base | 0 | 0 |

| Kink | 0.9 | 0.9 |

| Multiplier | 0.056 | 0.067 |

| Jump Multiplier | 9 | 9 |

| USDT0 IR Parameters | Current Value | Recommended Value |

|---|---|---|

| Base | 0 | 0 |

| Kink | 0.9 | 0.9 |

| Multiplier | 0.049 | 0.061 |

| Jump Multiplier | 9 | 9 |

Rationale

USDC, USDT, & USDT0

We propose increasing the interest rate multipliers for USDC, USDT, and USDT0 on Optimism for the same reasons outlined above. These stablecoin markets have exhibited similar utilization patterns, with borrowers demonstrating willingness to pay rates above the current kink rate. By raising the multipliers across all three markets, we aim to enable smoother rate discovery while ensuring suppliers have adequate liquidity buffers to exit positions without triggering extreme rate spikes. This adjustment will maintain consistency in our approach to stablecoin interest rate curves on Optimism.

USDC

Current APYs

With reserve factor of 10%

| Utilization | Borrow APY | Supply APY |

|---|---|---|

| 0% | 0% | 0% |

| 90% (kink) | 4.59% | 3.72% |

| 100% | 94.59% | 85.13% |

Projected APYs

With reserve factor of 10%

| Utilization | Borrow APY | Supply APY |

|---|---|---|

| 0% | 0% | 0% |

| 90% (kink) | 6.03% | 4.89% |

| 100% | 96.03% | 86.43% |

USDT

Current APYs

With reserve factor of 10%

| Utilization | Borrow APY | Supply APY |

|---|---|---|

| 0% | 0% | 0% |

| 90% (kink) | 5.04% | 4.08% |

| 100% | 95.04% | 85.55% |

Projected APYs

With reserve factor of 10%

| Utilization | Borrow APY | Supply APY |

|---|---|---|

| 0% | 0% | 0% |

| 90% (kink) | 6.03% | 4.89% |

| 100% | 96.03% | 86.43% |

USDT0

Current APYs

With reserve factor of 10%

| Utilization | Borrow APY | Supply APY |

|---|---|---|

| 0% | 0% | 0% |

| 90% (kink) | 4.41% | 3.57% |

| 100% | 94.41% | 84.97% |

Projected APYs

With reserve factor of 10%

| Utilization | Borrow APY | Supply APY |

|---|---|---|

| 0% | 0% | 0% |

| 90% (kink) | 5.49% | 4.45% |

| 100% | 95.49% | 85.59% |

Additional Links

Anthias Labs has not been compensated by any third party for any statements made. All opinions and suggestions provided are based solely on our independent analysis and are not influenced by external entities.