September 2025 Update

Key Insights

- Moonwell Morpho Vaults Proposals Advanced through Governance. In mid-September, Moonwell contributors and partners co-authored a proposal to further incentivize four popular Moonwell Morpho vaults on Base. The final proposal of the month involved the addition of a new vault.

- Routine proposals (risk management, liquidity incentives) and vault-related proposals were the primary voting activities for the month. Anthias Labs’ monthly recommendations and the monthly automated liquidity incentive proposals made up 50% of the onchain voting activity in September, while the vault proposals made up the other 50%.

- Average voter turnout remains high. Excluding August, average onchain voter turnout in September surpassed that of all other summer months.

Primer

The monthly governance recap serves as a compendium of key governance updates for the preceding month. This update covers Moonwell governance activities for September 2025.

While September’s total volume of proposals was relatively muted, onchain voter turnout remained consistently high.

Key Metrics

- 4 onchain proposals

- 0 Snapshot proposals

- 19 forum posts

The number of active voters for onchain proposals averaged 420, with a minimum of 370 and a maximum of 462.

This month, there were 0 Snapshot signal votes.

At 310 voters, the USDS proposal in January received the highest number of votes for a Moonwell Snapshot proposal.

Success Insights:

- Onchain: The onchain proposals in September had a 100% success rate.

- Offchain: N/A

Browse all of the proposals here.

Main Governance Initiatives in September

Moonwell Morpho Vaults Incentives Renewal

In mid-September, 0xMims, B.Protocol, and BlockAnalitica co-authored an onchain proposal to renew the incentives for four Moonwell Morpho vaults. The authors noted the current Vault TVL figures (ranging from $9.88M for EURC to $65.6M for USDC on Base, totaling $137.88M across five vaults on Base and OP Mainnet), and highlighted the overall success of the ongoing program. MIP-X08 and MIP-B44 had previously renewed the incentives program in December and June, respectively. MIP-B46 proposed distributing 3.33 million WELL as rewards for depositors on Base, allocated as follows: USDC Flagship Vault (50%), ETH Flagship Vault (24%), EURC Flagship Vault (13%), and cbBTC Frontier Vault (13%). At the end of the month, Block Analitica and B.Protocol also proposed listing a market for EtherFi’s weETH/ETH to the Moonwell Flagship ETH vault on Base. The post noted the favorable risk profile, distribution, lindyness, and its status as the first LRT asset supported by the Moonwell Flagship vaults. In the final week of the month, Anthias Labs submitted MIP-B47, which sought to take ownership of a new Moonwell Ecosystem USDC (meUSDC) Vault on Base, powered by Morpho, and set Anthias Labs as the curator.

Risk and Reward Speeds

Throughout the month, Anthias published weekly updates to report on week-over-week changes in borrows, supplies, utilization, liquidations, and more. In early September, Anthias published a forum post to adjust risk parameters for Moonwell’s Base and Optimism Mainnet deployments. The onchain proposal was created on September 16th, which proceeded to pass its governance vote. Early in the month, Anthias also created two posts (here and here), offering recommendations for September’s reserves on Moonwell’s Core Markets on Base. Their calculations include parameters including the probability of position liquidation and the maximum liquidation amount. September’s monthly automated liquidity incentive proposal, MIP-X30, successfully passed an onchain vote on September 11th, aiming to rebalance liquidity incentives on three Moonwell deployments. It additionally sought to auction off ~$78.09K of excess market reserves.

Additional Developments

- Performance Metrics: In August, Moonwell generated $1.3M in fees. This makes August the protocol’s best performance in six months. It also earned $254K across Base and OP Mainnet, the second highest in six months.

- New integrators of the Moonwell vaults on Base: Yo.xyz taps into the Moonwell Flagship EURC Vault on Base; depositors earn variable rates from Morpho borrow demand and WELL/MORPHO rewards.

Delegate Digest

Super Delegates

Super Delegates

| Delegate | Delegation Pitch | Delegation Page | Delegated Amount | Proposals Created | Completed their role’s minimum requirements this month? |

|---|---|---|---|---|---|

| Coolhorsegirl | Link | Link | 16K WELL | 20 | Yes |

| PGov | Link | Link | 1M WELL | 1 | Yes |

Mid-Tier Delegates

Mid-Tier Delegates

| Delegate | Delegation Pitch | Delegation Page | Delegated Amount | Proposals Created | Completed their role’s minimum requirements this month? |

|---|---|---|---|---|---|

| Jor-El | Link | Link | 200K WELL | 0 | Yes |

| Chidi | Link | Link | 200K WELL | 0 | Yes |

| Kimchiblock | Link | Link | 429K WELL | 0 | Yes |

| DAOplomats | Link | Link | 228 WELL | 0 | Yes |

| Maylosan | Link | Link | 46K WELL | 0 | Yes |

| FranklinDAO | Link | Link | 508 WELL | 0 | Yes |

Junior Delegates

Junior Delegates

| Delegate | Delegation Pitch | Delegation Page | Delegated Amount | Proposals Created | Completed their role’s minimum requirements this month? |

|---|

You can read more about the requirements to join each delegate tier and each tier’s contribution minimums here.

Delegate Highlights

- Jor-El and Chidi attended September’s governance call.

- PGov continues to regularly update their delegate pitch with rationales for their voting behavior.

Community Overview

| Social Channel | Data |

|---|---|

| Main X account | 55.2K Followers (+0.18%) |

| Governance X account | 1307 Followers (+6.43%) |

| Discord | 11,037 Members (-0.99%) |

| Announcements Telegram | 678 Members (-0.73%) |

| Chat Telegram | 9,219 Members (+20.37%) |

Community Trends

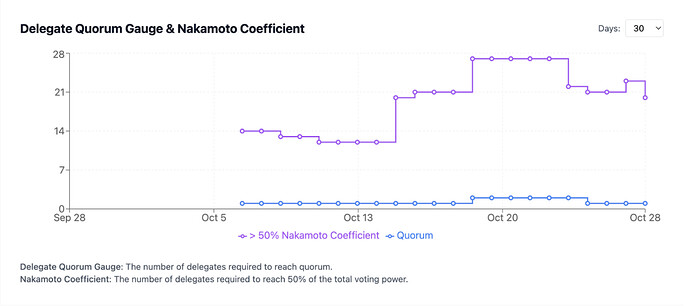

As noted in previous months, the standard trend that we observe in intra-month voting behavior involves the first proposal seeing the largest influx of voters, followed by a taper-off throughout the month. August deviated from that trend, as did July. This month largely followed suit. Until the final proposal of the month, each successive proposal gathered an increasing number of votes, ranging from 370 to 462.

At 420 average voters, this month’s turnout remains on par with our expectations (excluding August’s significant average of 719, July averaged 381 and June averaged 335).

Moonwell’s social channels are largely growing as expected, following trends seen in previous months. However, September deviated in two areas: the Discord’s membership decreased slightly while the chat Telegram surged, increasing by the largest month-over-month numbers since Boardroom’s coverage began.

Closing Summary

September 2025 had slightly fewer proposals than average, but voter turnout surpassed two out of the three previous months this summer. The delegate base continues to grow as new community members are joining the Super Delegate specialty tracks. Look for the next Monthly Governance Call on X on the last Thursday of each month. The next call will be on October 30th at 17:00 UTC.